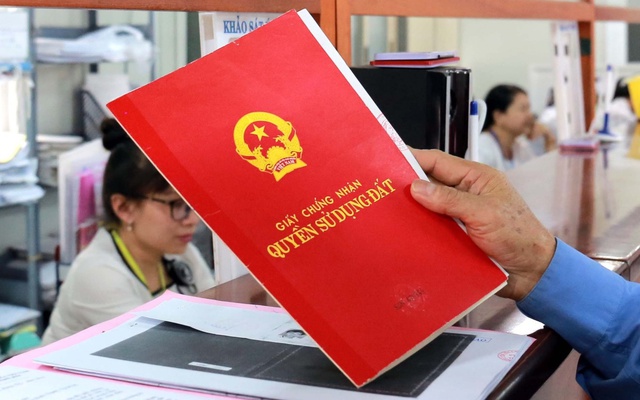

Red Book or Certificate of Land Use Rights is known as “sổ đỏ” in Vietnamese. It is a valuable and significant asset for every individual.

Transferring the Red Book is a form of registering changes in real estate assets. When transferring the Red Book, certain fees must be paid. Especially when transferring through buying and selling, personal income tax and stamp duty must be paid to the government. However, with the following transfer method, individuals are exempt from personal tax and fees.

Cases exempt from personal income tax:

Based on Point a, b and Point d Clause 1 Article 3 of Circular 111/2013/TT-BTC, individuals are exempt from personal income tax when transferring, donating, or inheriting real estate properties including:

– Income from transferring, inheriting, gifting the rights to use land, houses, and other assets attached to the land among the following individuals:

+ Husband and wife;

+ Biological parents and biological children;

+ Foster parents and foster children;

+ Parents-in-law and daughters-in-law;

+ Father-in-law and mother-in-law and son-in-law;

+ Maternal grandparents and grandchildren;

+ Paternal grandparents and grandchildren;

+ Siblings;

In the case of real estate properties (including future residential properties and construction works established in the future in accordance with the laws on real estate business) created by the spouse during the marriage period, these properties are determined to be the joint assets of the husband and wife. When divorced, the division of these assets is exempt from tax based on agreements or court rulings.

– Income from the transfer of residential houses, land use rights, and assets attached to residential land of individuals in the case where the transferor only has one residential house and one land use right in Vietnam. In this case, even if the transfer is made to someone else not related by marriage, blood, or nurture as mentioned above, it is still exempt from personal income tax.

According to Item 10 Article 9 Decree 140/2016/ND-CP, real estate received as inheritance or as a gift between: Husband and wife; biological parents and biological children; foster parents and foster children; parents-in-law and daughters-in-law; father-in-law and mother-in-law and son-in-law; maternal grandparents and grandchildren; paternal grandparents and grandchildren; siblings, are exempt from stamp duty when the competent state authority issues the certificate.