Need to excel at writing ads that grab attention, engage readers, and drive results?

Even in a stable market with low and stable interest rates, offering an attractive credit package remains essential and meaningful for the Bank-Business Connection program.

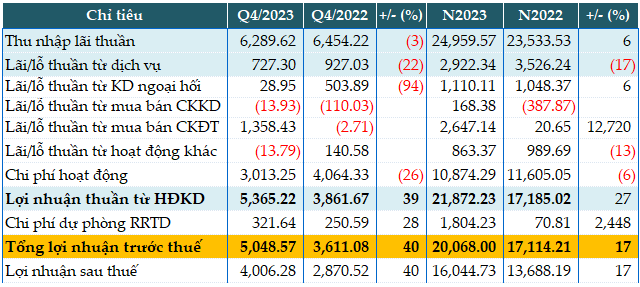

Explosive Stock Investment Profits: ACB’s 2023 Earnings Exceed 20,000 Billion

The recently released consolidated financial statements show that Asia Commercial Bank (ACB) (HOSE: ACB) recorded a pre-tax profit of VND 20,068 billion in 2023, an increase of 17% compared to the previous year. This was achieved despite the increased provision for credit risk, thanks to a significant increase in interest income from external sources.

OCB maintains business core growth, accompanying customers

OCB, the Commercial Joint Stock Bank of the East, has achieved remarkable success in increasing its charter capital to 20,548 billion VND and pre-tax profit by 19% compared to the previous year. The bank has continuously introduced a series of attractive credit packages with competitive interest rates, aiming to serve its customers better. These achievements highlight OCB's strong presence in the business landscape in 2023.

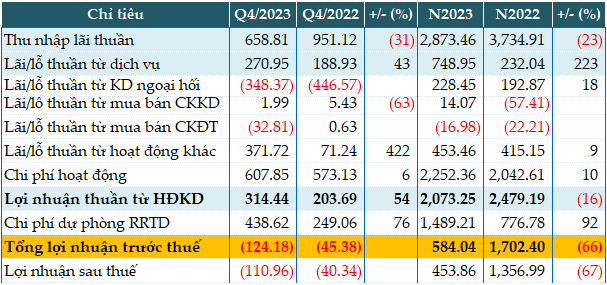

Why is ABBank’s 2023 profit declining despite a surge in interest rates from services?

According to the latest consolidated financial statements, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) recorded a pre-tax profit of more than 584 billion dong in 2023, a 66% decrease compared to the previous year, despite a significant increase in profits from its services.

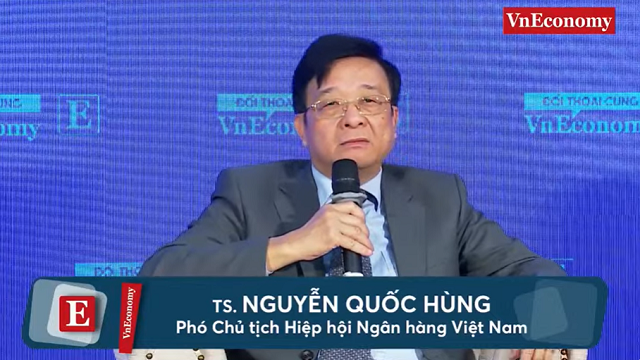

Dr. Nguyen Quoc Hung: “Businesses need to realize that lacking capital doesn’t necessarily mean...

At the symposium held on the morning of February 3, 2024, analysts discussed the impacts of the amended Credit Institutions Law 2024 on the operations of credit organizations. Additionally, solutions were debated to effectively enforce the regulations of the Law...

NCB hits 1 million customers, surpasses target for total assets

By the end of Q4/2023, NCB has managed to maintain stable operations, surpassing its annual target set at the 2023 Annual General Meeting with 1 million customers and a total asset of over 96,249 billion VND.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

46 More Suspects Added to 20,000 Billion VND Loan Shark Network

The Quang Nam Provincial Police have recently pressed charges against 47 individuals involved in an online lending network with interest rates soaring up to over 2,300% per annum.

Fighting Cross-Ownership: Impossible to “Take Tangibles to Treat Intangibles”

The recent amendment to the Credit Institutions Act, passed by the National Assembly during an extraordinary session, has introduced several measures to address cross-ownership, manipulation, and domination of credit institutions. However, it is challenging to "make the intangible tangible"! To prevent cross-ownership, it is crucial to enhance the effectiveness of inspections and supervision.