Domesco Medical Import-Export Joint Stock Company (code DMC) – a subsidiary of Abbott Laboratories recently announced its financial report for the first quarter of 2024 with net revenue reaching over 419 billion VND, a slight increase of 3.3% over the same period last year.

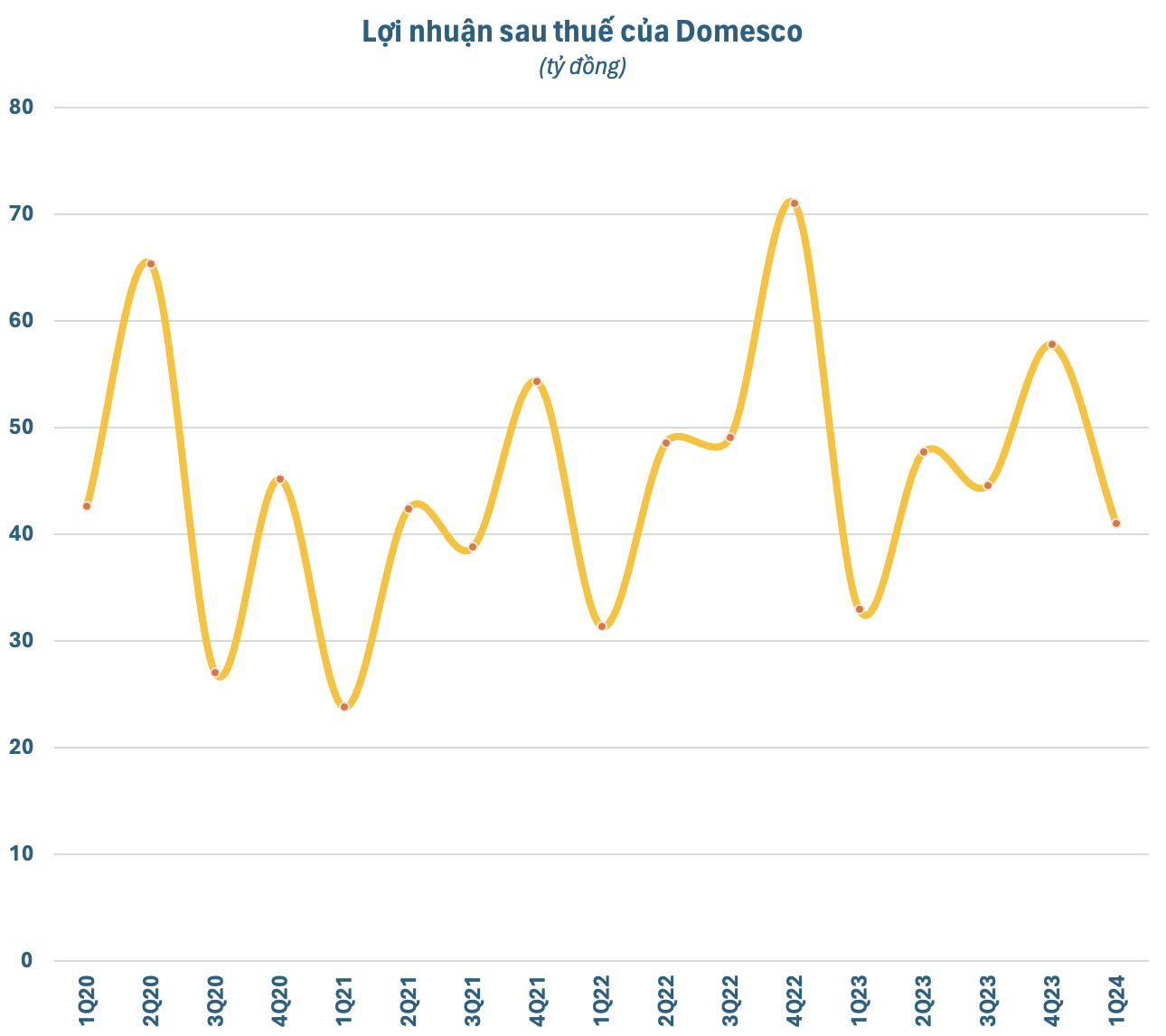

Slower increase in cost of goods sold has significantly improved gross profit margin from 19.5% to 23.3%. Gross profit reached 97.5 billion VND, a 23% increase compared to the first quarter of 2023. After deducting expenses, Domesco’s net profit was nearly 41 billion VND, up by more than 24% compared to the same period of 2023.

According to the document of the 2024 Annual General Meeting of Shareholders, Domesco plans to submit to shareholders for approval a business plan with the target of achieving net revenue of 1,810 billion VND and after-tax profit of 200 billion VND, respectively increasing by 5% and 9% compared to 2023. Thus, Domesco has achieved 23% of its revenue plan and 20.5% of its profit target after the first quarter of the year.

Last year, Domesco recorded net revenue of 1,719 billion VND, up by nearly 8% compared to 2022. However, after-tax profit decreased by 8.5% compared to the same period, down to 183 billion VND. With this result, the company fulfilled its revenue plan but failed to meet its profit target, achieving only 85% of its goal.

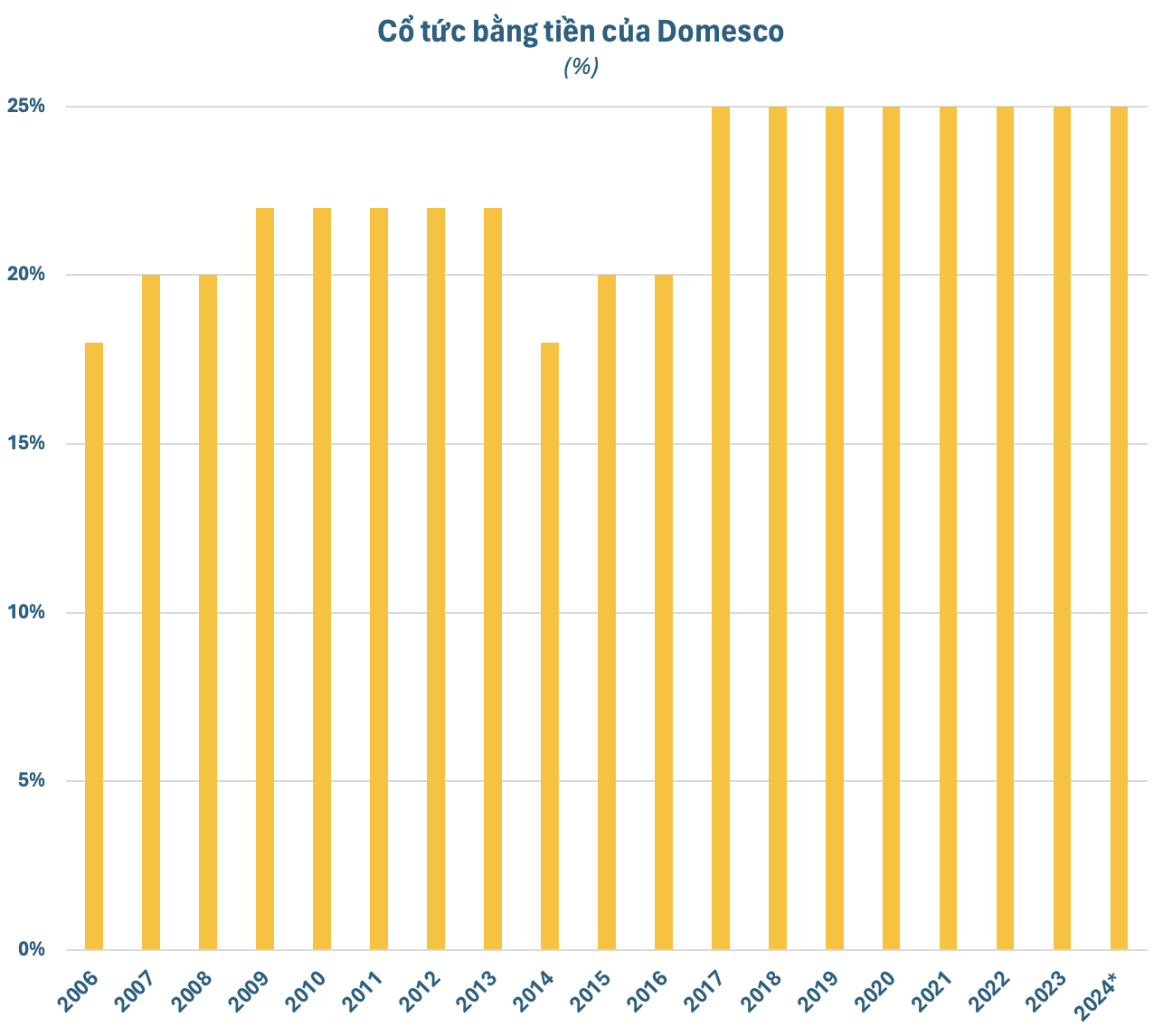

Despite this, Domesco will still submit to shareholders for approval a dividend payment plan in accordance with the plan approved by the 2023 Annual General Meeting of Shareholders of 25% in cash, corresponding to an estimated disbursement of approximately 87 billion VND. Regarding the profit distribution plan for 2024, the company plans to maintain a dividend of 25% in cash.

Domesco is known as a company with a tradition of paying regular dividends every year. Since its listing at the end of December 2006, this pharmaceutical company has never failed to pay cash dividends to its shareholders. If the proposed dividend plan is completed, Domesco will have consecutively paid cash dividends to its shareholders for the 8th year at a rate of 25%.

Domesco was established in May 1989, specializing in research and development, manufacturing, marketing, and trading of pharmaceuticals, herbal medicines, functional foods, purified drinking water, and herbal drinks. In addition, the company also operates in the field of import and export of drugs, pharmaceutical ingredients, food – functional food, medical supplies, and medical equipment serving the medical examination and treatment of the entire population.

Domesco is the first pharmaceutical company on the stock exchange to “sell out” to a foreign investor with the “blockbuster” deal in 2012. At that time, CFR International Spa – Chile (a subsidiary of Abbott Laboratories since 2014) continuously bought up to 8.2 million DMC shares, becoming the largest shareholder holding 45.94% of Domesco’s shares.

Immediately after Domesco increased its foreign room to 100% in September 2016, this foreign shareholder did not miss the opportunity to increase its ownership ratio to 51.69% of shares. It is estimated that the “giant” Abbott Laboratories spent about 400 billion VND to acquire Domesco. Up to now, the value of these shares has reached 1,150 billion VND, nearly 3 times the initial investment, not to mention the “huge” annual dividends with a high rate.

Founded in 1888, Abbott is a world-leading healthcare corporation. Present in Vietnam since 1995, the group is known to Vietnamese consumers through its main products of formula milk, with some famous brands such as Ensure, PediaSure BA, Grow…