Vietnam’s stock market witnessed a positive session on December 8th, though the gains were unevenly distributed, with most stocks closing in the red. The VN-Index’s upward momentum was primarily driven by the Vingroup conglomerate, notably VIC, which hit its ceiling price and emerged as the market’s key driver.

At the close, the VN-Index gained 12.42 points to reach 1,753.74 points, with trading value on HoSE exceeding VND 17.2 trillion. Foreign investors were net sellers, offloading a total of VND 1.907 trillion across the market. Here’s a breakdown:

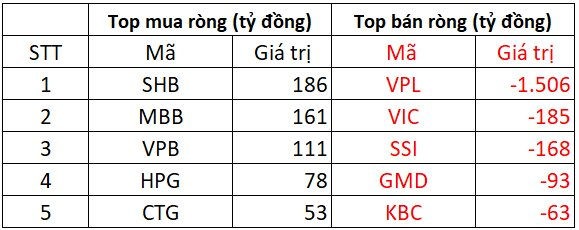

On HoSE, foreign investors net sold approximately VND 1.84 trillion

Selling pressure was concentrated on several blue-chip stocks. VPL led the decline, with foreign investors net selling VND 1.506 trillion, primarily through negotiated transactions. VIC followed, with net outflows of around VND 185 billion, while SSI saw net selling of VND 168 billion. GMD and KBC also experienced net outflows of VND 93 billion and VND 63 billion, respectively.

On the buying side, SHB attracted the most foreign interest, with net purchases of approximately VND 186 billion. MBB also saw significant foreign inflows, with net buying of around VND 161 billion, followed by VPB at VND 111 billion. Two other large-cap stocks, HPG and CTG, received net foreign inflows of VND 78 billion and VND 53 billion, respectively.

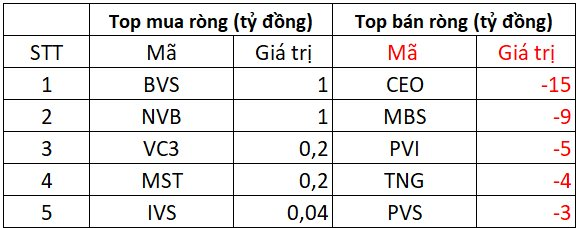

On HNX, foreign investors net sold approximately VND 46 billion

Foreign investors were net buyers of BVS and NVB on HNX, with each stock seeing net purchases of around VND 1 billion. VC3 and MST both recorded net buying of approximately VND 0.2 billion, while IVS saw modest net inflows of VND 40 million.

Conversely, CEO faced the strongest selling pressure, with net outflows of around VND 15 billion. MBS (-VND 9 billion), PVI (-VND 5 billion), TNG (-VND 4 billion), and PVS (-VND 3 billion) also experienced significant net selling.

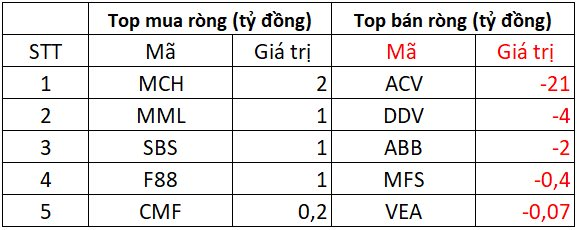

On UPCOM, foreign investors net sold approximately VND 22 billion

On UPCOM, MCH saw the strongest foreign buying interest, with net purchases of around VND 2 billion. MML, SBS, and F88 followed, each recording net buying of approximately VND 1 billion, while CMF saw net inflows of VND 0.2 billion.

On the selling side, ACV experienced the heaviest foreign outflows, with net selling of around VND 21 billion. DDV (-VND 4 billion), ABB (-VND 2 billion), MFS (-VND 0.4 billion), and VEA also ranked among the top net-sold stocks.

Vietstock Weekly 08-12/12/2025: Climbing Back to the Peak?

The VN-Index extended its winning streak to four consecutive weeks, despite trading volumes remaining below the 20-week average. The Stochastic Oscillator has already signaled a buy, while the MACD is narrowing its gap with the Signal line. If the MACD confirms a buy signal soon, the outlook will become even more optimistic. The index is approaching its historical peak of 1,760-1,795 points, a critical resistance level that will determine the potential for further upside in the final months of the year.