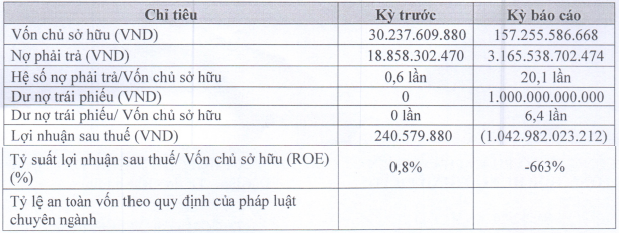

Specifically, Hung Thinh Phat’s after-tax profit has turned from a gain of nearly VND 241 million in 2022 to a loss of nearly VND 1.043 billion in 2023, corresponding to the ratio of after-tax profit to owner’s equity (ROE) from a positive of 0.8% to a negative of 663%.

Owner’s equity has increased by 5.2 times to over VND 157 billion; its payable debt has even increased by 168 times to VND 3,166 billion, corresponding to 20.1 times the owner’s equity, of which VND 1,000 billion is new bond debt.

|

Hung Thinh Phat’s financial status in 2022-2023

Source: HNX

|

This could be a part of the value of the bond lot that this company has recently issued successfully. Specifically, on March 12, 2024, Hung Thinh Phat announced the completion of the mobilization of the bond lot HTPCH2327001 with a value of VND 2,888 billion. The bond was issued on December 31, 2023, with a term of 4 years to December 31, 2027, and is registered by HD Securities Corporation (HDBS).

According to data from HNX, HTPCH2327001 is a non-convertible bond, not attached to warrants, has secured assets, an interest rate of 12%/year and pays interest every 6 months at the end of the period. This is also the only bond lot currently in circulation of Hung Thinh Phat.

|

List of bonds of Hung Thinh Phat

Source: HNX

|

Hung Thinh Phat was established on October 13, 2021, initially operating in the field of civil and industrial construction following the LLC model with a charter capital of VND 30 billion.

On December 19, 2023, corresponding to about 2 weeks before the time of issuance of the HTPCH2327001 bond lot, Hung Thinh Phat changed its operation model to a JSC and changed its main business line to real estate, land use rights owned by the owner, user or lessee. The company increased its charter capital to VND 940 billion, with the ownership structure consisting of Ms. Nguyen Thi Anh Thu 46.81%, Mr. Nguyen Dinh Ngoc 45.74%, Mr. Le Khoi 4.26%, Mr. Lam Ky Dieu 2.23% and Ms. Nguyen Thi Le Thuy 0.96%. The position of General Director and legal representative is held by Mr. Ngoc.

In the list of shareholders of Hung Thinh Phat, Ms. Thu is also the Chairman of the Board of Directors and legal representative of GDK Real Estate Company Limited (charter capital of VND 340 billion as of December 9, 2020), while Mr. Ngoc is the Chairman of the Board of Directors and legal representative of ADK Real Estate JSC (charter capital of VND 530 billion as of January 14, 2021). Both GDK and ADK are on the list of related parties of Danh Khoi Real Estate Group (NRC), with the same key management members, according to information on NRC‘s 2023 financial statements.