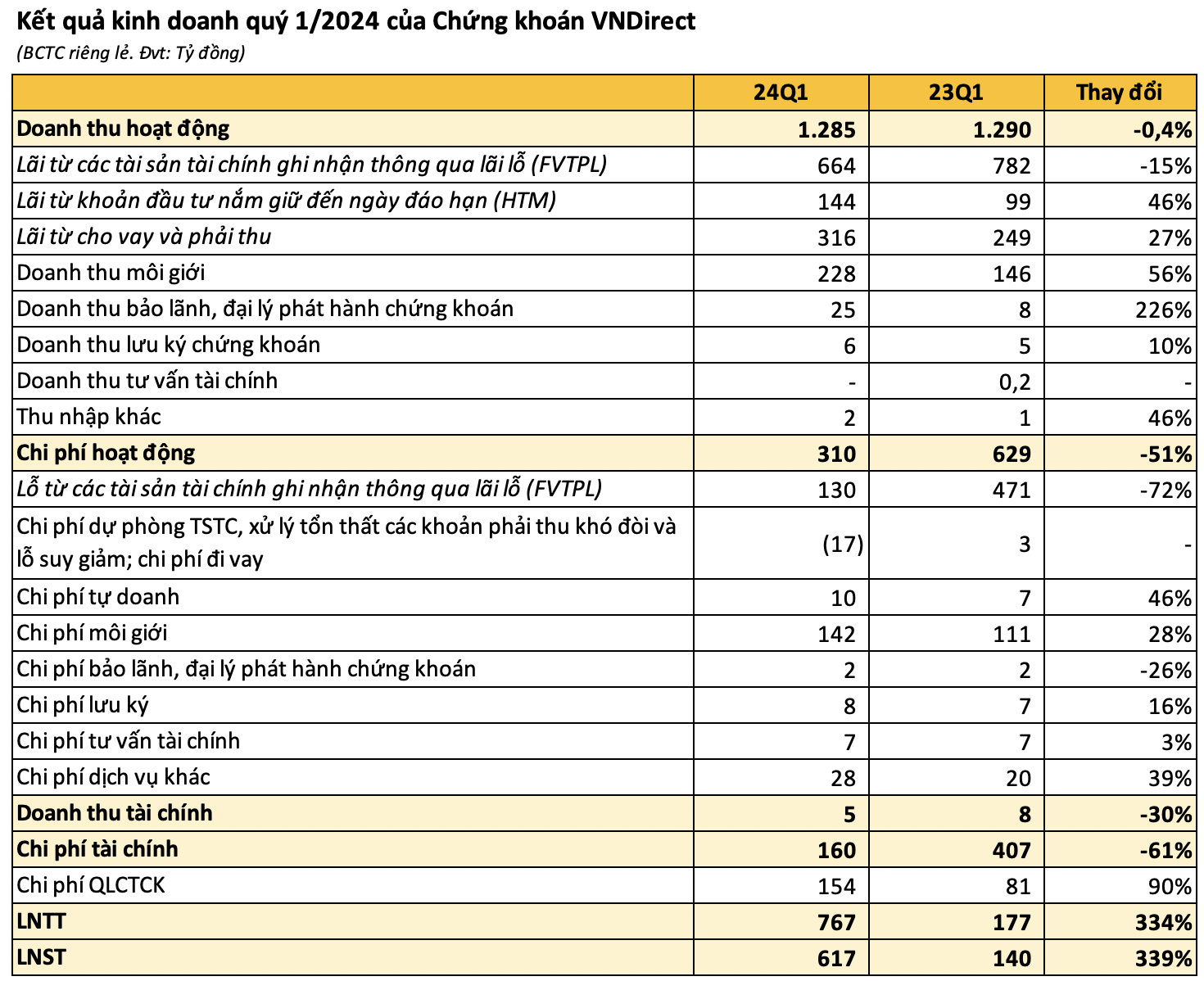

VNDirect Securities Corporation (code VND) has just published its Q1/2024 separate financial report with operating revenue slightly dropping by 0.4% year-on-year to VND 1,285 billion. However, pre-tax profit sharply increased by 334% compared to Q1/2023, reaching VND 767 billion. This is mainly attributed to the reduction of the loss in proprietary activities.

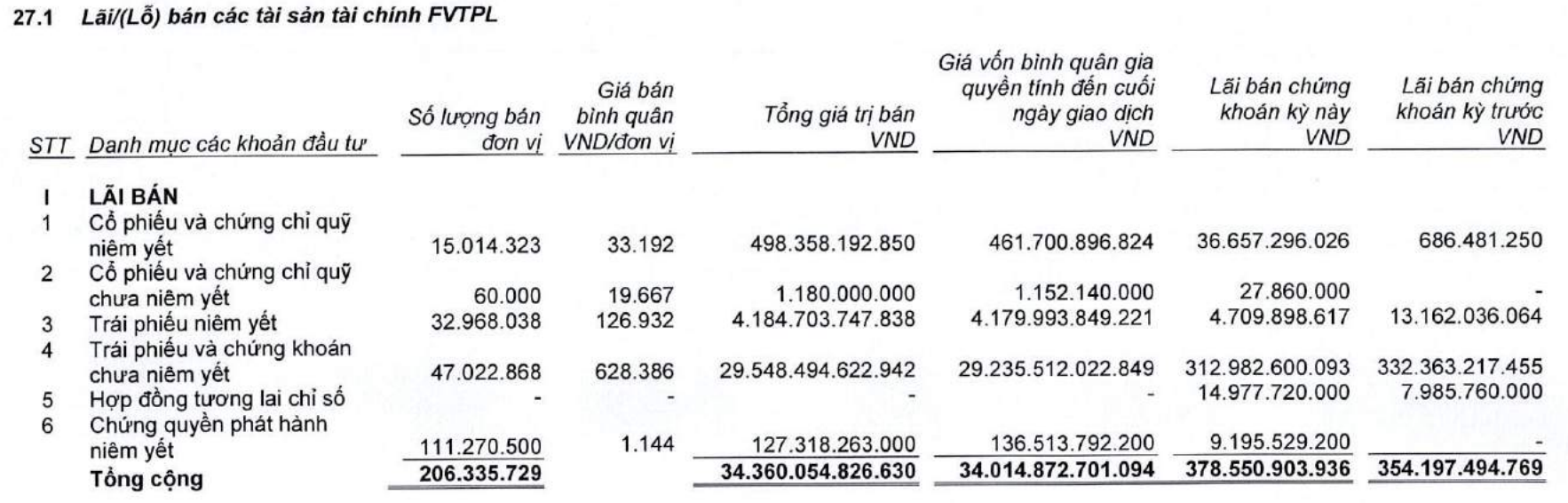

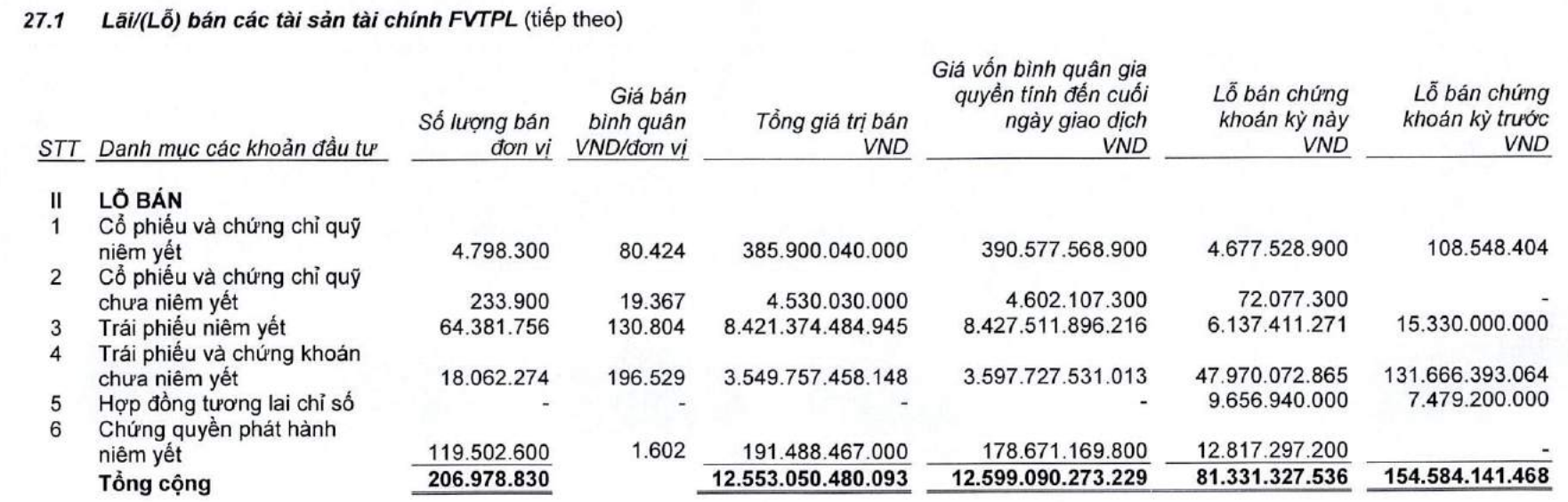

In the first quarter of 2024, profit from financial assets recorded through profit/loss (FVTPL) decreased by 15% compared to the same period in 2023, at VND 664 billion. This decline mainly stemmed from dividends and interest arising from FVTPL, falling from nearly VND 278 billion to VND 176 billion. On the contrary, profit from FVTPL sales increased by 7% year-on-year to VND 379 billion, primarily thanks to a sharp increase in profit from selling listed stocks and fund certificates of nearly VND 37 billion (in Q1/2023, it was less than VND 700 million).

Meanwhile, losses from FVTPL decreased by 72% compared to the same period in 2023, to VND 130 billion. This drop is due to a significant reduction in losses from the sale of unlisted bonds and securities, from VND 132 billion in Q1/2023 to nearly VND 48 billion, along with a decrease in the revaluation difference of FVTPL assets to nearly VND 36 billion (nearly VND 317 billion in Q1/2023). As such, VNDirect earned a net profit from proprietary activities of over VND 520 billion in Q1/2024.

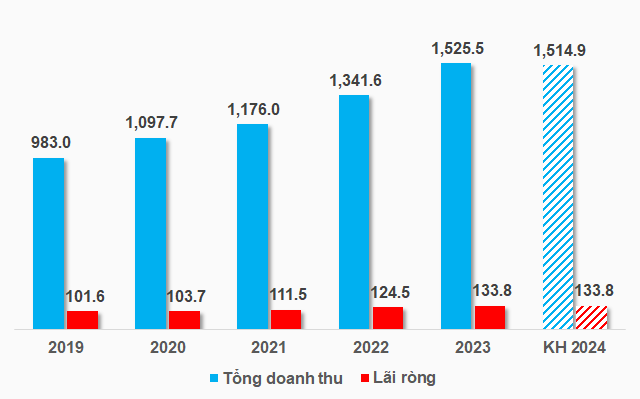

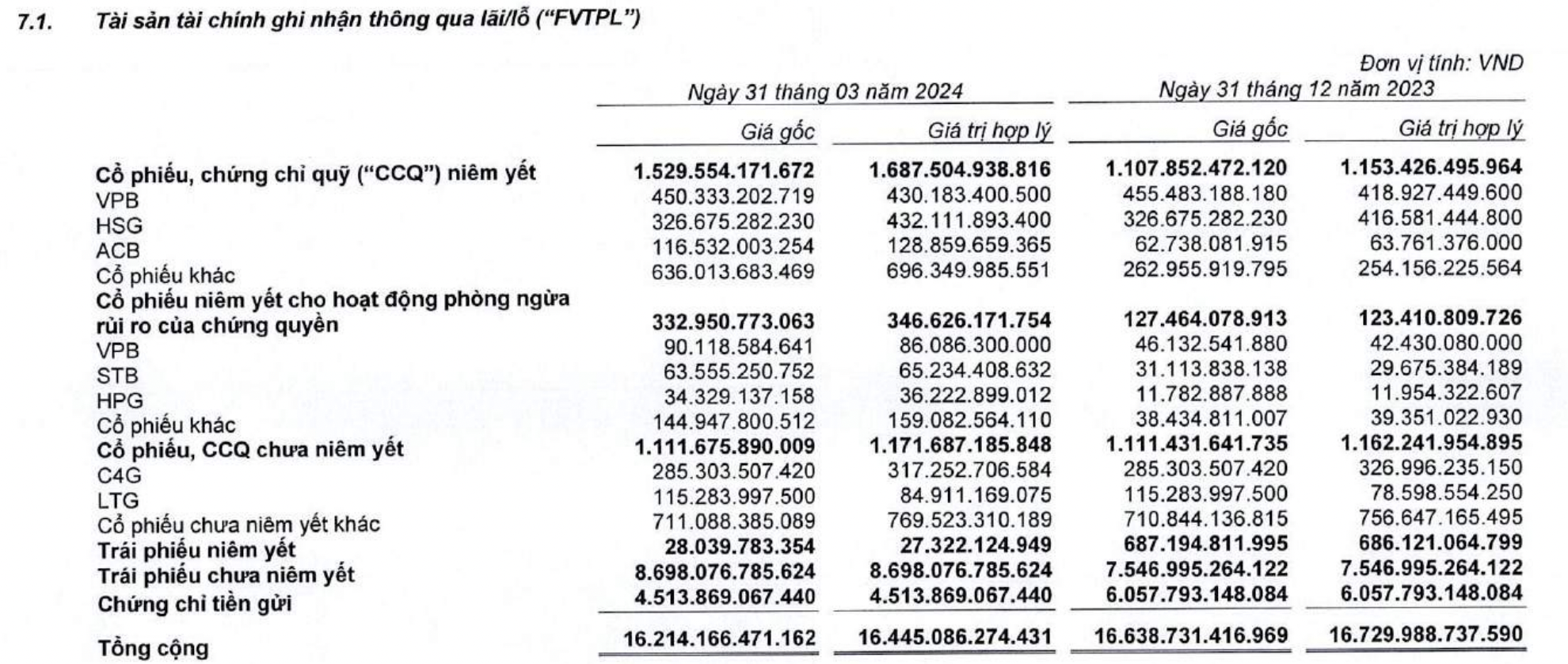

As of the end of Q1/2024, VNDirect’s proprietary portfolio had an original value of over VND 16,200 billion, a decrease of VND 425 billion compared to the end of 2023. This reduction was mainly in the form of time deposits (reduced by VND 1,544 billion). Conversely, the value of listed shares increased by VND 420 billion compared to the end of the previous year, to over VND 1,500 billion, including VPB (VND 450 billion, down VND 5 billion), HSG (VND 327 billion), ACB (VND 117 billion, up VND 54 billion), and other stocks (VND 636 billion, up VND 373 billion).

In Q1/2024, VNDirect’s interest income from held-to-maturity investments (HTM) increased by 46% year-on-year to VND 144 billion. As of March 31st, 2024, the company had nearly VND 7,800 billion in term bank deposits with maturities of less than one year, an increase of VND 368 billion from the beginning of the year.

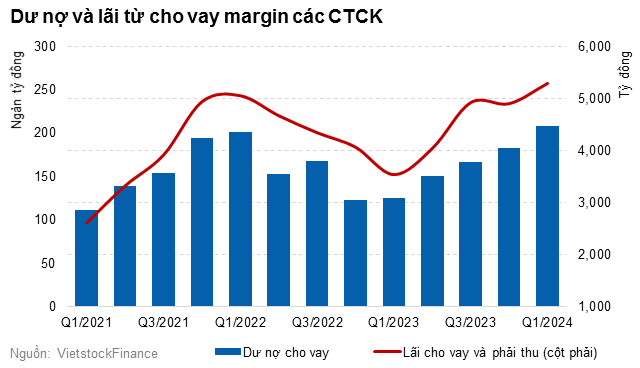

Interest from loans and receivables increased by 27% compared to Q1/2023, to VND 316 billion. At the end of the first quarter, VNDirect’s loan balance reached VND 9,958 billion, a decrease of nearly VND 320 billion from the end of 2023, all of which were margin balances.

Brokerage activities brought in VND 228 billion in revenue during Q1, an increase of 56% compared to the same period in 2023, but still down nearly 28% compared to the previous quarter. In the first quarter of 2023, VNDirect’s market share in stock, fund certificate, and derivative brokerage on HoSE declined significantly to 6.01%, ranking only in the top 4, behind VPS, SSI, and TCBS.