“Viettel family” stocks soar

While the market is fluctuating, the “Viettel family” stocks are unexpectedly shining. All 3 stocks: VGI of Viettel Global, CTR of Viettel Construction, and VTK of Viettel Consultancy, have been accelerating their growth recently, even setting new record highs.

The stock with the highest value in the Viettel group is CTR of Viettel Construction, which continues to skyrocket, reaching its all-time high of VND 112,500 per share on the morning of March 11th. CTR has increased by 25% since the beginning of the year and doubled in price compared to one year ago.

CTR of Viettel Construction sets a new record

VGI of Viettel Global, the only billion-dollar enterprise in the Viettel family, has also performed well with a 5.5% increase on March 11th, reaching VND 38,500 per share. Although it has not reached the peak of the past, these Viettel family stocks have come close to the peak with a 49% increase since the beginning of the year. VGI’s current market capitalization is nearly VND 116.8 trillion, equivalent to USD 4.7 billion.

Meanwhile, VTK of Viettel Consultancy also rose by 3.2% to VND 42,000 per share. Since the beginning of the year, this stock has grown by 27%.

Preparing to be listed on HoSE, the VTP stock of Viettel Post has continuously surged, reaching a new all-time high of VND 78,400 per share on the same day it left the UPCoM exchange. From November 2023 until now, its price has almost doubled. The current market capitalization of Viettel Post has increased to over VND 9.5 trillion, triple the value from one year ago.

The Viettel family stocks are flourishing just before the VTP stock of Viettel Post officially moves from UPCoM to HOSE on March 12th. Specifically, 121.78 million VTP shares will be officially listed on HoSE on March 12th with a reference price of VND 65,400 per share (with a fluctuation limit of +/- 20%).

Moreover, positive support for these stocks is also attributed to the successful auction of the right to use radio frequency for the 2500 – 2600 MHz band by the Viettel Military Industry and Telecoms Group within the next 15 years with a relatively large successful bid.

The 2500-2600 MHz band won by Viettel is planned by the Ministry of Information and Communications for the deployment of mobile information systems according to 5G, 4G, and future technologies.

According to Viettel’s representative, this frequency band is of special importance for Viettel to accompany the global telecommunications technology development trend, continue to develop 4G networks, and transition to 5G technology.

Core business activities are growing

The high stock price increase of the Viettel group is mainly due to overall positive business results, despite differentiation among enterprises.

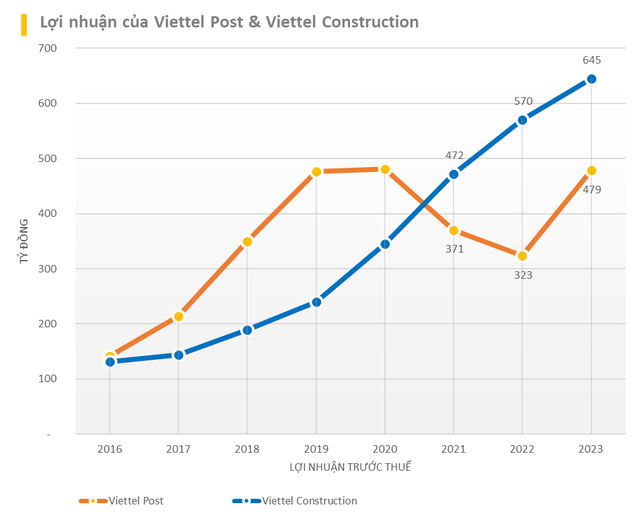

Notably, Viettel Construction JSC (stock code CTR) is the most prominent. In January 2024, CTR recorded revenues and pre-tax profits of VND 869 billion and VND 50 billion, respectively, representing a growth of 15% and 17% compared to the same period.

In 2024, Viettel Construction aims to achieve a consolidated total revenue of over VND 12.653 trillion and pre-tax profit of VND 671.4 billion, an increase of 10% and 4% respectively compared to 2023. With the results achieved in the first month of the year, the company has accomplished 6.9% of its revenue plan and 7.4% of its annual profit target.

Looking back at 2023, the company’s net revenue reached VND 11.299 trillion and after-tax profit was VND 517 billion, representing a growth of 19% and 13% respectively compared to 2022. This is the tenth consecutive year of revenue growth and the seventh consecutive year of profit growth.

Viettel Post (stock code VTP) also performed well after two years of declining profits. In 2023, Viettel Post achieved revenues of VND 19.59 trillion, a 9% decrease compared to 2022. However, a significant decrease in costs resulted in a strong increase in gross profit of nearly VND 876 billion. After deducting expenses, Viettel Post achieved a net profit of over VND 380 billion, an increase of 49% compared to 2022.

In 2024, Viettel Post targets a total revenue of VND 13.847 trillion, a 29% decrease compared to 2023, but its estimated after-tax profit will slightly increase to VND 384 billion. Over the next 5 years, the company aims for its sales to increase to 10 times the level of 2023, equivalent to an annual growth rate of 60-65% for both core and new business areas.

The company stated that it is still seeking opportunities in foreign markets, which are potential areas for growth in the 2025-2030 period. The company already has 2 subsidiaries in the international express delivery sector, Mygo Cambodia and Mygo Myanmar. Viettel Post is promoting the construction of transportation routes linking Vietnam with China and ASEAN; participating in the construction of the most modern smart border gate project in Vietnam.