7 Banks Offering Interest Rates from 6%/year

On July 9, VietBank became the seventh bank to raise its deposit interest rates in July 2024, and the only bank to make such an adjustment that morning.

VietBank increased interest rates on deposits with terms of 1–6 months by 0.3%/year and on deposits with terms of 7–36 months by 0.1%/year, effective immediately. According to VietBank’s online deposit interest rate table, the interest rate for a one-month term deposit is now 3.4%/year, 3.5%/year for two months, 3.6%/year for three months, 3.7%/year for four months, and 3.8%/year for five months.

The interest rate for a six-month term deposit is now 4.9%/year. Meanwhile, the new interest rate for terms of 7–10 months is 4.7%/year, and for an 11-month term, it is 4.8%/year.

VietBank’s interest rates for other terms have already exceeded the 5%/year threshold. Currently, the interest rate for a 12-month term is 5.3%/year, 14-month term is 5.4%/year, and 15-month term is 5.6%/year.

VietBank is offering an interest rate of 5.8%/year for online term deposits with terms of 16–17 months, while the highest interest rate is for terms of 18–36 months, at 5.9%/year.

According to statistics, since the beginning of July, seven commercial banks have raised their deposit interest rates, including NCB, Eximbank, SeABank, VIB, BaoViet Bank, Saigonbank, and VietBank.

Seven commercial banks have raised their deposit interest rates since the beginning of July.

Statistics also show that the race among banks to raise deposit interest rates is heating up, with seven banks now offering interest rates of 6%/year or more without requiring any deposit conditions.

For example, ABBank is offering an interest rate of 6.0%/year for a 12-month term, which is also the leading market rate for this term.

HDBank leads the market with an interest rate of 6.1%/year for an 18-month term.

After its recent rate increase, NCB is offering an interest rate of 6.1%/year for terms of 18–36 months. Additionally, for deposits over 1 billion VND, NCB is currently offering the following promotional interest rates: 6.05–6.2%/year for a 12-month term; 6.15–6.35%/year for a 13-month term; and 6.55–6.7%/year for an 18-month term.

OceanBank is currently offering an interest rate of 6.1%/year for its online savings package with a 36-month term, the highest interest rate in the market. Following closely are OCB and SeABank, which are offering an interest rate of 6.0%/year for the same term.

BVBank is also offering an interest rate of 6.0%/year for a 60-month term.

In addition to the interest rates of 6–6.1%/year offered by the above-mentioned banks, the interest rate of 5.9%/year that VietBank has just reached is also considered an attractive rate in the market today and is only offered by a few banks for deposits with terms of 18 months or more.

Besides VietBank, only BaoViet Bank is offering an interest rate of 5.9%/year for an 18-month term.

For terms of 24–36 months, in addition to the above-mentioned banks, only PGBank is offering an interest rate of 5.9%/year for these terms.

However, interest rates above 5%/year are becoming increasingly common in banks’ deposit interest rate tables, especially in the last two months.

|

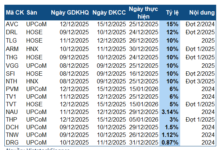

HIGHEST DEPOSIT INTEREST RATES AT BANKS ON JULY 9, 2024 (%/YEAR) |

||||||

|

BANK |

1 MONTH |

3 MONTHS |

6 MONTHS |

9 MONTHS |

12 MONTHS |

18 MONTHS |

|

AGRIBANK |

1.6 |

1.9 |

3 |

3 |

4.7 |

4.7 |

|

BIDV |

2 |

2.3 |

3.3 |

3.3 |

4.7 |

4.7 |

|

VIETINBANK |

2 |

2.3 |

3.3 |

3.3 |

4.7 |

|

|

VIETCOMBANK |

1.6 |

1.9 |

2.9 |

2.9 |

4.6 |

|

|

ABBANK |

3.2 |

4 |

5.8 |

6 |

5.7 |

|

|

ACB |

2.8 |

3.1 |

3.9 |

4 |

4.7 |

|

|

BAC A BANK |

3.5 |

3.7 |

4.9 |

5 |

5.6 |

|

|

BAOVIETBANK |

3.1 |

3.9 |

5.1 |

5.2 |

5.9 |

|

|

BVBANK |

3.4 |

3.5 |

4.9 |

5.05 |

5.8 |

|

|

CBBANK |

3.4 |

3.6 |

5.15 |

5.1 |

5.55 |

|

|

DONG A BANK |

2.8 |

3 |

4 |

4.2 |

4.7 |

|

|

EXIMBANK |

3.5 |

4.3 |

5.2 |

4.5 |

5.1 |

|

|

GPBANK |

3 |

3.52 |

4.85 |

5.2 |

5.85 |

|

|

HDBANK |

3.25 |

3.25 |

4.7 |

6.1 |

||

|

KIENLONGBANK |

3 |

3 |

5.2 |

5.5 |

||

|

LPBANK |

3.4 |

3.5 |

4.8 |

5.6 |

||

|

MB |

3.1 |

3.4 |

4.2 |

4.3 |

4.9 |

|

|

MSB |

3.7 |

3.7 |

4.6 |

5.4 |

||

|

NAM A BANK |

3.1 |

3.8 |

5.7 |

|||

|

NCB |

3.7 |

4 |

5.55 |

6.1 |

||

|

OCB |

3.7 |

3.9 |

5 |

5.4 |

||

|

OCEANBANK |

3.4 |

3.8 |

4.9 |

6.1 |

||

|

PGBANK |

3.2 |

3.5 |

4.5 |

5.8 |

||

|

PVCOMBANK |

3.15 |

3.15 |

4.3 |

5.5 |

||

|

SACOMBANK |

2.7 |

3.2 |

5.1 |

|||

|

SAIGONBANK |

2.5 |

2.8 |

5.6 |

|||

|

SCB |

1.6 |

1.9 |

2.9 |

3.9 |

||

|

SEABANK |

3.2 |

3.7 |

5.7 |

|||

|

SHB |

3.3 |

3.4 |

5.5 |

|||

|

TECHCOMBANK |

2.85 |

3.25 |

4.95 |

|||

|

TPBANK |

3.3 |

3.6 |

||||

|

VIB |

3.1 |

3.3 |

||||

|

VIET A BANK |

3.4 |

3.7 |

Hải Hà Petro and Xuyên Việt Oil accumulate bad debts of over 11,000 billion dong

Not only did these two petroleum companies commit violations regarding the Price Stabilization Fund and massive tax debts, but they also have bad debts at banks amounting to tens of thousands of billion Vietnamese dong.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.