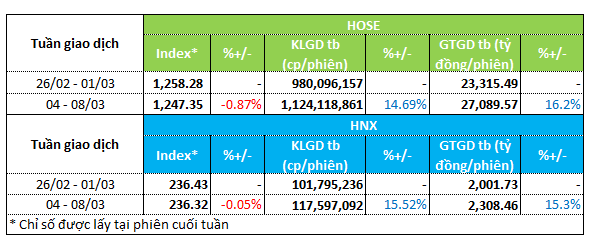

During the week of March 4th to March 8th, the stock market reversed its upward trend and experienced a slight decline. The VN-Index dropped nearly 1% to 1,247.35 points, while the HNX-Index decreased slightly by 0.05% to 236.32 points.

Despite the decrease in index points, market liquidity saw an increase. At the HOSE exchange, trading volume and value surged by 15-16% to 1.1 billion units per session and 27 trillion dong per session. Meanwhile, liquidity at the HNX exchange increased by over 15%. Trading volume and value reached an average of 117.5 million units and 2.3 trillion dong per session.

|

Weekly liquidity overview for March 4th – March 8th

|

During the week, market liquidity increased significantly, with a strong focus on real estate stocks. Representing this group, 10 out of the top 20 stocks with high liquidity on the HOSE exchange belonged to the real estate sector. These stocks all experienced a trading volume increase of over 100% compared to the previous week. Notably, AGG recorded a trading volume surge of 260% to 1.2 million units per session.

Other stocks such as NBB, HQC, LDG, KBC, ITC, NHA, SCR, EVG, and BCM also saw their liquidity rise by 100-200% compared to the previous week.

At the HNX exchange, real estate stocks also attracted capital inflows. API, IDJ, L14, and TIG experienced a trading volume increase of 30-150% throughout the week.

In parallel with real estate, the securities sector also received significant attention from investors. TCI, APS, PSI, VFS, BVS, EVS, and SHS were among the stocks favored by capital inflows.

On the other hand, the seafood sector experienced capital outflows after a week of inflows. ASM, ANV, and VHC were among the top stocks with a significant decrease in liquidity.

In addition, small-cap construction stocks and plastic stocks also faced significant capital outflows. KPF, MCO, VC2, CMS, and SCI from the construction sector appeared in the high liquidity decrease group. Meanwhile, TDP, TNH, and PLP from the plastic sector also experienced capital outflows.

|

Top 20 stocks with the highest increase/decrease in liquidity at the HOSE exchange

|

|

Top 20 stocks with the highest increase/decrease in liquidity at the HNX exchange

|

List of stocks with the highest increase/decrease in liquidity based on average trading volume of over 100,000 units per session.