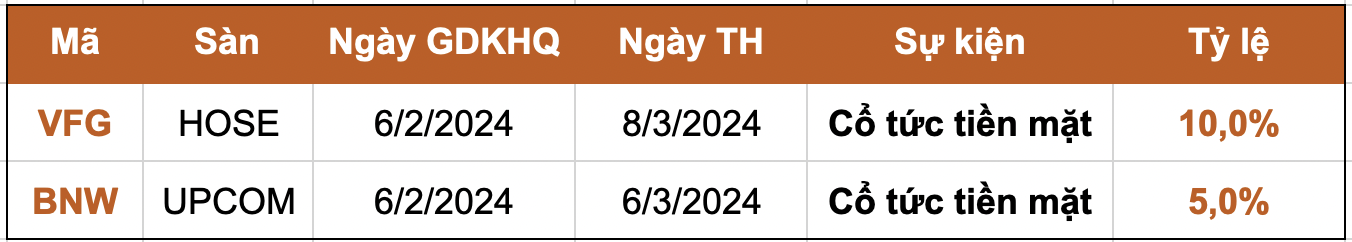

Two companies distribute cash dividends ahead of Lunar New Year

In the upcoming week, the company will be paying out a minimum cash dividend of 5%.

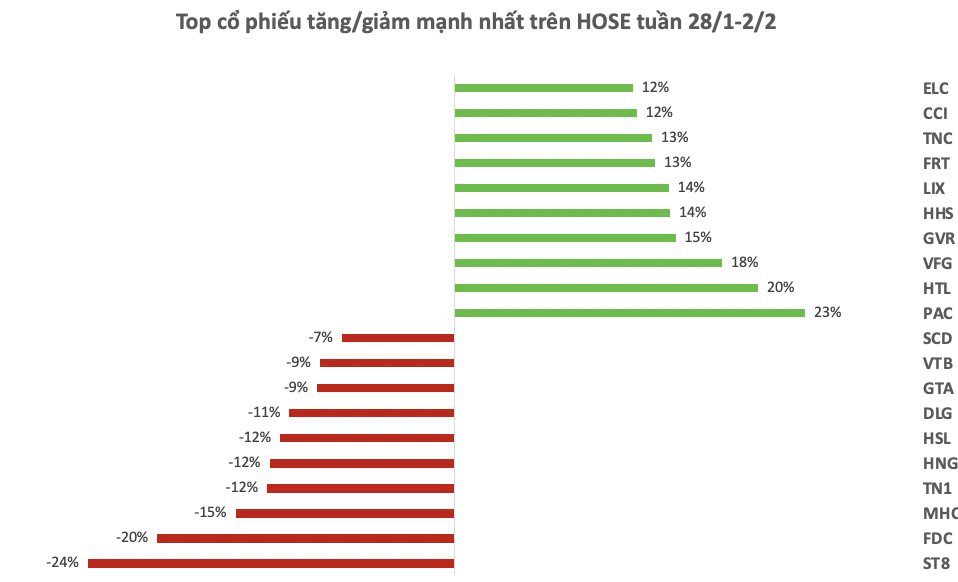

Top 10 Stocks with the Biggest increase/decrease This Week: “Wave” of Corporate Earnings Continues,...

The top 10 most successful stocks on the HOSE have seen the highest increase of 23% and the lowest increase of 12%.

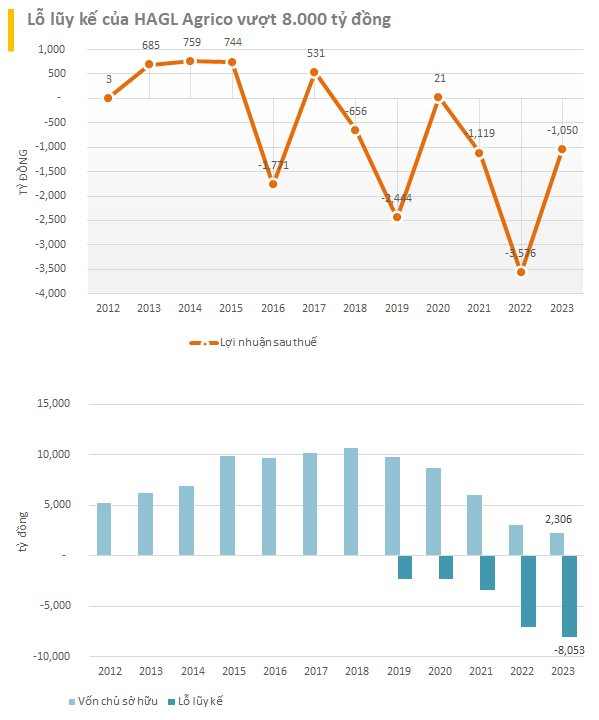

HBC, HNG, POM Receive “Final Warning” About Potential Mandatory Delisting

All three businesses have one thing in common - they have been experiencing a downturn in their business over the past few years, accumulating billions of dollars in losses.

How did Vietnam’s two biggest airlines perform in 2023: One made a profit of...

Vietnam Airlines and Vietjet Air, two leading airlines in Vietnam, have recently released their financial reports for the year 2023.

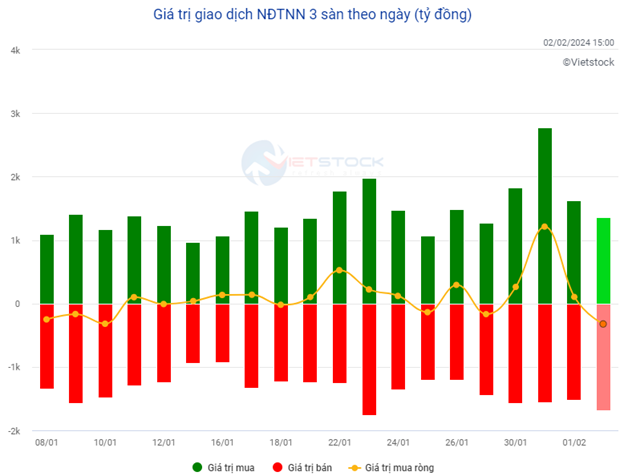

Stock Market Surges as Funds Pour In at the Start of the Year

In January 2024, the VN-Index surged more than 3%, reaching 1,164 points. Money poured into the market, boosting stock trading with a 4.6% increase in liquidity, averaging 16,531 billion Vietnamese dong. Notably, foreign investors returned as net buyers with a net buying value of 1,304 billion Vietnamese dong.

Market Pulse 02/02: Market retreats in the afternoon session

At the end of the trading session, the VN-Index decreased by 0.47 points (0.04%), reaching 1,172.55 points; the HNX-Index closed below the reference level at 230.56 points. The market breadth leaned towards buyers with 395 stocks increasing and 380 stocks decreasing. Red dominated the VN30-Index basket with 10 stocks rising, 16 stocks falling, and 4 stocks staying flat.

Market Update 31/01: VN-Index plunges, money flows back strongly

At the end of the trading session, the VN-Index fell by 15.34 points (1.3%) to 1,164.31 points; the HNX-Index decreased by 1.48 points (0.64%) to 229.18 points. The market breadth was tilted towards sellers with 265 stocks gaining and 474 stocks declining. Red dominated the VN30-Index basket with 3 stocks rising, 26 stocks falling, and 1 reference stock.

Vietstock Weekly 05-07/02/2024: Tug of War Still Continues

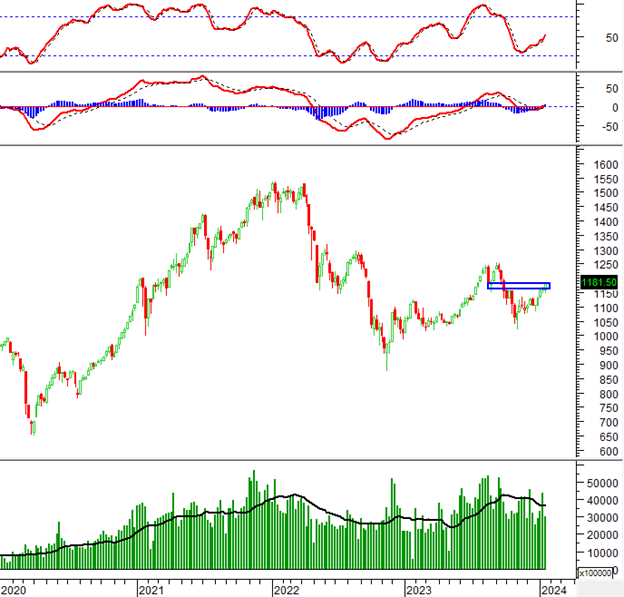

The VN-Index has continued to decline compared to the previous week and has formed a candlestick pattern similar to the High Wave Candle, indicating investor indecision. Currently, the index is still above the 200-week SMA. If it can maintain this level, the outlook for the future will not be too pessimistic.

Vietstock Weekly 29/01-02/02/2024: Still Exposed to Risks

The VN-Index experienced a drop in points and slowed down its upward momentum compared to the previous trading week. Trading volume has been volatile, and the index is currently testing a long-term resistance trendline, which may lead to potential fluctuations in the upcoming sessions.

Vietstock Weekly 22-26/01/2024: Maintaining the Upward Momentum

The VN-Index has experienced a strong increase and has surpassed the previous resistance level of August 2023 (around 1,160-1,180 points), indicating positive investor sentiment. Additionally, the MACD indicator has signaled a buy and crossed above the 0 threshold, suggesting further potential growth ahead.