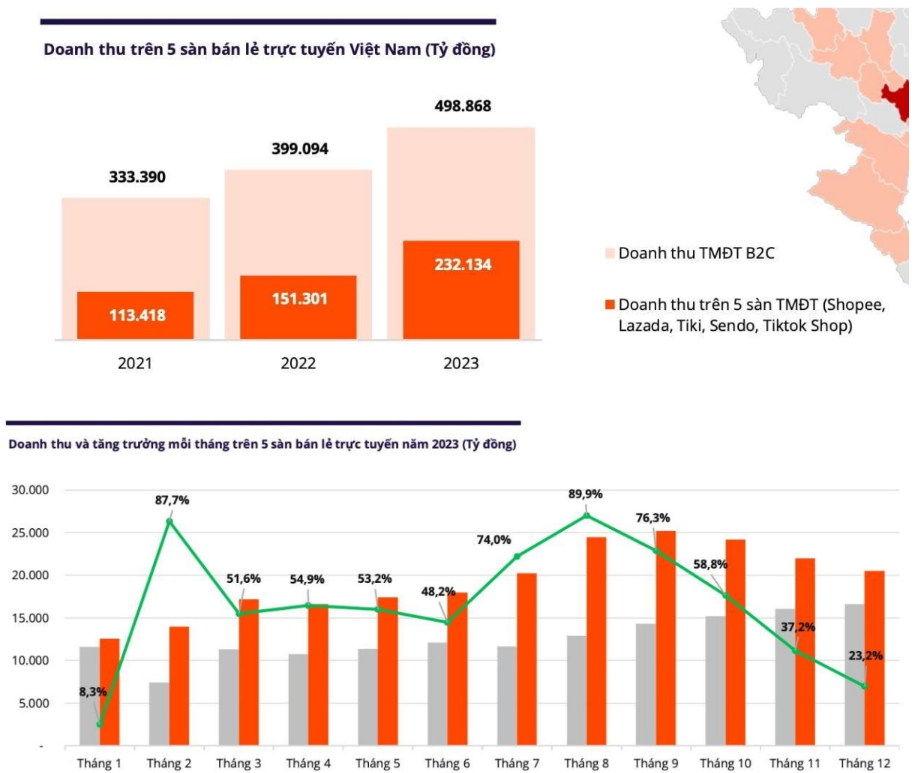

According to the recent E-commerce Market Report by Kirin Capital, data from Metric.vn indicates that the e-commerce landscape in Vietnam is dominated by five major platforms: Shopee, Lazada, Tiki, Sendo, and Tiktok Shop.

In 2023, the total revenue of the top 5 e-commerce platforms reached a staggering 232.134 billion dong, representing a 53.4% growth compared to the same period in 2022. The number of successful transactions also soared to 2.2 billion units.

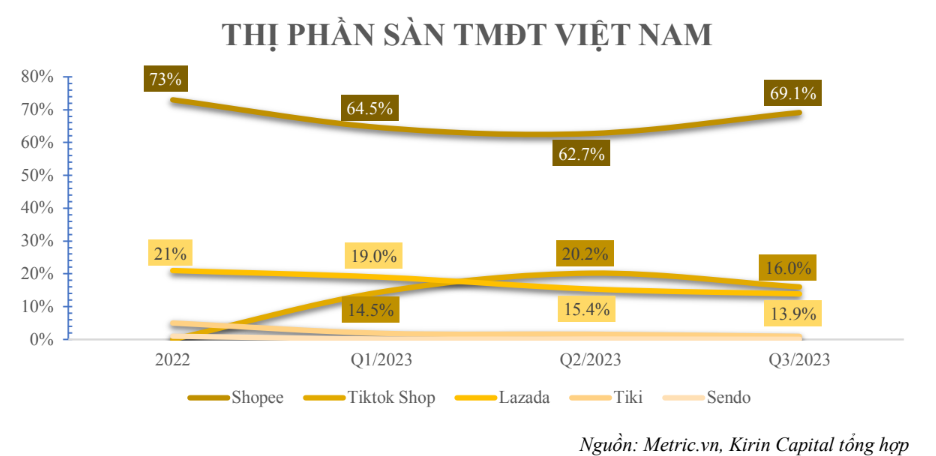

Furthermore, Metric.vn’s report reveals that since Tiktok Shop’s entry into the e-commerce market in 2022, Shopee’s market share has declined significantly from 73% to 69.1% in the third quarter of 2023.

Kirin Capital notes that despite entering the Vietnamese e-commerce market in 2016, Shopee surpassed both Lazada and Tiki within two years, becoming the most popular e-commerce platform in Vietnam by 2018.

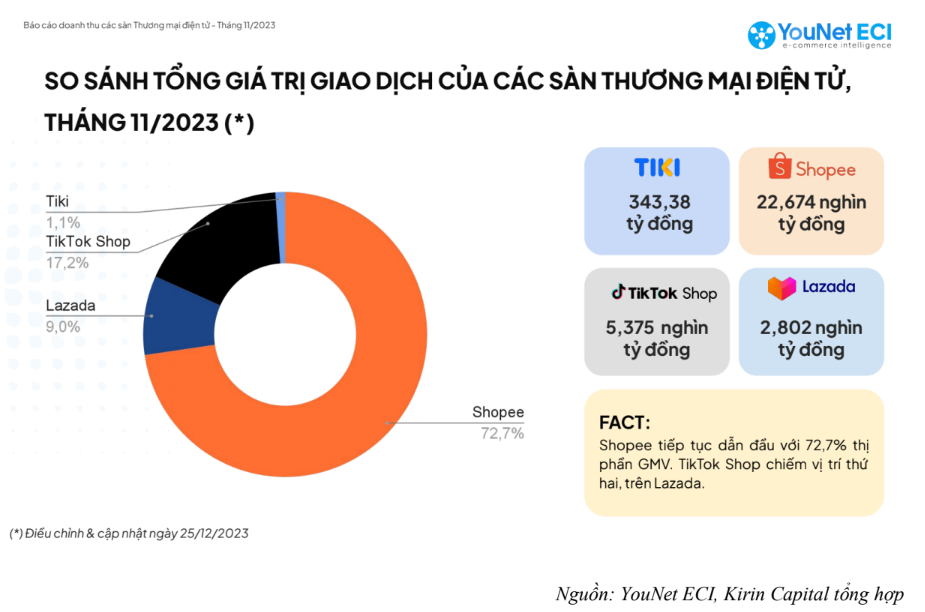

Shopee continues to maintain its position as the platform with the highest share of revenue in Vietnam. According to a report from data company YouNet ECI, in November 2023, the four e-commerce platforms generated a combined transaction value of 31.195 billion dong from 405,000 sellers. The sales revenue in November 2023 also grew by 9.3% compared to October. Shopee remains the market leader with a 72.7% share (equivalent to 22.674 billion dong). TikTok Shop follows with a 17.2% market share, while Lazada holds a 9% market share.

Kirin Capital attributes Shopee’s success in Vietnam to its aggressive spending and marketing strategies.

Upon entering the Vietnamese market, Shopee and other e-commerce platforms engaged in a “cash-burning” race to gain market share and shift consumer behavior from traditional brick-and-mortar stores to online shopping.

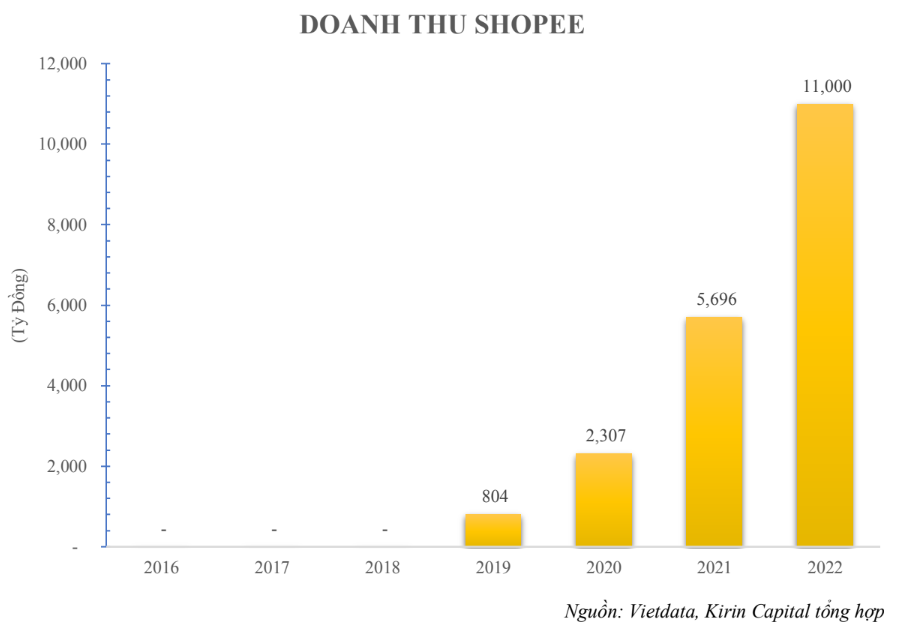

Shopee launched its “cash-burning” campaign upon its inception in 2016, employing revenue-neutral tactics for three consecutive years from 2016 to 2018, coupled with numerous promotional codes to swiftly dominate the market.

Despite this aggressive strategy, Shopee recorded its first profit in 2019 and has since experienced robust growth. Notably, in 2022, according to data from Vietdata, Shopee reported a profit of 3,000 billion dong, with revenue surging to 11,000 billion dong, offsetting 40% of its accumulated losses from previous years.

Kirin Capital believes that, in the long run, Shopee’s strategy is likely to yield long-term profitability as online shopping becomes more prevalent in Vietnam, attracting a growing number of users to the platform and creating a robust ecosystem that fosters a mutual dependency between buyers and sellers. Consequently, Shopee can gradually reduce its current promotions while retaining a stable customer base.

Additionally, the implementation of artificial intelligence (AI) in data analysis and customer profiling allows Shopee to provide product recommendations tailored to each shopper’s preferences.

After more than seven years in the Vietnamese market, Shopee has continuously integrated diverse features into its shopping app, transforming it into a miniature social network. Shopee aims to foster a community and encourage interaction among users through functionalities like ShopeeLive (live streaming), Shopee Games (in-app games with rewards), Shopee Feed (content-sharing about products), and Shopee Live Chat (live chat between buyers and sellers).

Kirin Capital commends Shopee’s marketing campaigns for their effectiveness in capturing consumer attention and leveraging current trends. Of particular note is Shopee’s strategic use of influencers.

Recognizing that young shoppers constitute over 30% of the Vietnamese market, Shopee has strategically chosen brand ambassadors who resonate with this demographic. These include celebrities such as Son Tung MTP and Tien Dung. The company even went a step further by collaborating with the renowned South Korean girl group BLACKPINK for its promotional campaigns.

Capitalizing on the influence of these brand ambassadors, Shopee has produced trending and engaging TV commercials. For instance, the promotional video for its 12.12 Birthday Sale in 2018 featured BLACKPINK’s hit song “DDU-DU DDU-DU.” Similarly, the campaign starring Son Tung MTP featured the catchy slogan “Shopping? It’s Shopee!” All of Shopee’s advertising efforts have resonated with consumers, reflecting the company’s strategic and effective deployment of influencers.