Popular interest rates in March

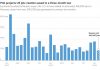

Comparing and cross-checking the data, it can be seen that in March 2024, most banks apply two interest rates: preferential interest rates for short-term loans (3-12 months) and interest rates after the preferential period. The adjustment range of interest rates between preferential and post-preferential periods in popular banks is from 2-3.8%.

In particular, the preferential interest rates for commercial housing loans at banks in March 2024 range from 5-14.05% per year, and after the preferential period, floating interest rates range from 8-13% per year.

The state-owned banks (Agribank, Vietcombank, Vietinbank, and BIDV) apply interest rates for production and business loans, consumer loans, and home loans ranging from 5.3-8.5% per year, depending on the term.

Specifically, BIDV offers 6.5% per year for the first 6 months and 7% per year for the next 12 months, with a minimum loan term of 36 months. For customers who borrow to buy a house for a minimum of 60 months, the interest rates range from 7.5-8.5% per year, depending on the term;

The adjustment range of interest rates between preferential and post-preferential periods in popular banks in March 2024 is from 2-3.8%. (Illustrative image)

VietinBank offers 5.7% per year for short-term loans and 6.45% per year for medium and long-term loans for production and consumption purposes;

Vietcombank offers preferential interest rates of 6.0% per year for the first 6 months for short-term loans (under 12 months) for individual customers who borrow to buy a house, buy a car, or consumer loans; or 6.3% per year for the first 6 months for medium and long-term loans. As for SME customers, depending on their capacity and credit rating, Vietcombank applies interest rates starting from 5.3% per year for short-term production and business loans;

Agribank applies a fixed interest rate of 7% per year for medium and long-term loans, with the application period extended from 12 months to 24 months.

For joint-stock commercial banks (BV Bank, VPBank, Sacombank, MSB, TPBank, ACB, HD, OCB, TPBank), the housing loan interest rates range from 5-10.5% per year.

Foreign banks (Wooribank, Shinhan Vietnam, Standard Chartered) also adjust their interest rates.

Notes on conditions for home loans

In reality, some banks offer particularly attractive housing loan interest rates. However, customers need to be aware that these preferential rates only apply for a short period of time, and after the preferential period, the interest rates will float according to the market rate. At some banks, if customers want to enjoy better interest rates, they need to purchase additional bundles such as savings deposits, attractive account numbers (OCB), credit cards, etc.

Therefore, in addition to comparing the housing loan interest rates offered by different banks to choose a suitable loan package, buyers should carefully consider their cash flow and repayment capacity. Instead of being attracted by preferential interest rates, it is advisable to calculate based on floating interest rates in the market.

Experts advise buyers to allocate a maximum of 30-40% of their total monthly income for housing needs. (Photo: Lập Đông Tiền Phong)

Regarding the conditions for home loans, although banks have set certain criteria such as customers being at least 18 years old, having good credit scores, stable income, and ensuring repayment capacity, customers should still call or visit the branches/transaction offices of the bank for specific advice on bank loan interest rates.

Experts also advise buyers to allocate a maximum of 30-40% of their total monthly income for housing needs in order to ensure the ability to cover basic expenses. Monthly principal repayment, if not carefully planned and reasonable, can create financial burdens and significant pressures on life.

Difficulties in accessing the 120,000 billion VND credit package

Previously, Circular 06/2023/TT-NHNN allowed individuals to borrow from one bank to repay loans from another bank in advance. However, many customers have reflected that it is not easy to access new loans with low interest rates. If customers are facing difficulties with their current loans, the risk of overdue and bad debts will be high with new loans, so not all banks are willing to lend.

In addition, customers should also consider certain costs that they must bear, such as prepayment fees ranging from 0.5-3% or higher depending on the lending bank, red book collateral release fees, new mortgage registration fees, notarization fees, insurance fees for new loans, etc.

People find it difficult to access the 120,000 billion VND credit package. (Photo: Lập Đông Tiền Phong)

In reality, many banks have implemented policies for individuals to borrow funds to repay loans from other banks at preferential interest rates. Specifically, the State Bank has issued instructions for the implementation of the 120,000 billion VND credit package for social housing projects, worker housing, renovation projects, and reconstruction of old condominiums. Specifically:

The borrowers include project owners and customers who buy houses in these projects; the borrowing conditions are that the projects must belong to the list announced by the Ministry of Construction; at the same time, the borrowers must meet the eligibility criteria and meet the loan conditions according to regulations;

The interest rates for home loans under the 120,000 billion VND credit package from 1/1-30/6/2024 are 8% per year for project owners, lasting for 3 years from the disbursement date, and 7.5% per year for home buyers, lasting for 5 years from the disbursement date.

The above bank loan interest rates will not be fixed, every 6 months, the State Bank will notify participating banks of any adjustments.

Many people have commented that the interest rate of the 120,000 billion VND credit package is higher than the preferential interest rate for commercial housing loans currently applied by some banks, as well as higher than the preferential interest rate for social housing loans, which is currently at 4.8-5% per year (applicable until 31/12/2024).