FPT Corporation (FPT) has recently approved an interim cash dividend for the first quarter of 2024 with a ratio of 10% (equivalent to VND 1,000 per share). The payment is expected to be made in the fourth quarter of 2024.

With over 1.46 million shares currently in circulation, FPT is expected to spend more than VND 1,460 billion on dividends for existing shareholders.

At the same time, FPT announced the list of employees participating in the 2024 ESOP, offering shares to employees who have made significant contributions in 2023. Specifically, 226 people registered to buy a total of 7,302,117 shares, and seven senior leaders registered to buy 3,319,000 shares at VND 10,000 per share.

Notably, the shareholders of this technology enterprise will continue to receive cash dividends in the upcoming fourth quarter, following the dividend payment in June this year. Previously, on June 12, FPT finalized the list of shareholders to pay the remaining 2023 dividend in cash, with a ratio of 10%, paid on June 20. Accordingly, FPT spent approximately VND 1,460 billion on dividend payments.

On July 29, FPT shares rose over 1% to VND 129,800 per share, up 55% compared to the beginning of the year.

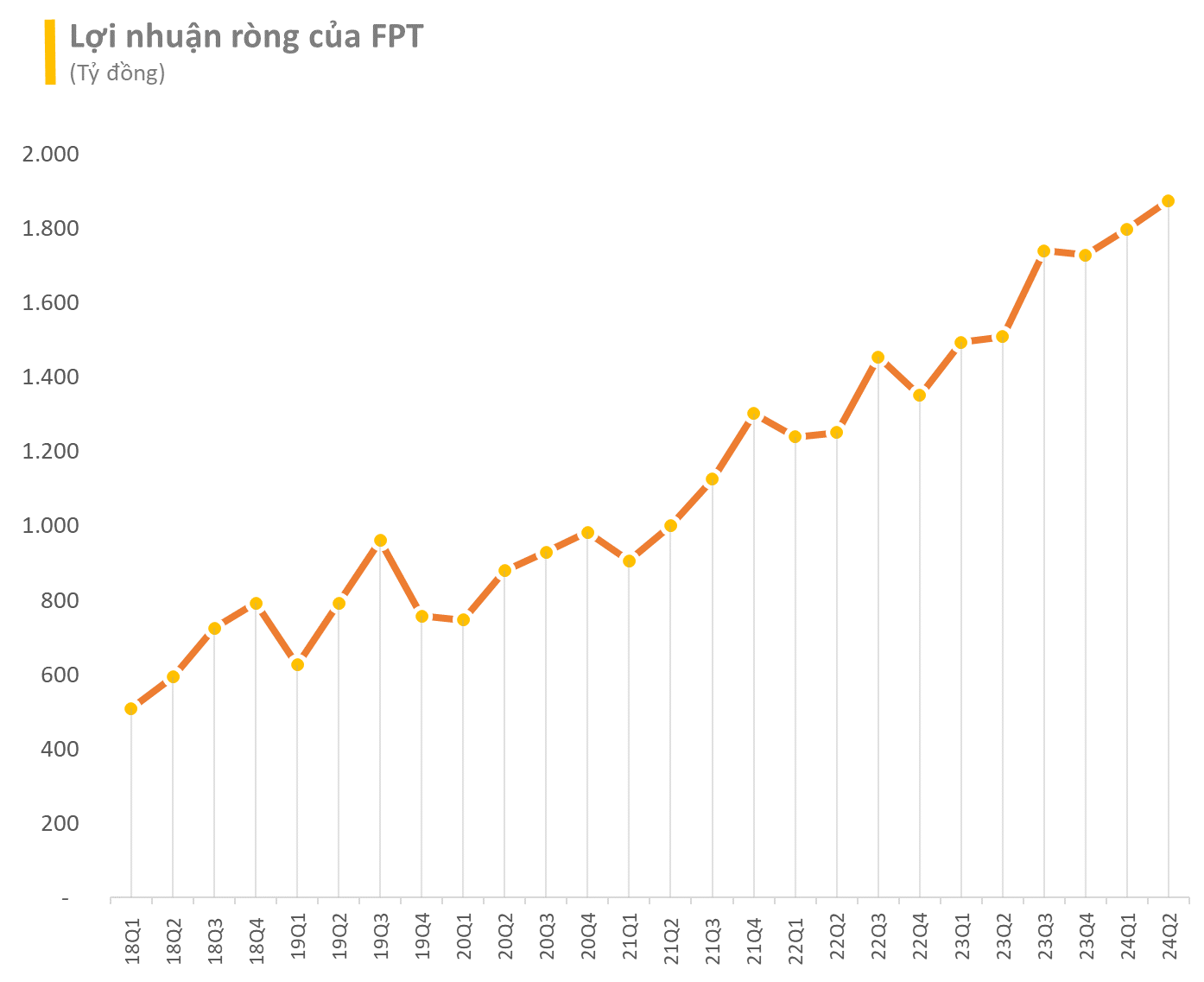

FPT Corporation has just announced its business results for the first half of 2024, with revenue reaching VND 29,338 billion and pre-tax profit of VND 5,198 billion, up 21.4% and 19.8%, respectively, compared to the same period last year. After-tax profit for the parent company’s shareholders (net profit) also increased by 22.3% to VND 3,672 billion, equivalent to an EPS of VND 2,514 per share.

In the second quarter of 2024, FPT’s pre-tax profit reached VND 2,664 billion, up 20.1% year-on-year. Net profit increased by 24% over the same period last year to VND 1,874 billion.

In 2024, FPT set a record-high business plan with a revenue target of VND 61,850 billion (~USD 2.5 billion) and a pre-tax profit of VND 10,875 billion, both up about 18% compared to the results of 2023. With the results achieved in the first half, the corporation has fulfilled 47% of the revenue plan and 48% of the profit target.

A “squad” carrying mattresses back home for Tet holidays

In 2023, May Sông Hồng achieved a net revenue of 4,542 billion VND, a decrease of 18% compared to the previous year, and a post-tax profit of over 245 billion VND, experiencing a decline of nearly 28%.