Hai Phát Investment Corporation Extends Bond Maturity and Announces Interest Payment Plan

In an official document dated August 22, 2025, signed by Mr. Do Quy Hai, Chairman of the Board of Hai Phat Investment Corporation (Tax Code: 0500447004), the company announced a successful agreement with bondholders of the HPXH2125007 bond series. This agreement extends the repayment deadline by 18 months, moving it from the original maturity date of August 25, 2025, to February 25, 2027.

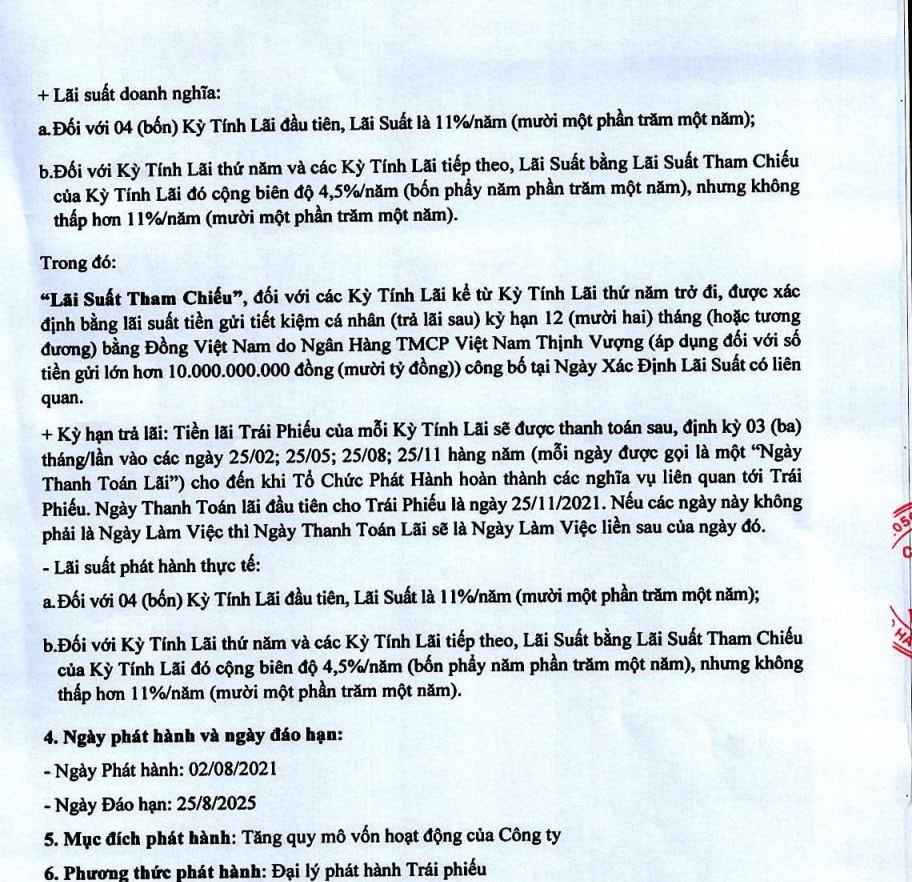

Details of the HPXH2125007 bond issuance announced by HPX on August 15, 2021.

The company outlined its plan to settle outstanding interest payments up to August 15, 2025. Interest rates for installments 9 through 16 are set at 11% per annum. Beyond the interest payments for installments 7 through 16, HPX is not obligated to pay any additional fees or penalties, including those related to delayed interest payments.

The final deadline for settling all outstanding interest is set for August 25, 2025.

Regarding the bond extension, HPX’s recent announcement confirms the agreement with bondholders to adjust the maturity date of the HPXH2125007 bonds issued in 2021. The new maturity date is February 25, 2027, as reflected in the bond issuance plan, information disclosure, bond terms, and related documents.

The interest rate for the extended period remains at 11% per annum, with a single payment due on the new maturity date of February 25, 2027.

Hai Phat Investment Misuses Hundreds of Billions of Dong from Bond Issuance

The Government Inspectorate recently released its findings on the compliance with policies and laws regarding private corporate bond issuance and the use of bond proceeds from January 1, 2015, to June 30, 2023. Hai Phat Investment Corporation was found to have misallocated hundreds of billions of dong from its bond issuance, using the funds for purposes other than those stated in the issuance plan.

Hai Phat Investment Corporation misallocated 250 out of 450 billion dong from the HPXH2122011 bond issuance. The bonds were intended to fund specific projects, including the Urban Residential Area Project at Km3 and Km4, Hai Yen Ward, Mong Cai City, Quang Ninh Province.

However, the company used 9.107 billion dong to compensate households affected by the Mai Pha New Urban Area Project in Lang Son City; 51.490 billion dong to pay for land use rights auctions for the Commercial Housing Project on extended B6, B10, and TT12 roads in Lao Cai Province; 5.027 billion dong for resettlement compensation for the An Pha New Urban Area Project in Lang Son City; and an additional 184.37 billion dong for other expenses.

Hai Phat Investment also misallocated 103.968 billion dong out of 400 billion dong from the HP-BOND2020/RL01, HP-BOND2020/RL02, and HP-BOND2020/RL03 bond issuances.

These bonds were intended for business cooperation and investment in other company activities. Instead, the funds were directed to the Cao Bang Project.

Regarding the 100 billion dong from the HPXH2122002 bond issuance, the funds were meant for project implementation and land use rights auctions in various provinces (including Bac Giang, Lao Cai, and Hanoi), as well as for covering legitimate and regular company expenses.

However, Hai Phat Investment used the entire 100 billion dong to increase the charter capital of Saphire Investment Company Limited.

For the 104.248 billion dong out of 300 billion dong from the HPXH2224001 bond issuance, the funds were intended for investment in projects such as the Urban Residential Area Project at Km3 and Km4, Hai Yen Ward, Mong Cai City (Phase 1), Quang Ninh Province, and the Ngoc Island Resort Villa Project. They were also meant to cover regular and legitimate company expenses.

Instead, Hai Phat Investment used 104.248 billion dong for a joint investment in the Kien An – Hai Phong Project with Solaris Vietnam Investment Corporation.

Regarding the HPX2124009 bond issuance, the funds were intended for business operations, including regular expenses, construction costs, office renovations, tax obligations, and investment in projects like the Mai Pha New Urban Area Project in Lang Son City.

However, Hai Phat Investment used 1.9785 billion dong to settle debts with PSP Urban Services Corporation and 51.941 billion dong to pay for land use rights auctions for the Commercial Housing Project on extended B6 road.

“Maturity Extension: GKM Holdings Seeks Two-Year Extension on Bond Maturity”

As of writing, with just a few days left until the nearly VND 45 billion bond maturity date, GKM Holdings seeks to extend this bond issue by another two years.