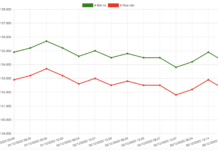

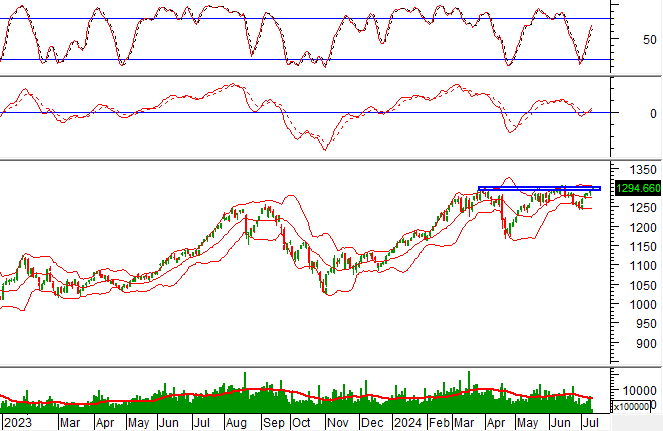

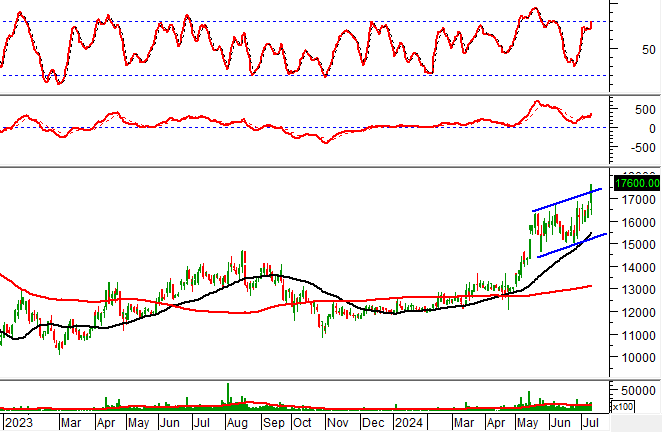

Technical Signals for the VN-Index

During the morning trading session of July 10, 2024, the VN-Index witnessed a slight increase in points, while trading volume showed a mild decline. This indicates the investors’ cautious sentiment.

Additionally, the VN-Index continues to retest the old peak from March 2024 (around 1,290-1,300 points) as the MACD indicator consistently widens the gap with the Signal line, providing an earlier buy signal. If this buy signal is sustained and the index successfully breaks through this resistance zone, the short-term upward trend is likely to resume in the upcoming sessions.

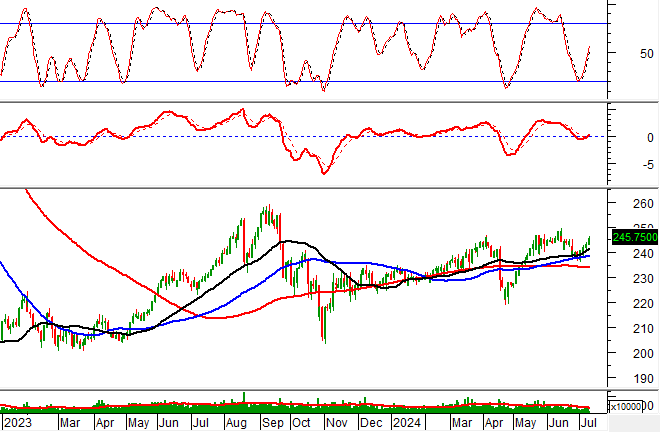

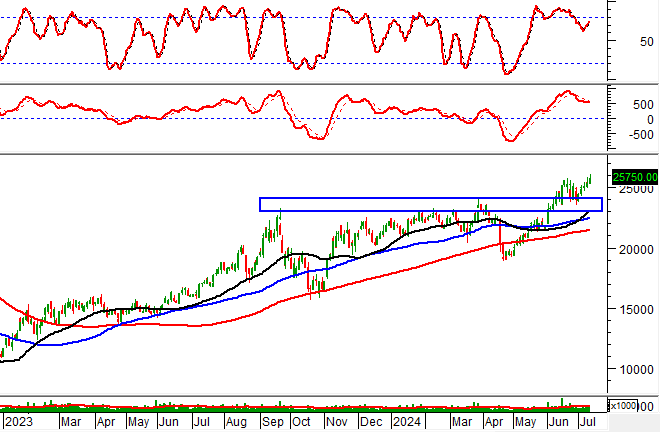

Technical Signals for the HNX-Index

On July 10, 2024, the HNX-Index experienced a slight increase in points, while liquidity significantly dropped during the morning session, reflecting investors’ cautious sentiment.

Furthermore, the HNX-Index is receiving strong support from the group of SMA 50 and SMA 100 day lines, and the MACD indicator gives a buy-back signal. This suggests that the medium-term upward trend of the stock is being firmly maintained.

HAX – Green Car Service Joint Stock Company

On the morning of July 10, 2024, HAX hit the ceiling price, forming a White Marubozu candlestick pattern, while liquidity significantly increased and exceeded the 20-session average. This indicates active trading by investors.

Additionally, the stock price surged and successfully broke through the upper edge of the rising price channel (Bullish Price Channel). The MACD indicator consistently widens the gap with the Signal line, giving an earlier buy signal, further reinforcing the current upward trend of the stock.

HSG – Hoa Sen Group Joint Stock Company

During the morning session of July 10, 2024, HSG witnessed an increase in price, and trading volume significantly improved, surpassing the 20-session average, indicating investors’ optimistic sentiment.

Furthermore, a golden cross occurred between the SMA 50 and SMA 100 day lines, and the Stochastic Oscillator indicator continues its upward trajectory after providing an earlier buy signal. This suggests that the medium-term upward potential remains intact.

Technical Analysis Department, Vietstock Consulting