Illustrative image

An Binh Joint Stock Commercial Bank (ABBank) has just announced the application of a new deposit interest rate schedule starting yesterday, June 25. The highest increase was up to 1.4%/year – a very strong margin in one adjustment of deposit interest rates by banks.

According to the Online Savings Interest Rate Schedule – the product with the highest interest rate at ABBank, the interest rate for 1-2 month terms remains at 3.2% and 3.3%/year.

The interest rate for 3-month term deposits increased by 0.4%/year to 4%/year, while the interest rate for 4 and 5-month terms remained unchanged at 3.6%/year.

Deposit interest rates for terms of 6 months and above were adjusted strongly upward. Specifically, the interest rate for the 6-month term increased by 0.8%/year to 5.6%/year; the interest rate for terms of 7 to 11 months increased by 1.4%/year, listed at 5.8%/year.

With this adjustment, ABBank currently has the highest deposit interest rates for terms of less than 12 months in the system.

In addition, ABBank’s 12-month term deposit interest rate has officially reached the 6%/year milestone after an increase of 0.4%/year.

Meanwhile, deposit interest rates for terms of 13 to 60 months remain unchanged at 5.7%/year.

Source: ABBank

This is the second time in June that ABBank has increased deposit interest rates. Previously, on June 6, 2024, the bank also increased interest rates across the board from 1 to 60 months. The term of 13-60 months saw an increase of up to 1.6%/year.

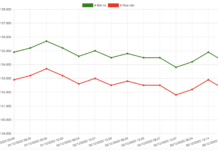

According to statistics, from the beginning of June up to now, 23 commercial banks have increased deposit interest rates, including: VietinBank, TPBank, VIB, GPBank, BaoViet Bank, LPBank, Nam A Bank, OceanBank, ABBank, Bac A Bank, MSB, MB, Eximbank, OCB, BVBank, NCB, VietBank, VietABank, VPBank, PGBank, Techcombank, ACB, and SHB. Many banks have increased deposit interest rates 2-3 times since the beginning of June, including: GPBank, VIB, MB, BaoViet Bank, OceanBank, NCB, TPBank, PGBank, LPBank, OCB, Eximbank, and ABBank.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.