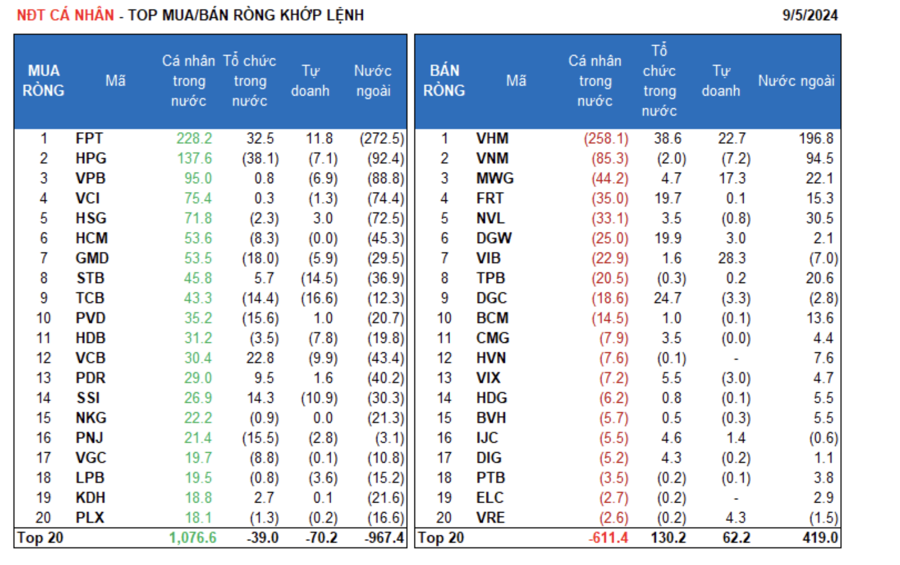

Vietnam’s stock market experienced significant volatility during the trading week ending October 25th. The VN-Index, the country’s benchmark index, started the day in positive territory but faced strong selling pressure in the latter half of the session, eventually closing just above the 1,250 level. The index ended the day down 4.69 points, or 0.37%, at 1,252.72. Foreign investors sold a net value of VND 384 billion on the market.

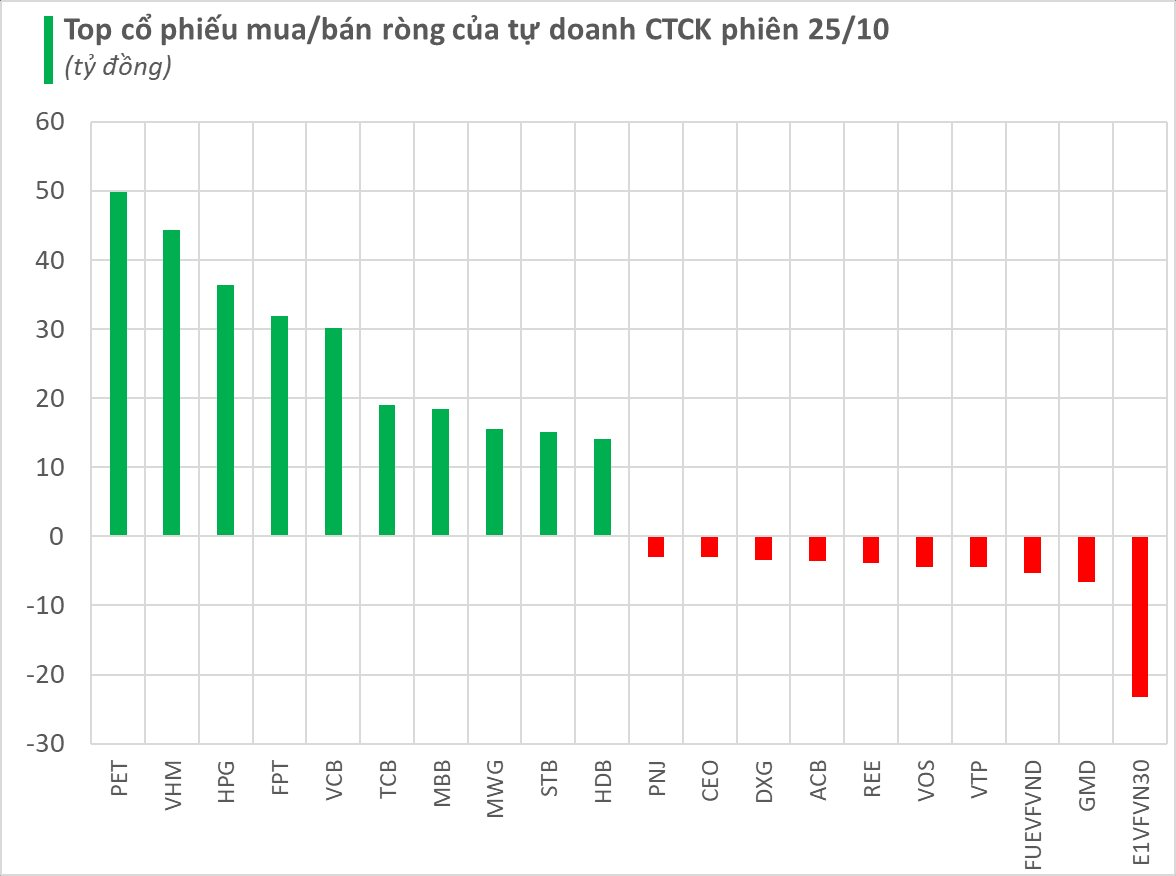

Proprietary trading by securities companies recorded a net buy value of VND 319 billion on the market.

On the HoSE, proprietary trading by securities companies recorded a net buy value of VND 318 billion, including a net buy of VND 324 billion in matched orders and a net sell of nearly VND 6 billion in negotiated trades.

Specifically, securities companies bought a net value of VND 50 billion in PET shares, while VHM shares were also net bought for VND 44 billion. Additionally, securities companies net bought shares of HPG, FPT, VCB, TCB, and other stocks during the session.

On the other hand, they net sold E1VFVN30 and GMD the most, with values of VND 23 billion and VND 7 billion, respectively. VTP, VOS, REE, and a few other stocks were also among the net sold stocks during the trading day.

On the HNX, proprietary trading by securities companies recorded a slight net buy value, with VCS being the most net bought stock at over VND 3 billion. PVS and BVS were also net bought for more than VND 1 billion each, while CEO was net sold for VND 3 billion.

On the UPCoM, there were no proprietary trading activities by securities companies.

“Heavy Foreign Sell-Off in Monday’s Session: Which Stocks Were in the Firing Line?”

In the afternoon trading session, MSN stock witnessed an unprecedented surge in foreign selling pressure, with a massive sell-off amounting to 280 billion VND.

Unlocking New Opportunities: Navigating the Impact of Potential Land Policy Reforms on Businesses and Finances

The proposed abolition of financial policies related to land, including waivers and reductions in land rent and land use fees, has been a topic of discussion. The Ministry of Finance has provided justification for this decision, citing the need to align with the newly enacted Land Law 2024.