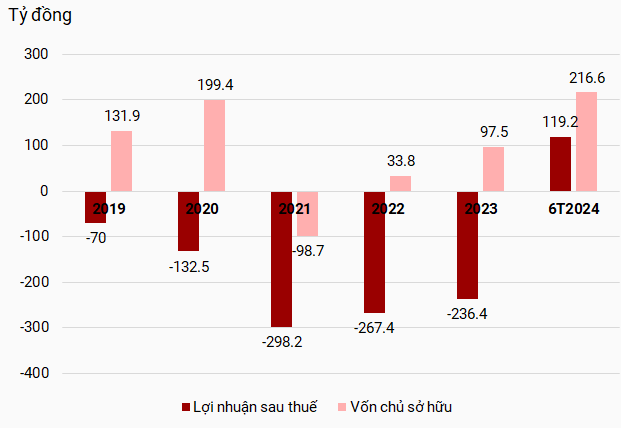

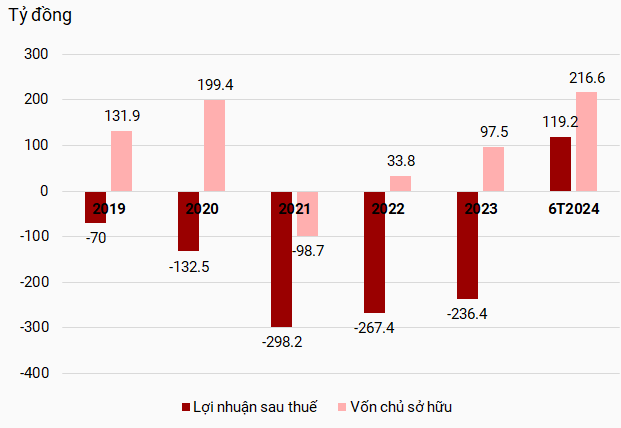

In a report to HNX, Hoang Truong Tourism Real Estate Investment Joint Stock Company revealed a remarkable turnaround with a post-tax profit of 119.2 billion VND in the first half of 2024, compared to a loss of 139.6 billion VND in the same period last year. This comes as a surprise given the company’s history of consistent losses amounting to hundreds of billions of VND annually from 2019 to 2023.

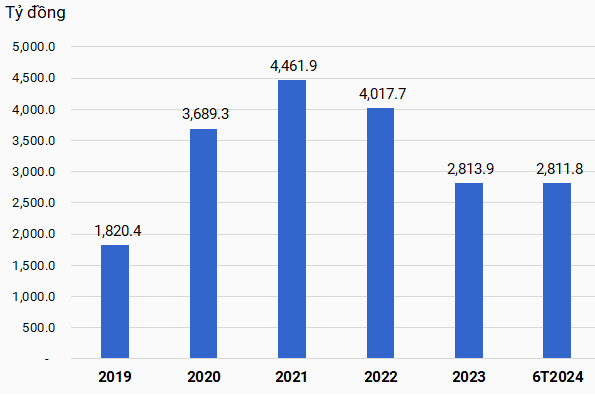

With this profit, Hoang Truong’s owner’s equity reached 216.6 billion VND by the end of June 2024. In 2021, the company’s owner’s equity was negative, at -99 billion VND, and its debt peaked at nearly 4,462 billion VND.

As of mid-2024, Hoang Truong’s debt has decreased to 2,812 billion VND, of which 1,400 billion VND is bond debt.

|

Hoang Truong’s Financial Metrics

|

Source: Author’s Compilation

|

In the first half of 2024, Hoang Truong spent over 84 billion VND on bond interest payments. The company currently has a single bond issue with the code HTCH2024001, valued at 1,400 billion VND. The bond was issued on December 21, 2020, with a four-year maturity, due on December 21, 2024, and a coupon rate of 9.3% per annum. In December 2023, the company was fined 65 million VND by the State Securities Commission for failing to disclose information on time to the Hanoi Stock Exchange (HNX).

Established in 2014, Hoang Truong has a charter capital of 1,200 billion VND. The company is led by Ms. Nguyen Thi Tram Anh, who serves as its Chairwoman, General Director, and legal representative.

After record low interest rate until 2023, Mobile World (MWG) forecasts a 14-fold profit increase in 2024 but still falls short of the peak period

After a comprehensive restructuring that began in Q4/2023, The Gioi Di Dong believes that the company has the potential to further strengthen its revenue and improve profitability targets.