A sudden surge in selling pressure this afternoon pushed liquidity up by a factor of one and a half from the morning session, but stock prices plummeted across the board. The VN-Index closed with a loss of 12.5 points (-0.99%), with the number of declining stocks tripling the number of gainers. Large-cap stocks remained the main culprit behind the market’s “flash crash.”

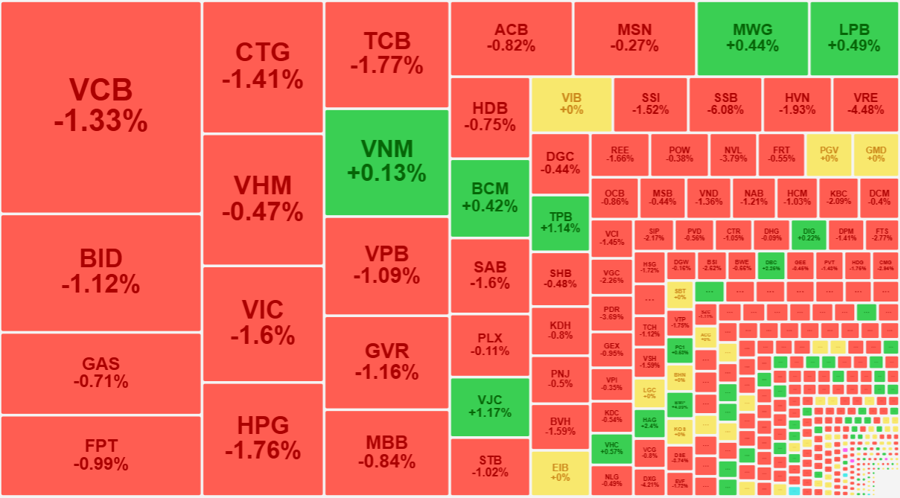

The VN30-Index ended 1% lower, with only 5 stocks advancing while 24 declined, of which 14 fell by more than 1% in value. Among the top 10 stocks by market capitalization on the VN-Index, 6 saw sharp declines: VCB fell by 1.33%, BID by 1.12%, CTG by 1.41%, VIC by 1.6%, HPG by 1.76%, and TCB by 1.77%.

In terms of point impact, bank stocks exerted the most pressure, with VCB, BID, TCB, SSB, and CTG leading the decline. SSB plunged by 6.08%, marking its biggest one-day drop since June 2024 and pushing the stock to a three-year low. The banking sector, in general, was very negative, with only 3 out of 27 stocks in the green: TPB, PGB, and LPB.

Food stocks, which had a strong showing in the morning session, managed to stay in positive territory in the afternoon but showed some signs of weakness. DBC rose by 2.25%, BAF by 4.67%, HAG by 2.4%, VHC by 0.57%, PAN by 2.67%, ANV by 1.43%, LTG by 4.67%, while MSN reversed course to close 0.27% lower. However, some stocks in this sector showed improvement, with VLC gaining 3.66% and NAF up by 5.16%…

If the strongest stocks in the market are faltering, the rest are surely in a negative state. The HoSE floor ended the day with a breadth of 94 gainers to 320 decliners, a significant deterioration from the morning session’s 131 gainers to 226 decliners. Moreover, the number of stocks on the HoSE that fell by more than 1% increased from 72 in the morning to 137 by the close.

Many stocks faced intense selling pressure, resulting in deep declines with high liquidity. HoSE had 23 stocks that fell between 1% and 4% with liquidity exceeding 100 billion VND each. Unsurprisingly, several blue-chips witnessed high liquidity, including HPG, which fell by 1.76%, VPB by 1.09%, VRE by 4.48%, TCB by 1.77%, and VIC by 1.6%…

The real estate and securities sectors also saw some of their constituents experience intense selling: SSI fell by 1.52% with a matching volume of 432.5 billion VND; HCM declined by 1.03% with 341.1 billion; VIX dropped by 2.58% with 245 billion; VCI fell by 1.45% with 203.6 billion; VND decreased by 4.61% with 148.6 billion; and FTS slid by 2.77% with 143.1 billion. In the real estate sector, PDR fell by 4.69% with a matching volume of 305 billion; DXG declined by 4.21% with 297.8 billion; NVL fell by 3.79% with 157.9 billion; and NTL dropped by 5.79% with 126.4 billion. Stocks that declined by more than 1% at the close on HoSE accounted for 48.6% of the total trading value on this exchange.

Liquidity on the HoSE in the afternoon surged by 55% compared to the morning session, reaching 8,466 billion VND. The VN30 basket also witnessed a nearly 69% increase in liquidity, totaling 4,202 billion. Compared to the morning close, only MWG remained unchanged in the VN30 basket, while the rest weakened.

Bottom-fishing funds remained largely inactive, mainly placing passive orders to wait for lower prices. Statistics from HoSE showed that only about 111 stocks witnessed significant price rebounds of at least 1% from their intraday lows. This number accounts for approximately 30% of the total number of stocks that traded during the session. Maintaining prices above their intraday lows can be seen as a sign of buying support from bottom-fishing funds.

The sharp decline at the end of the day indicates that psychological pressure has triggered more decisive selling actions. This development is not largely related to external factors, as US stocks rebounded nicely yesterday, and futures contracts on indices showed little movement during our session today.

The Dragon’s Breath: QCG Stock Plunges as VN-Index Faces Headwinds

The QCG stock of JSC Quoc Cuong Gia Lai unexpectedly surged to its daily limit of VND6,560 per share, with the trading volume doubling that of the previous session.