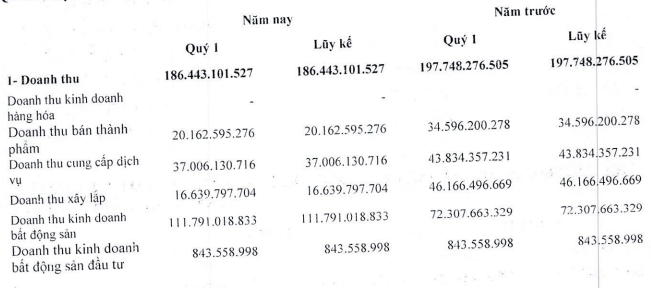

DIG’s revenue in Q1 reached over VND186 billion, a 6% decrease year-on-year. Despite this, revenue from real estate business still increased by nearly 55% to nearly VND112 billion. However, the company recorded nearly VND186 billion in value of returned goods sold, leading to net revenue of less than VND500 million, while in Q1/2023 it was nearly VND197 billion.

|

DIG’s revenue structure in Q1

Source: DIG

|

With net revenue of less than VND500 million, DIG still reported a gross loss of nearly VND51 billion despite a 67% decrease in cost of goods sold.

In addition to sales revenue, DIG’s financial revenue also decreased significantly by 93% to only VND12 billion with no more than VND162 billion in income from investments in Q1/2023.

DIG’s expenses increased as sales and management costs increased by 38% and 72%, respectively, in the context of declining revenue. The only positive highlight was an 82% reduction in financial expenses.

As a result, DIG reported a net loss of over VND117 billion in Q1/2024, the highest quarterly loss since the company’s listing.

|

DIG’s business results in Q1/2024

Source: VietstockFinance

|

On the balance sheet, DIG’s total assets as of March 31, 2024 were nearly VND17.8 trillion, an increase of 6% compared to the beginning of the year. The value of inventories increased by 4% to nearly VND6.8 trillion. Notably, cash on hand increased by 18% to nearly VND3 trillion.

On the other hand, DIG’s liabilities increased by 12% to nearly VND10 trillion, mainly due to a 36% increase in total borrowings, exceeding VND4.2 trillion.

In the long-term debt calculation, the outstanding balance of DIG’s bonds issued to HDBank exceeded VND1.55 trillion at the end of March 2024, while at the beginning of the year it was only over VND250 billion. In the explanation of this item, DIG stated that this was the company’s mobilization from HDBank through 2 bond issuances with a total value of VND1.6 trillion, with the same term of 36 months. The interest rate for the first two interest calculation periods (12 months) is 11.25%/year, and the interest calculation periods are calculated by a total of 4%/year and HDBank’s 12-month post-paid savings interest rate.

The VND600 billion bond was issued on December 29, 2023, while the VND1 trillion bond was issued on March 25, 2024.