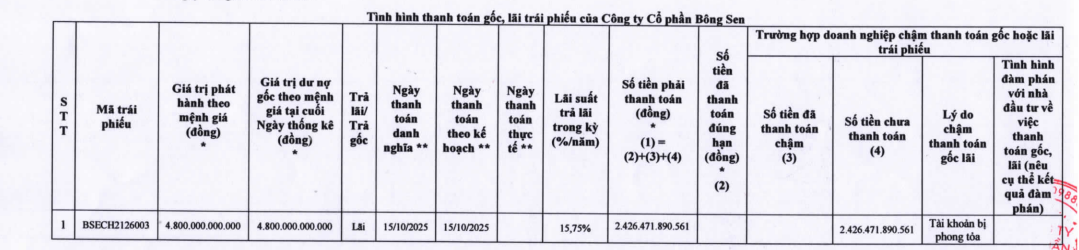

Bông Sen Corporation (Bông Sen Corp) has submitted a document to the Hanoi Stock Exchange (HNX) detailing the status of principal and interest payments on its bonds.

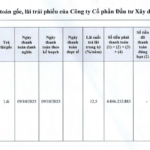

Specifically, the BSECH2126003 bond series issued by Bông Sen has a total value of VND 4.8 trillion, with an interest rate of 15.75% per annum for this period.

According to the schedule, on October 15, 2025, Bông Sen Corp is due to pay approximately VND 2,426.5 billion in interest. However, the company has not made the payment due to a frozen bank account.

Bông Sen has not yet provided specific details regarding the payment timeline or negotiation outcomes with investors.

Source: HNX

The BSECH2126003 bonds were issued by Bông Sen Corp on October 15, 2021, to fund the development of an office building, commercial center, and residential complex at 152 Tran Phu, Ho Chi Minh City. This prime location was previously owned by Vietnam National Tobacco Corporation (Vinataba).

The collateral includes: a 30% equity stake in Tri Duc Real Estate Company valued at VND 180 billion, owned by Ms. Tran Thi Pho; over 63.4 million shares (valued at approximately VND 634.5 billion) representing 69.9% of the charter capital of Daeha JSC, held by Hop Thanh 1 Investment JSC (upon meeting mortgage conditions). Additionally, the collateral comprises existing or future real estate and movable assets owned by the company (or third parties); other collateral will be replaced or supplemented as needed to secure bond obligations.

During the first-instance trial phase of the Van Thinh Phat case, Bông Sen Corp was listed among 762 companies associated with Truong My Lan’s conglomerate.

Originally a member of Saigon Tourism Corporation (Saigontourist), Bông Sen was transformed into a joint-stock company on December 27, 2004, with an initial charter capital of VND 130 billion.

As of the registration change in November 2016, the charter capital was VND 4,777 billion. Currently, Ms. Vu Thi Hong Hanh (born in 1993) serves as the Chairwoman of the Board and legal representative of the company.

Bông Sen Corp is renowned for owning several luxury hotels and restaurants in Ho Chi Minh City, including Palace Saigon Hotel, Bông Sen Saigon Hotel, Bông Sen Annex Hotel, Lemongrass Restaurant, Buffet Gánh, Lion Restaurant, and Vegetarian Restaurant.

In Hanoi, Bông Sen became the parent company of Daeha in 2015, which owns the Daewoo Hanoi Hotel complex and Daeha office building at 360 Kim Ma. This is one of Hanoi’s first international 5-star hotels.

Financially, as of June 30, 2025, Bông Sen Corp’s equity stood at VND 4,539 billion, with owner’s investment capital remaining at VND 4,777 billion.

For the first half of 2025, the company reported a net loss of nearly VND 356 billion, compared to a loss of VND 401 billion in the same period last year. Prolonged losses have resulted in accumulated losses of nearly VND 3,092 billion as of June 30, 2025.

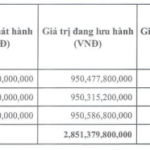

By the end of Q2 2025, Bông Sen’s total liabilities exceeded VND 9,076 billion, including VND 4,800 billion in bond debt from the aforementioned BSECH2126003 series.

Additionally, the company linked to Truong My Lan recorded other liabilities totaling over VND 4,271 billion, including short-term payables of nearly VND 2,257 billion, other long-term payables of over VND 928 billion, and deferred income tax liabilities of nearly VND 884 billion.

What Does SHS Utilize the Proceeds from ESOP Issuance For?

According to the announcement, the proceeds from the ESOP share issuance will be utilized by SHS to bolster its capital for margin lending activities.

Marina Tower Developer Delays Bond Interest Payments

Marina Tower’s developer has missed the scheduled interest payment for the DPJ12202 bond tranche and has communicated a revised payment timeline to investors.