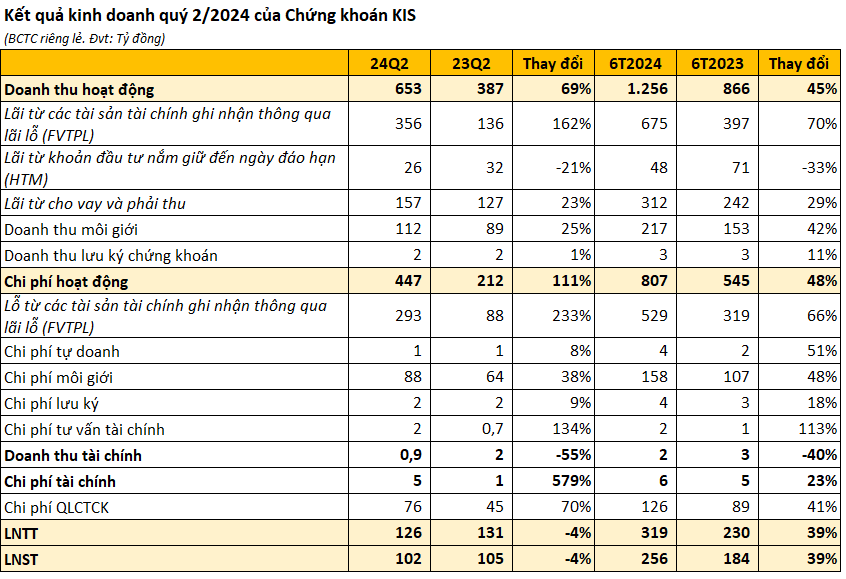

KIS Vietnam Securities JSC has released its Q2 2024 financial report, revealing impressive growth with operating revenue reaching VND 653 billion, a 69% increase compared to the same period last year. This significant boost is mainly attributed to the surge in profit from financial assets measured at fair value through profit or loss (FVTPL), which soared by 162% to VND 356 billion.

Additionally, profit from loans and receivables also witnessed a notable 23% uptick, contributing VND 157 billion. Similarly, securities brokerage revenue increased by 25% year-over-year to reach VND 112 billion.

On the expense side, operating costs amounted to VND 447 billion, more than doubling compared to Q2 2023. This surge was primarily driven by a 233% jump in FVTPL losses, which totaled VND 293 billion. Brokerage expenses also climbed by 38% compared to the previous year’s second quarter, reaching VND 88 billion.

After accounting for various expenses, KIS Vietnam Securities posted a pre-tax profit of VND 126 billion in Q2 2024, representing a slight 4% dip from the corresponding period last year. The corresponding net profit stood at VND 102 billion.

For the first half of 2024, the company’s operating revenue reached VND 1,256 billion, indicating a robust 45% year-over-year increase. Net profit for the same period stood at VND 256 billion, reflecting a solid 39% growth compared to H1 2023.

As of June 30, 2024, KIS Vietnam Securities’ total assets climbed by 24% from the beginning of the year to nearly VND 12,229 billion. Notably, the company held VND 1,610 billion in FVTPL assets (at cost), marking an increase of over VND 550 billion in the first half of the year and a VND 475 billion surge compared to the end of Q1. This included listed stocks worth over VND 653 billion and fund certificates valued at more than VND 500 billion. Notably, investments in corporate bonds exceeded VND 441 billion, reflecting a substantial increase of VND 353 billion within just three months.

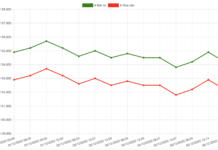

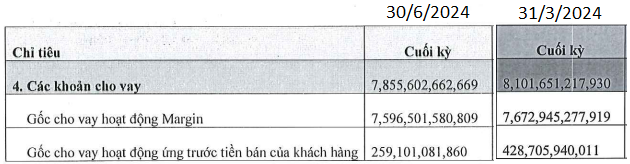

Despite the rise in lending profits, KIS Vietnam Securities’ margin lending and customer pre-sale balances stood at VND 7,856 billion, indicating a marginal 3% decrease (~VND 250 billion) from the beginning of the quarter. Margin lending balances specifically reached VND 7,597 billion.

Source: Q1 and Q2/2024 Financial Statements of KIS Vietnam Securities

For the full year 2024, KIS Vietnam Securities has set targets of VND 1,051 billion in revenue and VND 678 billion in net profit. With the strong performance in the first half, the company, which is a member of the KIS Group in South Korea, has already achieved 47% of its annual profit goal.

KIS Vietnam Securities is a prominent player in the industry, ranking among the top 10 in terms of market share for brokerage transactions of stocks, fund certificates, and covered warrants on the HOSE in both Q2 and H1 2024.

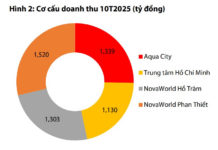

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.