Record-Low Interest Rates: What You Need to Know

A recent survey reveals that state-owned banks in Vietnam are offering competitive interest rates for home loans, ranging from 5% to 7% annually, depending on the term. This development is welcome news for prospective homeowners.

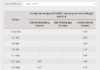

For instance, Agribank’s interest rates start at 4.0% annually for loans up to three months, gradually increasing to 4.5% for loans between three and six months, 5.0% for loans over six to 12 months, and even lower for long-term loans. After the third year, the interest rate will be floating (estimated at 8-9% based on the loan package).

VietinBank and BIDV, two prominent state-owned banks, are also offering attractive rates. VietinBank’s short-term loan interest rates start at 5%, while their medium and long-term loans begin at 5.6%. BIDV, specifically its branches in Hanoi and Ho Chi Minh City, offers a minimum interest rate of 5% for the first six months, with a minimum loan term of 36 months, or a minimum rate of 5.5% for the first 12 months with a minimum loan term of 60 months.

Vietcombank, another major player, provides promotional rates for individual home loans: 6% for the first six months on short-term loans (less than 12 months) and 6.3% for medium and long-term loans. After the promotional period, the floating rate is approximately 9%, adjusted quarterly.

Foreign banks such as Wooribank, Shinhanbank, Hong Leong Bank, UOB, and Standard Chartered have also adjusted their lending rates. Their interest rates vary between 5.5% and 6.8% in the first year, depending on the term.

Despite low-interest rates, home buyers remain cautious about taking out loans (Photo: Nhu Y).

Turning to joint-stock commercial banks, their home loan interest rates fluctuate between 4.99% and 7.9% annually, depending on the term.

In the context of these new low-interest loan packages, a personal lending director at a bank noted that customers are switching from one bank to another. Borrowers with high floating rates are moving to new banks to take advantage of the better rates, which are 2-4% lower.

While the floating rates for existing loans are now 2-3% lower than before, they are still significantly higher than deposit rates. Additionally, the floating rates offered by some private banks remain considerably higher than those of state-owned banks.

Currently, the floating rates after the promotional period for existing customers of state-owned banks hover around 9-10%, while some private banks continue to maintain rates above 12%.

Why Are People Hesitant to Borrow?

In an interview with Tien Phong , Mr. Nguyen Quang Huy, CEO of the Finance and Banking Faculty at Nguyen Trai University, shared his insights. While interest rates for home loans have decreased, most banks fix the rate for the first one to two years at below 10%. After this initial period, the rate becomes floating, based on the 12-month deposit rate plus a margin of 4-5%.

Mr. Huy attributed the cautious attitude of homebuyers to the still-high property prices. Most properties are priced above 5-8 billion VND, with few options below 3 billion VND. Taking on such a substantial loan would be a significant financial burden, requiring a substantial down payment and ongoing income to service the debt.

At present, large-scale real estate investors and developers are facing challenges in liquidating their holdings in major projects undertaken before the market downturn.

“Individuals with stable incomes who wish to purchase a home are hesitant to take out bank loans due to concerns about potential increases in deposit rates, which could lead to significant hikes in real estate loan rates, typically ranging from 10% to 15% (varying across banks and time periods),” Mr. Huy explained.

According to the PropertyGuru Vietnam report on the real estate market in the first half of 2024, prices in Hanoi continued to rise in the second quarter compared to the same period in 2023. Specifically, apartment prices increased by 31%, land prices by 19%, house prices by 32%, and villa prices by 18%.

Even in Ho Chi Minh City, where the market is sluggish, prices have remained stable, with no downward trend. While land, houses, and shophouses have maintained their values, apartment prices have registered a further increase of 6% year-on-year.

Mr. Tuan elaborated that a standalone house or apartment in these two cities currently costs a minimum of 2-2.5 billion VND. If an individual takes out a loan for 50-70% of the property value, which amounts to approximately 1.4-1.5 billion VND, they would be faced with monthly installments of 12 million VND, covering both principal and interest.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…