Annual Meeting Update

VJC‘s 2024 Annual General Meeting of Shareholders was held online on the afternoon of April 26

|

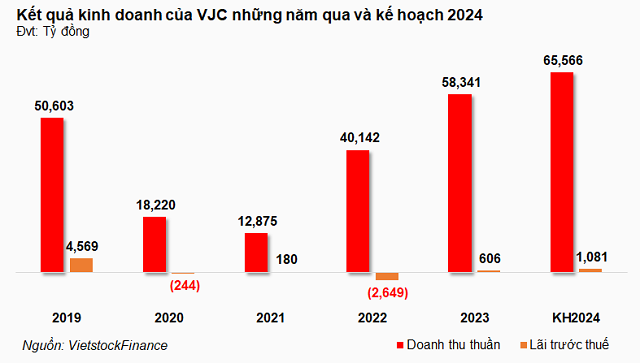

Plan for Pre-tax Profit to Return to the Trillion VND Threshold

VJC forecasts the Asia-Pacific region is likely to recover in 2024 with total passenger volume of approximately 3.4 billion passengers, equivalent to 99.5% of 2019 – the period before the COVID-19 pandemic. In the European and North American regions, basic recovery is expected as in the pre-pandemic period, with passenger volume expected to continue to increase but at a slower pace. Global total passenger volume is forecast at 9.4 billion, an increase of 2.5% compared to 2019.

Looking back at the Vietnamese market in 2023, total domestic and international passengers was approximately 72 million, 9% less than in 2019 (78.8 million). However, the domestic market reached 40.1 million and exceeded 2019 by 7%. The international market had 31.7 million passengers and was still 23% lower than in 2019, mainly due to the slower-than-expected recovery of the Japanese, Korean and especially Chinese markets.

Looking ahead to 2024, the VJC Board of Directors is submitting to the AGM for approval an operating plan with 95 fleets, 8 more aircraft than in 2023; operating 141,998 flights, an increase of 6.8%; transporting 27.4 million passengers, an increase of 8.3%; seat utilization rate remains at 87%.

Air transport revenue is expected to reach 59,066 billion VND, an increase of 10% compared to 2023; net revenue is 65,566 billion VND, an increase of 12.4%; pre-tax profit returns to the trillion VND level with 1,081 billion VND, an increase of 78%.

The 2024 business objectives were presented at the meeting by General Director Dinh Viet Phuong

|

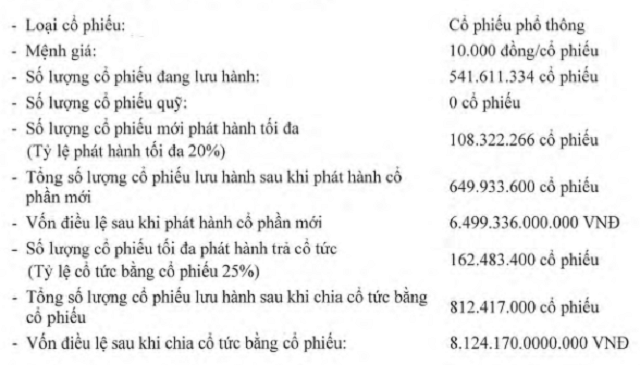

2024 dividend rate of up to 25%, new share offering not to exceed 20% of outstanding shares

The dividend distribution plan was submitted to the AGM for approval at a maximum rate of 25% in shares and/or cash. VJC has provided a detailed plan in case of implementation by shares with the corresponding issuance volume of nearly 162.5 million shares, sourced from accumulated undistributed consolidated profit up to 2024.

In addition, the new share offering plan was also submitted to the AGM for approval in the form of common stock and/or preferred stock dividends, the total number of which does not exceed 20% of the number of outstanding shares at the time of the offering, estimated at over 108.3 million shares.

The expected implementation time is within 2024 and before the 2025 Annual General Meeting of Shareholders, after being accepted by the State Securities Commission. The mobilized capital will be used 50% to supplement sources of liquidity, working capital, and 50% to repay principal and interest on maturing debts.

In the event that both the new share offering and dividend-paying shares are successfully implemented, it is estimated that VJC‘s number of shares will increase to over 812.4 million, equivalent to a charter capital of over 8,124 billion VND.

|

VJC‘s share issuance plan

Source: VJC

|

Regarding the employee stock option plan (ESOP) approved at the 2023 Annual General Meeting of Shareholders with an implementation period during 2023-2025, VJC said that it has not been implemented in the past due to a number of objective reasons and submitted to the 2024 AGM for extension to the 2024-2026 period, to be issued in several tranches.

According to the plan, VJC plans to issue 10 million ESOP shares at a price of 10,000 VND/share, corresponding to a total value of 100 billion VND and will be subject to a lock-up period of up to 3 years from the date of completion of each issuance.

Discussion:

VJC‘s market opening costs are the lowest in the world

In 2023, VJC exceeded its revenue plan for both the parent company and on a consolidated basis, but net profit did not reach the target. Can VJC share the unexpected reasons for this?

CEO Dinh Viet Phuong: This is also something that the VJC executive board carefully considered when reporting to the Board of Directors for approval of the 2024 plan.

2024 will be a difficult year for aircraft, not only for VJC but also for the Vietnamese aviation industry in general. VJC has aircraft that must be recalled, other airlines are also facing this problem. Therefore, there are some declines in capacity.

Even though it is difficult, we still have to ensure development speed, increase aircraft, and increase load. In addition, applying artificial intelligence and digital transformation to optimize, introducing many other solutions, to see how to reduce operating costs but still create opportunities for the fleet to fly more hours, thereby having the opportunity to transport more passengers and generate additional revenue.

We are very confident that with these determinations and efforts, VJC can implement the proposed plan.

Chairwoman Nguyen Thi Phuong Thao: The aviation industry is extremely difficult to operate efficiently. Regarding the plan set for 2023, the aviation industry has many factors that sometimes forecasts cannot overcome objective developments, such as the fact that the Chinese market was expected to recover quickly, but the reality is the opposite. VJC opened a new market in India, and it is these investment costs that have increased VJC‘s costs, resulting in the expected profit having to be shared with the cost of opening the market.

However, VJC‘s market opening costs are the lowest in the world.

Although the results did not meet expectations, when looking up, it is impossible to have profits like Singapore Airlines, but when compared to many other airlines, VJC is one of the few that made a profit after the pandemic, even many long-standing airlines have had to cease operations.

When presenting the 2024 plan figures, the Executive Board also considered potential impacting factors.

Fuel prices and exchange rates continue to rise. What solutions does VJC have to control risks?

CEO Dinh Viet Phuong: The fuel saving program is a broad strategy. VJC has a young and modern fleet. VJC continuously receives A321 Neo aircraft, saving up to 17% on fuel.

VJC always aims to optimize flight routes,