Gold prices surged on the morning of July 6, with plain 24K gold (9999) prices continuing their upward trajectory after a significant jump in global gold prices the previous night. The selling price of this gold type currently hovers around 76.5-77 million VND per tael.

Bao Tin Minh Chau, a prominent jewelry company, witnessed a substantial increase in gold ring prices, surging by nearly 400 thousand VND per tael to reach 75.38-76.68 million VND per tael. DOJI, another renowned jeweler, followed suit with a 600 thousand VND per tael increment, resulting in prices ranging from 75.65 to 76.95 million VND per tael.

SJC Company also joined the fray, displaying plain gold ring prices at 74.6-76.3 million VND per tael, reflecting a 200 thousand VND increase compared to the previous day.

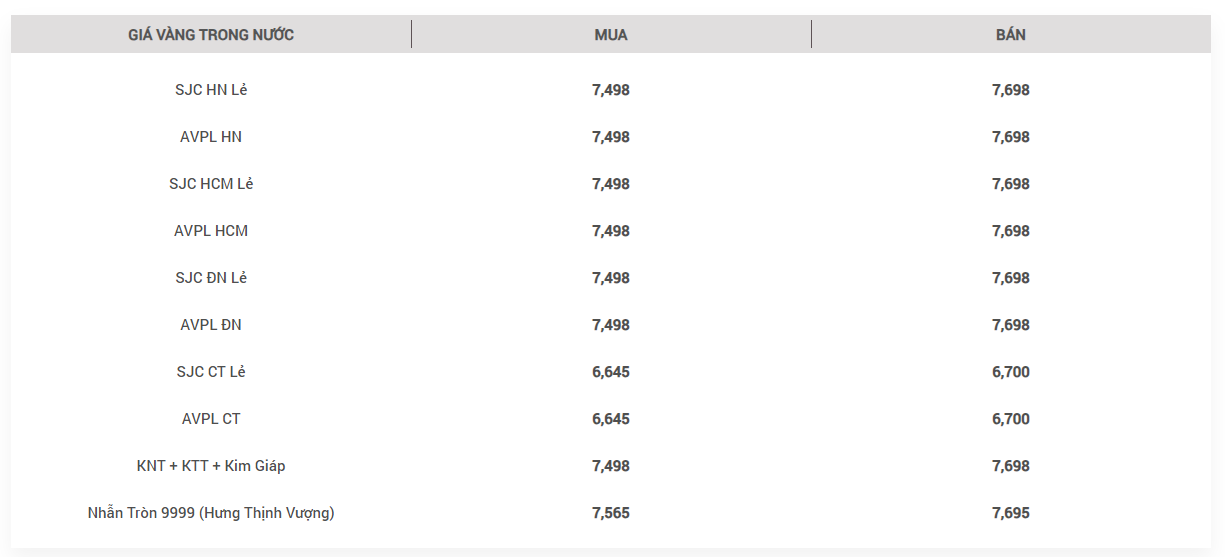

SJC gold prices remained stagnant, with buying and selling prices fixed at 75.0 million VND per tael and 77.0 million VND per tael, respectively.

DOJI’s buying price for plain gold rings has surpassed the buying price of SJC gold.

In the global arena, gold prices soared by approximately 30 USD per ounce on July 5, peaking at 2,390 USD per ounce. By 9:30 AM on July 6 (Vietnam time), the spot gold price settled at 2,388 USD per ounce. When converted using Vietcombank’s USD-VND exchange rate, the international gold price corresponds to 73.3 million VND per tael. Alternatively, using the black market’s USD exchange rate, the international gold price equates to 74.3 million VND per tael.

Numerous gold investors are eagerly anticipating the 2,400 USD mark, as the market perceives diminished obstacles to a loosening cycle initiated by the Federal Reserve (Fed). Disappointing economic data, including a slowdown in the US job market, are heightening market expectations for the Fed to slash interest rates in September. On Friday, the US Bureau of Labor Statistics revealed that the US economy generated 206,000 jobs in the previous month, surpassing expectations. However, the unemployment rate ticked up to 4.1%, up from 4.0% in May. According to CME FedWatch, market projections indicate a nearly 80% likelihood of the Fed cutting interest rates after the summer break.

Global gold prices witness a significant surge.

The mounting anticipation of embarking on a new loosening cycle has pushed the US Dollar Index to a three-week low, providing a boost to gold prices, which are currently trading at a four-week high. The DXY index, which gauges the strength of the US dollar against a basket of major currencies, dipped to 104.88 points, marking a 1% decline for the week.

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.