TLG Shareholders Annual General Meeting Update

TLG held its annual General Shareholders Meeting on the morning of April 23, 2024.

|

Discussion

TLG plans to increase its product pricing?

CEO Tran Phuong Nga: Our products developed in collaboration with international partners are innovative and highly differentiated. Initially, we did not aim for high volume, so profitability was lower than mass-market products. However, in the long term, profitability will be a key differentiator for our business.

The gross profit margin in the domestic market is around 40%, which is quite high compared to the stationery industry worldwide, due to our focus on high-volume, efficient products. We anticipate that this margin may be affected in the future, so we will consider adjusting our product portfolio to maintain a range of 38-45%.

Can the company share more about industry trends?

Chairman Co Gia Tho: Demand for writing instruments and office supplies remains strong in Vietnam and other Asian countries, with a focus on differentiated products that meet the evolving needs of consumers.

How does inventory affect the company’s sales performance?

CEO Tran Phuong Nga: Consignment inventory at sales points overseas significantly impacted performance in 2023. This situation persisted in the first half of 2024, but we have been able to stabilize the level of consigned inventory. Therefore, we are optimistic about stronger growth in the second half of the year.

Regarding inventory in the Vietnamese market, there has been some adjustment in the first few months of the year. We will continue to monitor the situation and make changes to our product mix, while still managing the existing inventory.

What are the cost of raw materials in 2024, and which product segments are driving the company’s growth?

CEO Tran Phuong Nga: The exchange rate increase has put pressure on plastic costs. We have had to adjust prices on existing products while only raising packaging costs for new products. This is to maintain our competitive advantage and provide value to consumers. If we were to increase prices across the board, it would make competition with the retail industry even more challenging.

Fortunately, our exports have also increased significantly, from 800 billion to 1,000 billion, which helps us offset the increased costs associated with the exchange rate and maintain our gross profit margin.

Does TLG plan to open more Clever Box stores?

CEO Tran Phuong Nga: We are exploring opportunities in new product categories, so we will develop plans to invest in new stores later this year. Currently, our stores are leased, so the investment required is relatively low. The main expense is operating costs, so we are not rapidly expanding at this time to manage expenses. However, the company remains committed to allocating a certain amount of its budget to store development in the future.

What are the criteria for evaluating store performance, and are there plans to offer new services?

CEO Tran Phuong Nga: We evaluate store performance based on product coverage, product display, and customer experience touchpoints. We want to emphasize the experiential factor rather than products with high sales. In the future, we will move into the toy segment, creating a new opportunity for TLG. Currently, we are not putting too much pressure on sales staff.

Why is there no target set for profit to issue ESOP?

Chairman Co Gia Tho: If there are no sales, there will be no profit. We have a proven track record of disciplined management in production, sales, and cost control, and our profit margin remains high at around 45%. The market is highly competitive, so our focus is on protecting market share. We cannot invest heavily in advertising to increase market share. Therefore, growing sales is a sustainable goal for TLG. When we face challenges, we will issue ESOP based on profitability.

Why did the company issue ESOP without any repurchase conditions?

Chairman Co Gia Tho: The planned ESOP issuance is expected to be modest in size. The purpose is to encourage and enhance the sense of responsibility of key executives within the company. When we issue ESOP, we carefully assess individuals who deserve it and have contributed to the company’s success.

Therefore, if they leave the company, we would not want to buy back their shares since the number of shares they hold is relatively small. We will note this feedback and consider introducing repurchase provisions in future issuances if the issuance size is larger and individuals leave the company.

How is TLG preparing its next generation of leaders?

Chairman Co Gia Tho: TLG is a disciplined company with a consistent track record of strong performance. We have a well-established management team with transparent hiring practices and a focus on professional development to support the company’s growth and maximize shareholder value.

Succession planning is a long-term process that requires dedication. We must carefully select talented individuals, provide them with specialized training aligned with TLG‘s vision, and guide them through the organization. Only after a thorough assessment and evaluation over an extended period will we consider and make decisions regarding succession, always prioritizing the best interests of the company.

What is R&D doing to create innovative new products?

Mr. Nguyen Dinh Tam – Member of the Board of Directors: The company has made significant investments in its design, innovation, and sustainable development teams. Our focus is on creating products that enhance the user experience for children, combining learning and play, personalization, and gift-giving.

TLG has a dedicated team of researchers and product developers. We also collaborate with recognized experts in our product areas. In 2023 and 2024, TLG will introduce several standout products to the market.

Chairman Co Gia Tho: During the post-pandemic era, we have seen an influx of Chinese products in various channels. These products are often highly innovative and diverse. Fortunately, TLG has invested heavily in product development over the years, resulting in improved product quality. Our products have evolved to reflect current trends, with vibrant colors and a focus on personalization. Our R&D team includes a dedicated design team, as product design has become increasingly important.

What were the results for the first quarter of 2024? How will China’s reopening impact TLG’s business operations?

CEO Tran Phuong Nga: First-quarter revenue declined by 12% year-over-year, to approximately 800 billion VND. Profit also decreased by 12%, but the company maintained its profit margin. Business performance in April has not yet shown any significant improvement. In the first quarter, sales points were cautious about inventory, and distributors reported challenging sales conditions. We have plans to drive significant growth in the second quarter, with record domestic revenue in May and June, reaching 1,000 billion VND, double the revenue in the first quarter, and continued growth in the third quarter.

Regarding China’s reopening, the market will be extremely competitive in terms of price and product design. However, we remain committed to investing in R&D to develop differentiated products. This will allow us to justify higher pricing. We believe that not all companies will be able to sustain losses by continuously reducing prices to compete. Therefore, we must hold our ground and maintain our current market share.

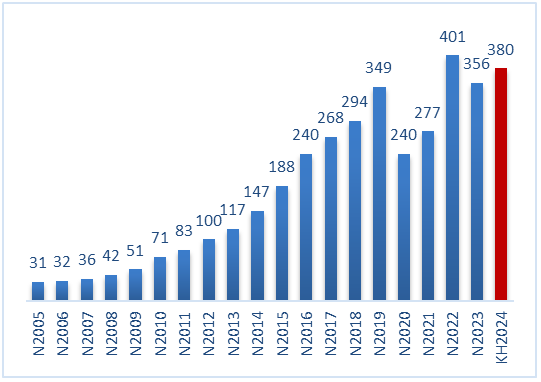

Net profit target for 2024 is 7% higher, at 380 billion VND

|

TLG‘s planned net profit for 2024. Unit: Billion VND

Source: VietstockFinance

|

In 2024, TLG targets net revenue of 3,800