According to Coteccons’ Q2 2023-2024 consolidated financial statements (ticker: CTD), the company recorded short-term and long-term receivables of VND 12,448 billion, accounting for 57% of total assets. The company has set aside VND 1,257 billion for this item.

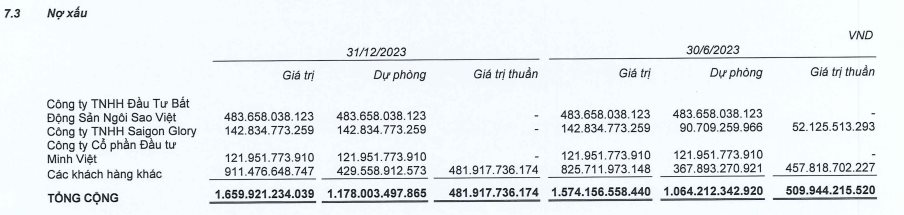

In particular, Coteccons also recorded VND 1,659 billion as bad debts and set aside nearly VND 1,200 billion for the above-mentioned bad debts. Some famous names appearing on the list of bad debts include Saigon Glory Limited Liability Company and Viet Star Investment Real Estate Company – a subsidiary of Tan Hoang Minh Corporation.

Specifically, Coteccons is recording Viet Star, a member of Tan Hoang Minh Group as a bad debt of nearly VND 484 billion. This company is associated with the controversial land deposit in Thu Thiem at the end of 2021 – beginning of 2022. At that time, Viet Star caused a stir when it accepted a bid price of VND 24,500 billion (nearly USD 1.1 billion) for a 10,060 square meter plot of land, equivalent to VND 2.44 billion per square meter.

In addition, the company also canceled 9 bond auction rounds from July 2021 to March 2022 worth a total of VND 10,030 billion.

Besides, Coteccons also recorded Saigon Glory as a bad debt of VND 143 billion. Saigon Glory is introduced as the owner of the 6-star office-commercial-apartment-hotel complex in Ben Thanh Square (The Spirit of Saigon), which includes two towers of 46 and 55 floors, 214 apartments for sale and 250 6-star hotel rooms. The total cost of the project is approximately VND 14,400 billion.

The company has been struggling with VND 10,000 billion in bond debt over the past year and has been rescheduling debt many times. Most recently, Mr. Vu Quang Hoi, Chairman of Bitexco Group, sent a letter to bondholders. In the letter, Chairman of Bitexco Group also stated that in the current reality existing at Saigon Glory and Ben Thanh Quadrangle Project, along with the legal and financial obligations of the related parties, the handling of collateral assets will be even more difficult and complex.

“The best solution is for you to agree to extend the principal and interest payment period of the bond to have more time to restructure financial sources and promote investment, construction, and business activities of the project to soon have centralized revenue for bond obligations,” wrote Mr. Vu Quang Hoi.

According to Mr. Vu Quang Hoi, Chairman of Bitexco Group, the unit has developed a financial plan to pay principal and interest on the bond as shown in the contents of the questionnaires. He hopes to receive the consent and unanimity of bondholders and is grateful for that.

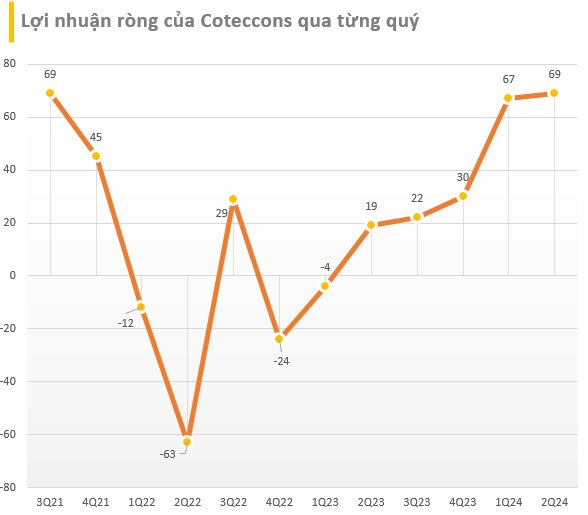

Coteccons’ profits continue to increase

In terms of Coteccons’ business performance in Q2 2023-2024, the company recorded net revenue of VND 5,660 billion, a decrease of 9% compared to the same period. However, thanks to the reduction in all costs, the company reported after-tax profit of over VND 69 billion for shareholders of the parent company, 3.6 times higher than the same period last year.

In the first 6 months of this fiscal year, Coteccons recorded net revenue of 9,784 billion and net profit of 136 billion, nearly 8.9 times higher than the same period last year.

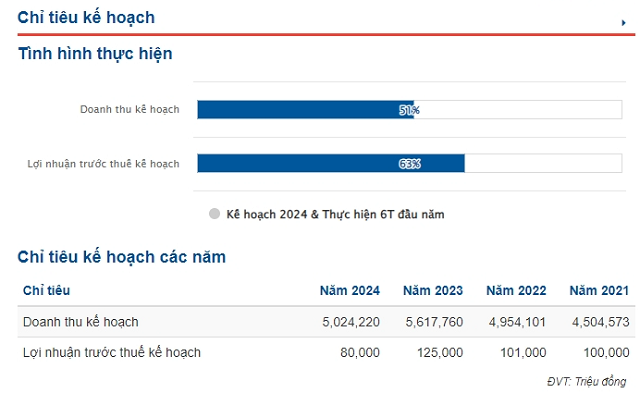

Coteccons has set a plan for the year 2023-2024 (from July 1, 2023, to June 30, 2024) with total revenue of VND 17,793 billion and after-tax profit of VND 274 billion. Therefore, after 6 months, the company has achieved 82% of the revenue target and 50% of the annual profit target.

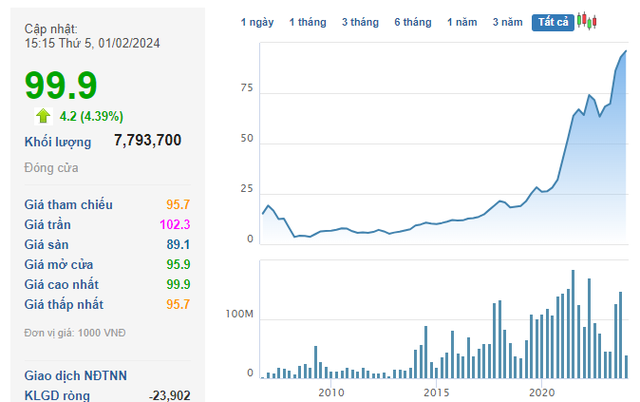

FPT’s stocks have just reached a new peak

According to Coteccons’ financial statements, the company also recorded securities trading with a total value of VND 222.5 billion. In which, the investment in FPT shares is notable when recording a reasonable number of VND 39.6 billion on December 31, 2023. Based on the share price in the last session of the year at VND 96,100/share, the company currently owns about 412,595 shares of this stock.

At the end of the trading session on February 1, 2024, FPT’s stock price has set a new peak at VND 99,900/share. As such, Coteccons is currently temporarily profiting 46% when investing in FPT shares.

However, at the end of 2023, the company had to provision VND 4.5 billion when investing in ETF certificate KIM GROWTH VN and nearly VND 6 billion for investments in other companies.