Surge in profit thanks to divestment from Nam Hai Port

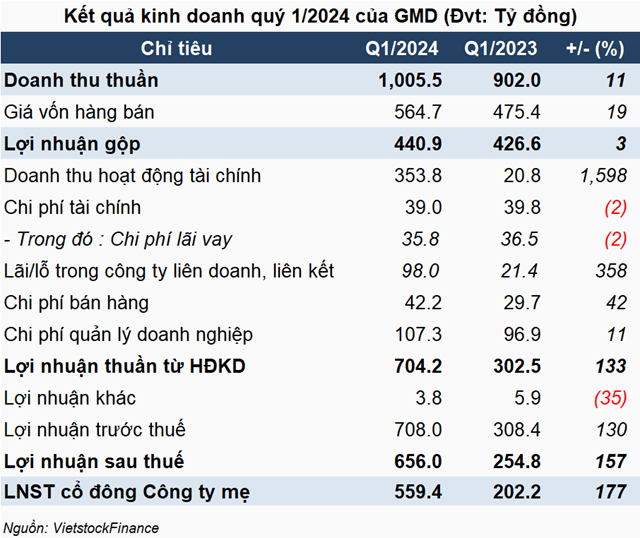

In Q1/2024, GMD‘s net revenue reached 1,006 billion VND, an 11% increase compared to the same period last year. Of which, port operation contributed nearly 843 billion VND, an increase of 29% and占84% of the revenue structure; Logistics, office rental and other activities brought in nearly 163 billion VND, a decrease of 34% but accounting for an insignificant proportion.

The highlight in GMD‘s Q1 business results was financial revenue, which was 17 times higher than the same period last year, reaching nearly 354 billion VND, after the transfer of Nam Hai Port JSC helped to generate a profit of nearly 336 billion VND. Finally, GMD recorded after-tax profit of over 559 billion VND, 2.8 times higher than the same period last year.

Image of Nam Hai Port when it still belongs to Gemadept

|

Previously, in an announcement dated April 17, GMD said that it had completed divesting all of its capital from Nam Hai Port, thereby reducing its ownership from 99.98% to 0%, based on the share transfer contract dated March 15 between GMD and Nhat Viet (Vietsun) Company. The divestment deal had been approved by GMD‘s Board of Directors on October 31, 2023.

Sharing about Nam Hai Port in the 2023 financial report, GMD said that with the new planning of Hai Phong City and the development of inner-city transport infrastructure, Nam Hai Port is no longer suitable for exploiting large-sized container ships. At the same time, GMD has a strategy to focus resources on developing Nam Dinh Vu in the downstream of Bach Dang River to become the largest river port in the North.

This divestment does not affect the source of goods, the total output at the Northern port group, but at the same time helps optimize operational efficiency, reduce operating costs and add capital for reinvestment, early development of phase 3 of the Nam Dinh Vu port cluster.

New asset milestone

After the divestment deal, GMD‘s retained earnings after tax increased by 17% to over 3,472 billion VND. On the other hand, long-term debt at the end of Q1/2024 at BIDV Thirty April branch increased to 234 billion VND, equivalent to 4 times at the beginning of the year, resulting in a 7% increase in long-term debt to 1,625 billion VND.

On the other side of the balance sheet, cash equivalents increased sharply, reaching 1,239 billion VND, 1.7 times higher than at the beginning of the year, all of which were bank deposits with terms of not more than 3 months. In addition, short-term receivables, prepayments to sellers and other short-term receivables all recorded increases.

At the end of Q1/2024, GMD‘s total assets reached 14,338 billion VND, up 6% and setting a new historical milestone, according to data collected from Q3/2004.

| GMD‘s total assets in the past have never reached 14,338 billion VND |