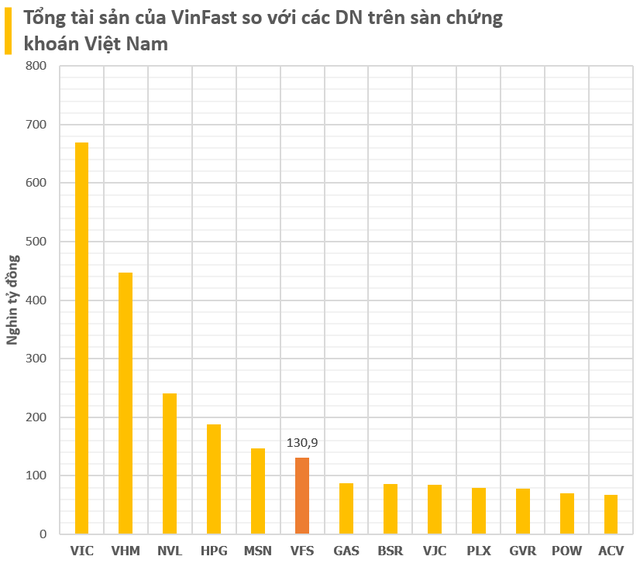

VinFast, an electric car manufacturer and a subsidiary of Vingroup (stock code: VIC), has just announced its financial performance for Q4 2023. As of December 31, 2023, VinFast’s total assets reached VND 130.9 trillion ($5.7 billion), a 15% decrease compared to the beginning of the year.

When compared to other companies listed on the Vietnamese stock exchange (excluding financial institutions such as banks, insurance companies, and securities companies), VinFast’s assets rank sixth, behind Vingroup, Vinhomes, Novaland, Hòa Phát, and Masan Group.

Currently, the other two members of the “Vin” family are leading in terms of assets held on the Vietnamese stock exchange. Specifically, Vingroup is the largest company with total assets of nearly VND 669 trillion ($29 billion), while Vinhomes has assets worth more than VND 447 trillion ($19.5 billion).

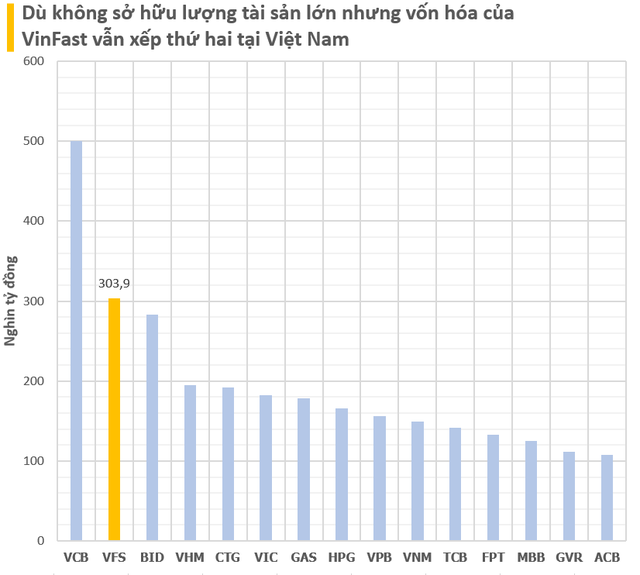

However, VinFast’s market capitalization surpasses these companies. The current price of VinFast shares (VFS) is around $5.3 per share, equivalent to approximately VND 290 trillion ($12.7 billion) in market capitalization.

In fact, VinFast’s market capitalization in Vietnam is only second to Vietcombank when compared to banks. Other banks such as VPBank, BIDV, and Vietinbank have assets that are greater than VinFast, but their market capitalization is smaller.

Regarding VinFast’s asset structure, more than half of its fixed assets consist of factories, machinery, and equipment worth VND 67.916 trillion ($2.97 billion). The second largest asset category is inventory, which reached VND 28.662 trillion ($1.25 billion), an increase of VND 7,000 billion compared to the beginning of the year. The company’s capital mainly comes from loans.

Throughout 2023, VinFast recorded a revenue of VND 28.596 trillion ($1.2 billion), a 91% increase compared to the previous year. However, the company had a gross loss of VND 57.175 trillion ($2.5 billion) for the year. In 2023, VinFast delivered a total of 34.855 electric cars, a 48% increase compared to the previous year, and sold an additional 72.468 electric motorcycles.

“In Q4/2023, VinFast achieved significant revenue growth and improvement in gross margin. We will continue to focus on improving investment efficiency and strengthening the balance sheet by optimizing production costs, bill of materials (BOM), and global capital expenditure (Capex). This will be a crucial support for VinFast’s market expansion, especially in potential markets such as Indonesia and India, driving strong sales growth,” said Ms. Nguyễn Thị Lan Anh, CFO of VinFast.

In the fiscal year 2024, VinFast aims to balance revenue growth and cost optimization based on its production and material cost optimization platform. The company also plans to strategically invest in potential markets in the region.

To boost electric vehicle sales, VinFast will expand its distribution channels by leveraging the network and experience of its dealers in each market. Success in key markets such as the United States will enhance the company’s competitive edge in other markets, especially in untapped Asian markets with great potential. Additionally, VinFast targets to deliver 100,000 vehicles in 2024 through its expanding distribution network.