Illustrative image

The Law on Credit Institutions (amended) takes effect from July 1st, requiring shareholders owning from 1% of the charter capital of a credit institution to provide the institution with their information and that of related persons, including: full name; personal identification number; nationality, passport number, date and place of issue for foreign shareholders; business registration certificate or equivalent legal document for institutional shareholders; and date and place of issue of this document.

In addition, shareholders owning from 1% of the charter capital must also provide information on the number and proportion of shares owned by themselves and related persons in the credit institution.

Shareholders owning from 1% of the charter capital are required to submit written information to the credit institution for the first time and when there are changes to this information within seven working days from the date of occurrence or change. Regarding the proportion of ownership, shareholders owning over 1% of the charter capital only need to disclose information when there is a change in the proportion of their shareholding or that of themselves and related persons from 1% of the charter capital compared to the previous submission.

The Law on Credit Institutions (amended) also requires credit institutions to publicly disclose information about the full names of individuals or names of organizations that are shareholders owning from 1% of the charter capital of the credit institution, and the number and proportion of shares owned by those individuals or related persons on the credit institution’s website within seven working days from the date the credit institution receives the provided information.

Also, in the amended Law on Credit Institutions, the concept of “related persons” has been extended to include grandparents, grandchildren, aunts, uncles, nieces, and nephews, i.e., five generations.

Previously, under the current regulations, shareholders only had to disclose information about transactions, ownership, and related persons when holding 5% or more of the capital of a business or bank (major shareholder).

Currently, the circulating shares of banks are mostly at the level of 1 billion units, with the least being Saigonbank, which has nearly 340 million circulating shares. Thus, holding from 1% of a bank’s charter capital implies that the individual owns assets worth at least VND 40-50 billion.

According to market observations, some banks have already announced the implementation of the provisions on the provision and public disclosure of information under the Law on Credit Institutions 2024.

According to the Law on Credit Institutions (amended), Related Persons are organizations or individuals having direct or indirect relationships with other organizations or individuals in one of the following cases:

a) Parent company with its subsidiary and vice versa; parent company with its subsidiary’s subsidiary and vice versa; credit institution with its subsidiary and vice versa; credit institution with its subsidiary’s subsidiary and vice versa; subsidiaries of the same parent company or of the same credit institution with each other; subsidiaries of a subsidiary of the same parent company or of the same credit institution with each other; managers, supervisors, members of the Supervisory Board of the parent company or of the credit institution, individuals or organizations authorized to appoint such persons with the subsidiary and vice versa;

b) Company or credit institution with its managers, supervisors, members of the Supervisory Board or with the company or organization authorized to appoint such persons and vice versa;

c) Company or credit institution with organizations or individuals owning from 5% of the charter capital or voting shares and vice versa;

d) Individual with his/her spouse; biological parents, adoptive parents, step-parents, parents-in-law; biological children, adopted children, step-children, son-in-law, daughter-in-law; brothers and sisters of the same parents; brothers and sisters of the same father but different mothers; brothers and sisters of the same mother but different fathers; brothers-in-law, sisters-in-law, brothers-in-law, sisters-in-law, sisters-in-law, sisters-in-law, sisters-in-law, brothers-in-law, sisters-in-law;

đ) Company or credit institution with individuals having a relationship as specified in point d of this clause with the managers, supervisors, members of the Supervisory Board, contributing members or shareholders owning from 5% of the charter capital or voting shares of the company or credit institution and vice versa;

e) Individuals authorized to represent the contributed capital for organizations or individuals specified in points a, b, c, d and d of this Clause with the organization or individual authorizing; individuals authorized to represent the contributed capital of the same organization with each other;

g) Legal entities or individuals with other relationships that potentially pose risks to the activities of the credit institution or foreign bank branch as determined by the internal regulations of the credit institution or foreign bank branch or as required in writing by the State Bank through inspection and supervision activities;

h) For people’s credit funds, related persons to the fund’s customers include cases specified in points b, c, d and g of this Clause; customers with their spouses, parents, children, brothers and sisters.

Mango and Xemesis Sell 40% Stake in Beef Selling Avocado, Xemesis’s Brother Inherits as New Owner

The reason for the couple’s retreat to Bơ Bán Bò is revealed by Xoài Non, due to the unresolved issues of the shareholders.

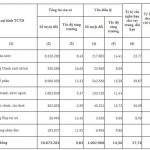

Total assets of commercial banks reach 20 quadrillion VND for the first time, how much do Agribank, BIDV, VietinBank, and Vietcombank account for?

As of the end of 2023, the total assets of the State Commercial Bank Group amounted to over 8,326 trillion VND, while the Joint Stock Commercial Bank Group reached nearly 8,987 trillion VND.