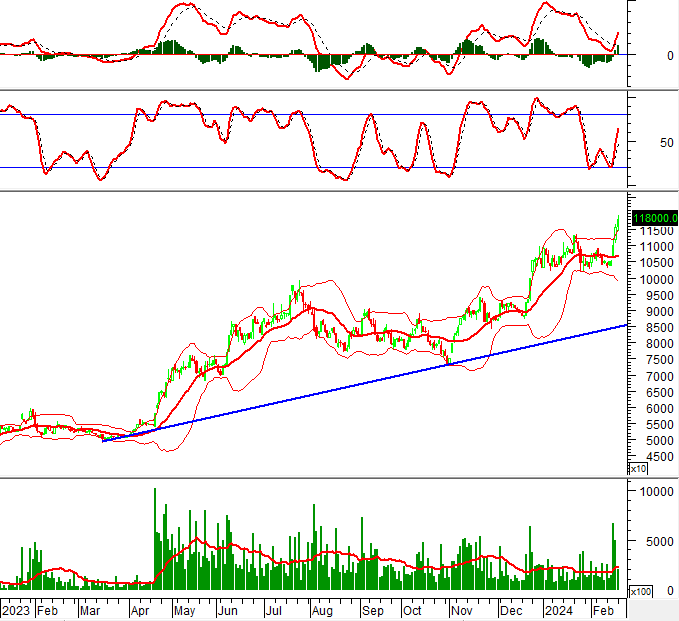

Technical Signal of VN-Index

In the morning trading session on February 26, 2024, VN-Index gained points while showing a High Wave Candlestick pattern, indicating the existing indecisiveness of investors.

In addition, the money flow is showing signs of withdrawal from the market as the trading volume is low and expected to be below the 20-day average at the end of the session.

Currently, the MACD indicator is likely to provide a sell signal as it tends to cross below the Signal Line in the near future. If this happens, the short-term prospects of the index will be quite pessimistic.

Technical Signal of HNX-Index

In the trading session on February 26, 2024, HNX-Index slightly decreased and stayed above the SMA 50-day, accompanied by a relatively low trading volume, indicating cautious sentiment among investors.

The Stochastic Oscillator has given a sell signal and the MACD indicator is also likely to provide a similar signal as it crosses below the Signal Line. If a sell signal appears in the next few sessions, the situation will be very risky.

ANV – South Vietnam Corporation

In the morning session on February 26, 2024, ANV stock hit the limit up and at the same time formed a Bullish Engulfing candlestick pattern, accompanied by a breakthrough and above-average trading volume for the past 20 sessions, indicating very optimistic sentiment among investors.

In addition, the MACD indicator continues to be above 0 and trending upwards, indicating positive prospects are still present.

Currently, ANV has successfully surpassed the 50% Fibonacci Retracement level and is approaching the 61.8% Fibonacci Retracement level (equivalent to the range of 34,000-34,900) with the gap between the 50-day SMA and the 100-day SMA narrowing. If a Golden Cross between these two lines occurs, the upward momentum will be further reinforced in the long term.

BMP – Binh Minh Plastics Corporation

In the morning trading session on February 26, 2024, BMP surged and continuously created higher highs and higher lows, while also forming a Three White Soldiers candlestick pattern, reflecting the optimistic sentiment of investors.

The trading volume improved in the morning session and is expected to surpass the 20-day average at the end of the session, indicating a lively trading atmosphere among investors.

On the other hand, the Stochastic Oscillator has given a buy signal and continues to move towards the overbought zone, indicating positive short-term prospects.

Technical Analysis Department, Vietstock Advisory Division