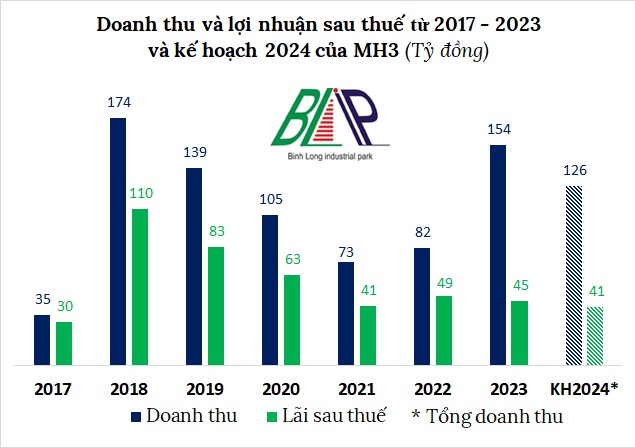

According to the newly updated 2024 Annual General Meeting documents, Binh Long Rubber Industrial Park stated that the impact of the Russia-Ukraine war continued to dampen the economy, causing difficulties for investors in the industrial park due to declining orders and revenue.

Therefore, the company set relatively cautious targets for 2024, with total revenue of over VND 126 billion and profit after tax of nearly VND 41 billion, a decrease of 36% and 10%, respectively, compared to the previous year. MH3 also plans to pay a minimum dividend of 16%.

Source: VietstockFinance

|

Explaining the reason for the conservative plan, Binh Long Rubber Industrial Park stated that revenue decreased compared to the plan due to the absence of one-time revenue and lower financial revenue as a result of declining bank interest rates.

Regarding land leasing, MH3 currently has only 6,831 m2 of industrial park land available for rent and is seeking options to adjust and convert this area. Subsequently, the industrial park will actively look for suitable projects for the remaining land.

For the expansion of Minh Hung III Industrial Park Phase 2 (covering an area of over 577 hectares), the company continues to work with the departments, branches, and sectors of Binh Phuoc province to obtain investment approval.

MH3 informed that, according to the contents of the document issued by the Management Board of Economic Zones, the company found that it was infeasible to re-apply for the investment certificate. Consequently, the supplementary report to serve the environmental impact assessment (EIA) could not be carried out. However, the company has submitted a report to the People’s Committee of Binh Phuoc province, and the Department of Natural Resources and Environment is considering and directing the implementation of the EIA improvement to ensure compliance with legal regulations.

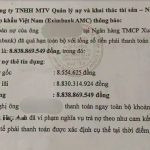

Using raised capital to supplement the Minh Hung III Industrial Park Phase 2 project by depositing it in a bank

MH3 shared that the process of obtaining approval for the investment policy and selecting investors for the Minh Hung III Industrial Park Phase 2 project could be prolonged. Once approved, the company still needs to carry out other legal procedures, such as site clearance, investment project formulation, and geological surveys.

To enhance capital efficiency from the share offering, the MH3 Board of Directors proposed to the Annual General Meeting to adjust the capital usage plan. Specifically, the entire amount of nearly VND 336 billion raised from the offering is expected to be deposited in a bank with a maximum term of 12 months.

It is known that in October 2023, MH3 successfully offered 12 million shares at a price of VND 28,000/share, raising nearly VND 336 billion and increasing its charter capital from VND 120 billion to VND 240 billion. The purpose of this capital mobilization was to supplement the company’s matching capital to meet the financial capacity requirements for the Minh Hung III Industrial Park Phase 2 project.

Wrapping up the first quarter, MH3 recorded total net revenue of over VND 33 billion, an increase of 11% compared to the same period, and a profit after tax of nearly VND 11 billion, up 3%. Compared to the plan, MH3 has achieved 26% of both revenue and profit targets.

Thanh Tú

Largest Private Bank Slashes Deposit Rates Dramatically Starting Today (26/2)

This time, the adjustment level is quite substantial, about 0.4-0.6 percentage points in both the short term and long term.