Weekend Ending Sees Significant Gold SJC Price Drop

After surging to nearly 79 million dong per tael on February 2nd, the price of SJC gold is now plummeting towards the 78 million dong per tael mark this weekend.

The Glorious Journey of Purple Bank at the age of 15

TPBank has recently been honored with the "Shining Top Performer" award at the WeChoice Awards 2023. Through a journey of over 15 years of development, TPBank has consistently prioritized customers and utilized technology as a leverage, propelling the bank from a restructured institution to one of the top 5 most valuable private bank brands in Vietnam.

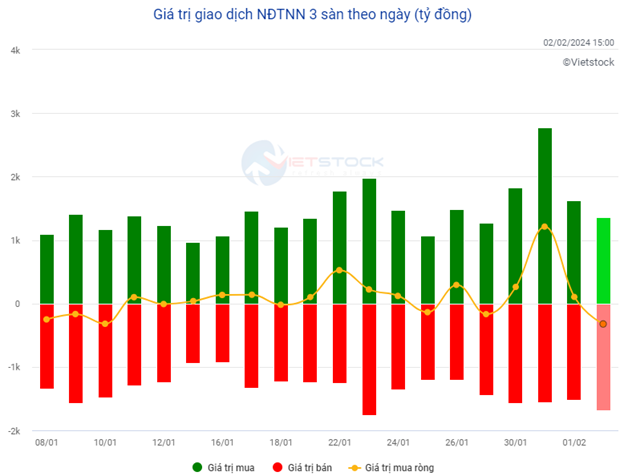

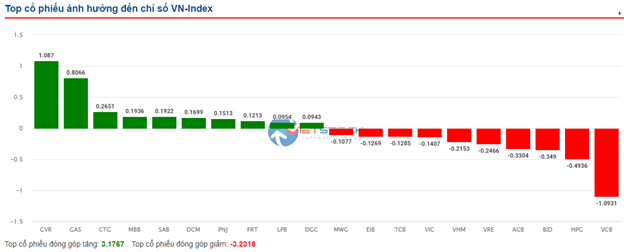

Market Pulse 02/02: Market retreats in the afternoon session

At the end of the trading session, the VN-Index decreased by 0.47 points (0.04%), reaching 1,172.55 points; the HNX-Index closed below the reference level at 230.56 points. The market breadth leaned towards buyers with 395 stocks increasing and 380 stocks decreasing. Red dominated the VN30-Index basket with 10 stocks rising, 16 stocks falling, and 4 stocks staying flat.

Hyosung still keen on spending billions to buy shares at GELEX, never giving up.

During the weekend trading session, East Anh Electrical Equipment (TBD) stocks surged 15% to reach 73,800 dong, setting a market capitalization of nearly 2,400 billion dong.

Market Update 31/01: VN-Index plunges, money flows back strongly

At the end of the trading session, the VN-Index fell by 15.34 points (1.3%) to 1,164.31 points; the HNX-Index decreased by 1.48 points (0.64%) to 229.18 points. The market breadth was tilted towards sellers with 265 stocks gaining and 474 stocks declining. Red dominated the VN30-Index basket with 3 stocks rising, 26 stocks falling, and 1 reference stock.

Vietstock Weekly 05-07/02/2024: Tug of War Still Continues

The VN-Index has continued to decline compared to the previous week and has formed a candlestick pattern similar to the High Wave Candle, indicating investor indecision. Currently, the index is still above the 200-week SMA. If it can maintain this level, the outlook for the future will not be too pessimistic.

Vietstock Weekly 29/01-02/02/2024: Still Exposed to Risks

The VN-Index experienced a drop in points and slowed down its upward momentum compared to the previous trading week. Trading volume has been volatile, and the index is currently testing a long-term resistance trendline, which may lead to potential fluctuations in the upcoming sessions.

Vietstock Weekly 22-26/01/2024: Maintaining the Upward Momentum

The VN-Index has experienced a strong increase and has surpassed the previous resistance level of August 2023 (around 1,160-1,180 points), indicating positive investor sentiment. Additionally, the MACD indicator has signaled a buy and crossed above the 0 threshold, suggesting further potential growth ahead.

Market Pulse 01/29: Selling Pressure Returns as VN-Index Falls close to Reference Level

At the close of the trading session, the VN-Index gained 0.02 points (0.00%), reaching a level of 1,175.69 points; the HNX-Index decreased by 0.38 points (0.17%), to a level of 229.05 points. Market breadth leaned towards the buying side with 383 stocks advancing and 375 stocks declining. Red dominated the VN30 basket with 11 stocks advancing, 14 stocks declining, and 5 reference stocks.

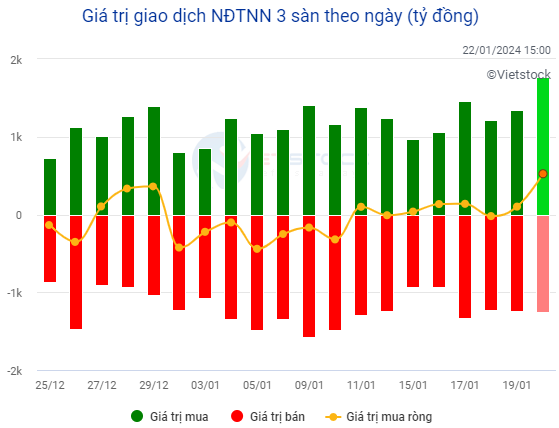

Market Pulse 01/22: Buying Strength Returns, VN-Index Back Above Reference

At the end of the trading session, the VN-Index increased by 1.36 points (0.12%), reaching 1,182.86 points; the HNX-Index rose by 0.29 points (0.13%), to 229.77 points. The overall market breadth leaned towards buyers with 376 stocks rising and 348 stocks declining. The majority of the VN30-Index basket was dominated by green with 14 stocks rising, 10 stocks declining, and 6 stocks unchanged.