**Northeast Coal Transport and Processing Corporation (VDB) to Pay Cash Dividend Surpassing Share Price**

In the stock market, many companies with stable financial positions do not hesitate to pay cash dividends of a few dozen percent to shareholders. However, few companies pay cash dividends several times higher than their share price.

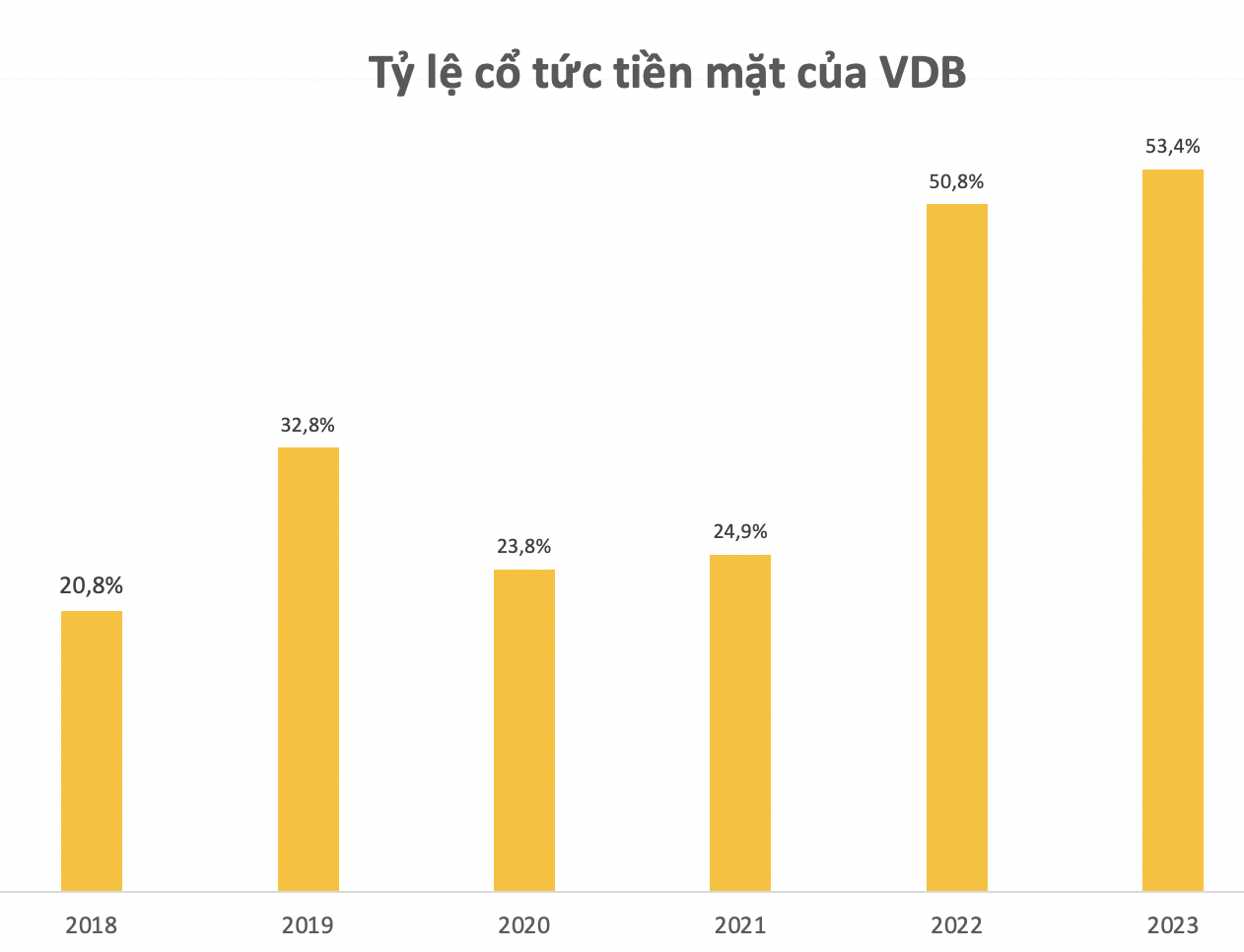

Northeast Coal Transport and Processing Corporation (VDB) has maintained a cash dividend higher than its share price for several years now. On May 7th, this coal company will finalize its shareholder list for the distribution of a 2023 cash dividend of 53.36%, equating to 5,336 VND per share. The payment date is expected to be May 24th, 2024.

With 8.6 million shares in circulation, the company expects to allocate nearly 46 billion VND for this dividend payment. Thus, VDB will utilize approximately 90% of its after-tax profit for 2023 (51 billion VND) for shareholder dividends. This is not the first time VBD has disbursed a substantial portion of its earnings as a cash dividend. In mid-2023, the company allocated nearly 92% of its 2022 profit to cash dividends.

Historically, since its initial public offering in 2018, this coal company has consistently paid cash dividends exceeding 20%. In 2022, dividends reached nearly 51%. However, the 2023 cash dividend remains the highest recorded in its trading history.

Notably, despite the generous cash dividend, VDB’s share price on the stock exchange is incredibly low. On May 3rd, VDB shares closed with no sellers at the ceiling price, and buy orders were placed for nearly a hundred thousand units. The share price has stagnated at 900 VND per share since July 2020. Consequently, the company’s 2023 dividend is almost six times its share price.

A concentrated shareholder structure is one of the primary reasons for VDB’s illiquidity over the years. In VBD’s shareholder structure, Dong Bac General Corporation – BQP, as the parent company, holds a 51% stake (4.4 million shares). Northeast Shipbuilding Industry Corporation holds the second-largest stake, owning 10% of the capital (867 thousand shares), and Phuong Son Limited Liability Company holds 6.06% of the capital (525 thousand shares). The remaining shares are owned by company executives and other individuals.

**Revenue in the Billions Each Year**

Northeast Coal Transport and Processing Corporation was initially called Coal Processing and Trading Enterprise, established on December 28th, 1995. In 2006, it transformed into a Coal Processing and Trading Company by decision of the Ministry of National Defense. However, it was not until 2018 that the company officially began trading on UPCOM with a charter capital of 51 billion VND.

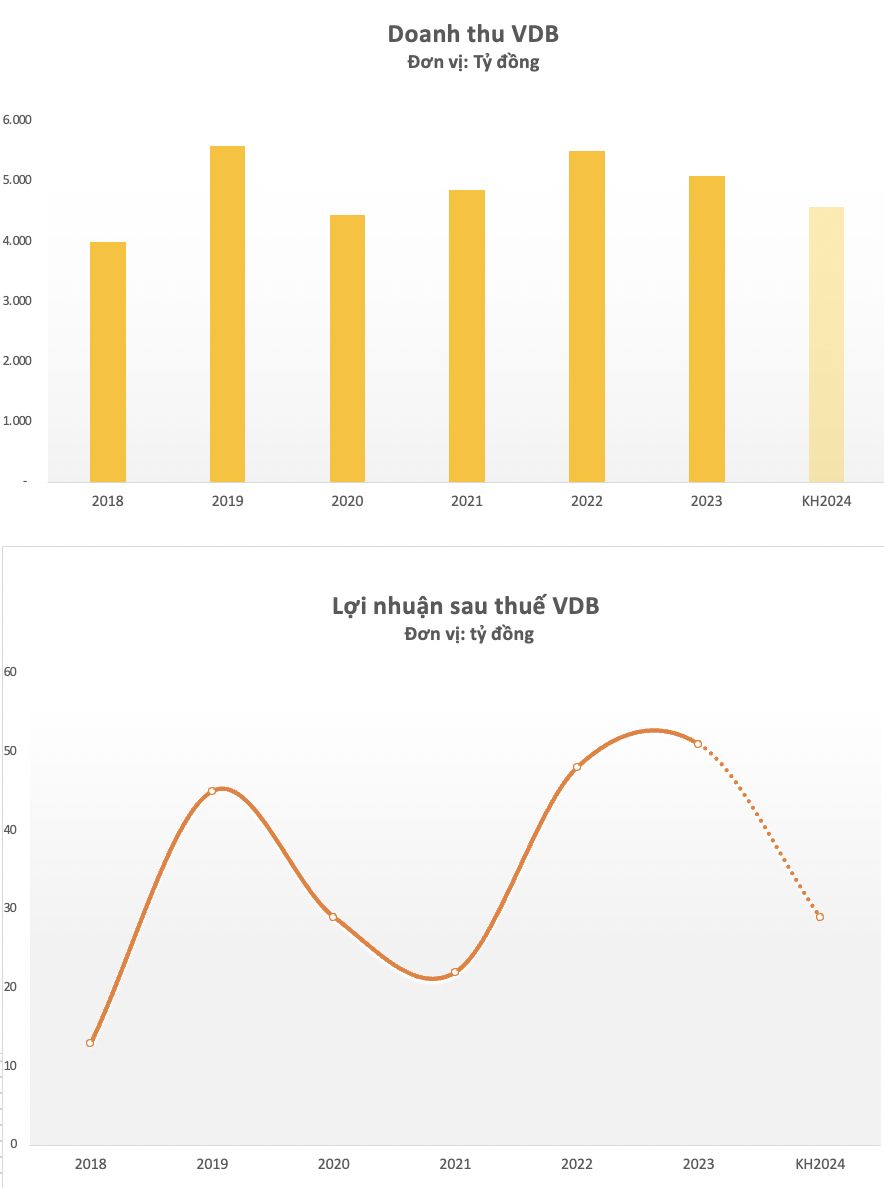

A strong business foundation has likely enabled VDB to pay high dividends consistently over the years. From 2018 to 2022, the company consistently recorded revenue exceeding 4,000 billion VND, with after-tax profits ranging from 12 to 48 billion VND.

In 2023, VDB’s total revenue reached 5,094 billion VND, a 7.6% increase year-over-year. Coal revenue accounted for 94% of total revenue, reaching 4,783 billion VND, primarily driven by coal production. On average, the company earns over 13 billion VND per day from coal sales. The remaining revenue comes from water transportation services (269 billion VND), coal delivery services (25 billion VND), and other revenue streams (18 billion VND). After deducting expenses, VDB recorded after-tax profits of 51 billion VND in 2023, a slight 6% increase compared to the previous year.

For 2024, the company projects coal production volume to reach 2.2 million tons, including 897 thousand tons of clean coal, 1.1 million tons of imported coal, and 250 thousand tons of raw coal. The company sets conservative business goals for 2024, with revenue targeted at 4,581 billion VND and after-tax profit targeted at 28.8 billion VND, representing decreases of 10% and 44%, respectively, compared to 2023. Notably, in previous years, VPB has also set modest business plans, but actual results have consistently exceeded targets. Additionally, the company plans to allocate 90% of its after-tax profit to distribute a 2024 cash dividend, totaling an estimated 25.9 billion VND.