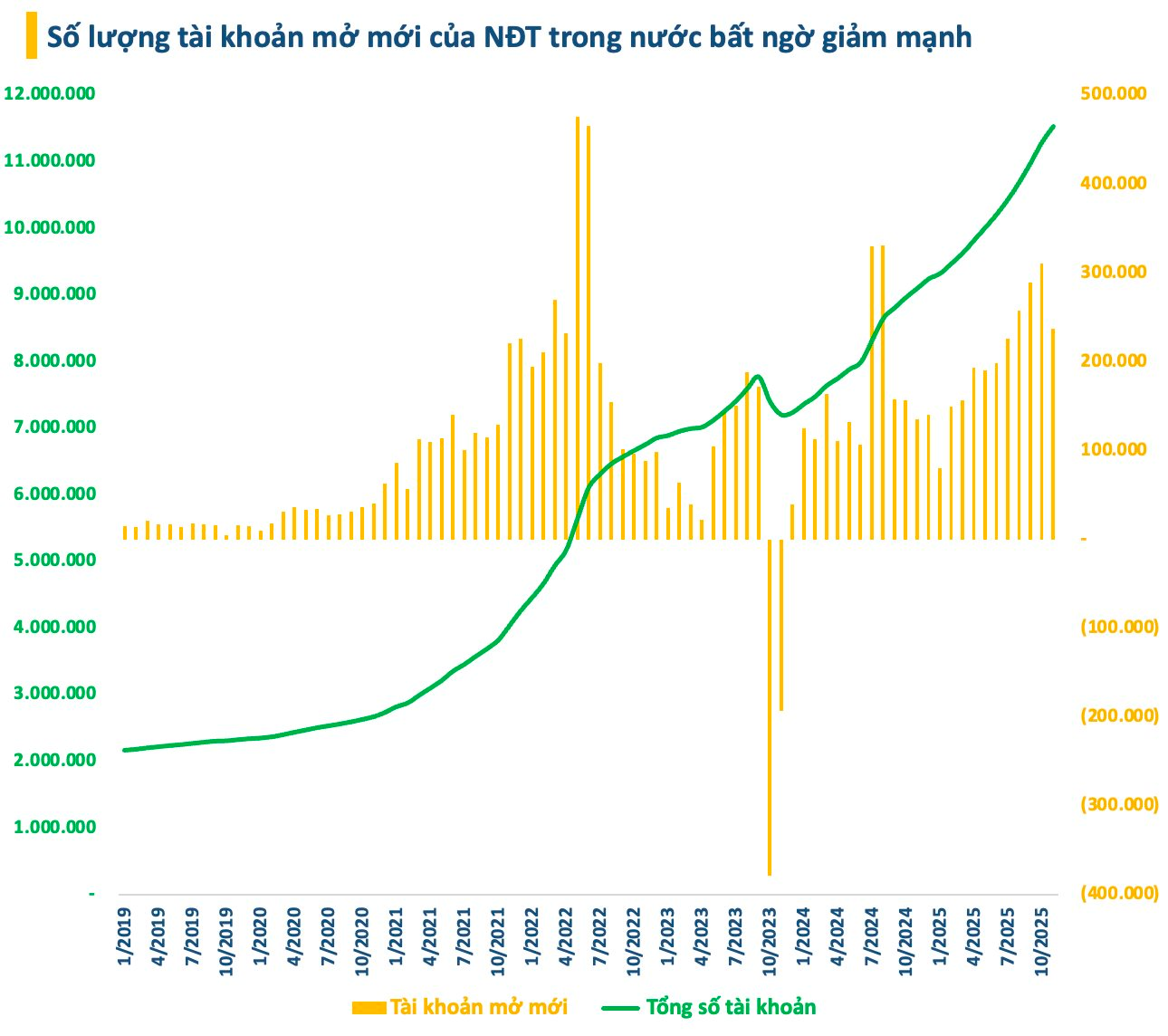

According to data from the Vietnam Securities Depository and Clearing Corporation (VSDC), domestic investor accounts increased by over 237,000 in November 2025. This figure is 73,000 accounts lower than the previous month and marks the lowest level in four months, ending a five-month consecutive growth streak. The majority of new accounts were opened by individuals, while only 146 were added by organizations.

In the first 11 months of the year, domestic investor securities accounts grew by nearly 2.3 million. As of November 2025, individual investors held a total of over 11.5 million accounts, equivalent to approximately 11% of the population, achieving the 2030 target ahead of schedule.

The slowdown in new account openings comes amidst a positive market performance. The VN-Index rose over 3% in November, approaching the 1,700-point milestone and setting the stage for further gains in early December. However, market liquidity declined significantly compared to the previous month, with average matching value on HoSE reaching only around 20 trillion VND per session.

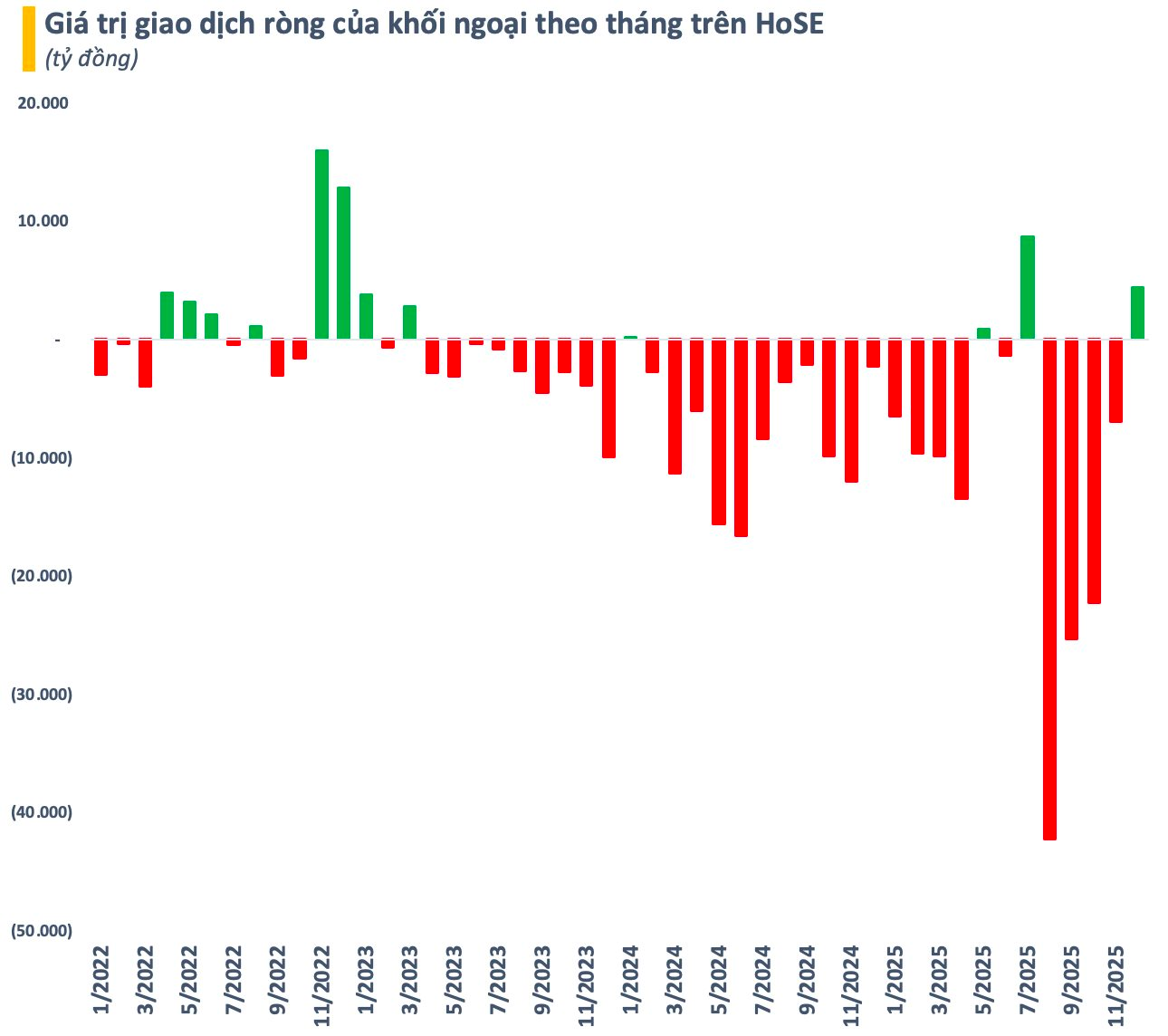

A positive note is the reduced selling pressure from foreign investors. In November, foreign investors net sold over 6.9 trillion VND on HoSE, the lowest level in four months. In contrast, net selling reached nearly 90 trillion VND during the August-September-October period. Foreign capital flows show signs of reversal, with net buying of approximately 4.4 trillion VND since the beginning of December.

Despite consistent net selling, the number of foreign investor accounts in Vietnam continued to rise monthly. Specifically, foreign accounts increased by 270 in November, with 245 individual and 25 organizational accounts added. The total number of foreign investor accounts now stands at 49,889.

Expert Insights: Early Stages of a New Wave in the Market – VN-Index May Fluctuate Before Targeting 1,800 Points

Early adjustments in the market, if they occur at the beginning of the week, are likely to stimulate low-price demand, thereby creating a more favorable environment for the VN-Index to gradually approach the target range of 1,800 points in the remainder of December.

Vietstock Weekly 08-12/12/2025: Climbing Back to the Peak?

The VN-Index extended its winning streak to four consecutive weeks, despite trading volumes remaining below the 20-week average. The Stochastic Oscillator has already signaled a buy, while the MACD is narrowing its gap with the Signal line. If the MACD confirms a buy signal soon, the outlook will become even more optimistic. The index is approaching its historical peak of 1,760-1,795 points, a critical resistance level that will determine the potential for further upside in the final months of the year.