Crude oil rises over 1% after US data prompts USD drop

Crude oil prices increased over 1% on Thursday after US retail data spurred selling pressure on the dollar, although investors also noted the International Energy Agency’s (IEA) report which showed slowing oil demand growth this year.

Brent crude oil ended the session up $1.26, or 1.5%, at $82.86 per barrel. US West Texas Intermediate (WTI) crude oil rose $1.39, or 1.8%, to $78.03.

Thursday’s dollar index fell about 0.3% after data showed US retail sales fell more than expected in January. A weak dollar often drives up the prices of USD-denominated commodities as they become cheaper for holders of other currencies.

The US Commerce Department’s Census Bureau said retail sales dropped 0.8% the previous month. December’s retail data was also revised down to show only a 0.4% gain instead of the previously reported 0.6% increase.

The data has raised optimism that the Federal Reserve will cut interest rates in the future, which would have a positive impact on oil demand.

Gold rebounds above $2,000

Gold prices also rose after the US dollar and US Treasury bond yields fell, while market focus turned to comments from Federal Reserve officials to seek signals about when the Fed will cut interest rates.

Spot gold finished the session up 0.6% at $2,004.05 per ounce; April gold futures rose 0.5% to $2,014.9.

There will be at least three more Fed officials speaking later this week.

Copper strengthens

Copper prices continued to rise as the US dollar weakened. Three-month copper futures on the London Metal Exchange (LME).

It ended the session up 1.4% at $8,313 per tonne – the largest daily gain in three weeks.

In addition to a weaker USD and falling US bond yields, stable production demand from the world’s leading consumer of copper – China – is also supporting metal prices.

China’s official Purchasing Managers’ Index (PMI) has rebounded slightly in January compared to the previous month, but is still below the 50-point threshold – the dividing line between expansion and contraction.

LME’s daily data showed copper inventories at registered warehouses with the LME fell to 132,525 tonnes, the lowest level since September.

Wheat falls, corn and soybeans drop to 3-year lows as US forecasts ample supplies

Corn and soybean futures prices fell to their lowest levels in over three years as traders remained concerned about demand after the US released forecasts suggesting inventory growth.

At an annual outlook forum, the US Department of Agriculture predicted that US corn stocks would increase by about 17% from the end of marketing year 2023/24 to 2.532 billion bushels by the end of marketing year 2024/25, the highest level since the 1987/88 season. The USDA also said soybean ending stocks are expected to rise 38% to 435 million bushels by the end of marketing year 2024/25, the highest level since 2019/20.

At Thursday’s close, soybean prices dropped 8-1/4 cents to $11.62-1/4 per bushel, while corn fell 6-1/2 cents to $4.17-3/4 per bushel. Wheat also declined 18-1/2 cents to $5.67 per bushel.

Raw sugar at one-month low

Raw sugar futures prices on ICE fell over 2% on Thursday, hitting their lowest level in a month as technical indicators suggested prices would drop. However, the decline was limited by delayed exports in Brazil and poor crops in Thailand.

At the close of trading, March raw sugar futures were down 0.55 cent, or 2.4%, to 22.82 cents per lb, having earlier touched the lowest level since mid-January at 22.75 US cents.

May white sugar fell 2.2% to $630.60 per tonne.

Coffee rises

Coffee arabica futures prices for May delivery on ICE rose 2.35 cents, or 1.3%, to $1.8515 per lb.

Rain in the world’s leading producer of arabica coffee – Brazil, is boosting coffee tree prospects, while certified stocks certified by ICE are also putting pressure on prices.

May robusta coffee on London futures rose 0.6% to $3,108 per tonne.

Rubber rises for 4th consecutive session

Rubber futures prices in Japan rose for a fourth straight session, buoyed by strong domestic stocks and a weak yen, although weak GDP data and falling oil prices capped gains.

The July rubber contract on the Osaka Exchange (OSE) closed up 0.8 yen, or 0.28%, to 288.8 yen ($1.92)/kg.

The Nikkei average closed up 1.21% at 38,157.94, near its record high reached in December 1989.

The yen strengthened to 150.09 versus the dollar, but still hovered near the key 150 level.

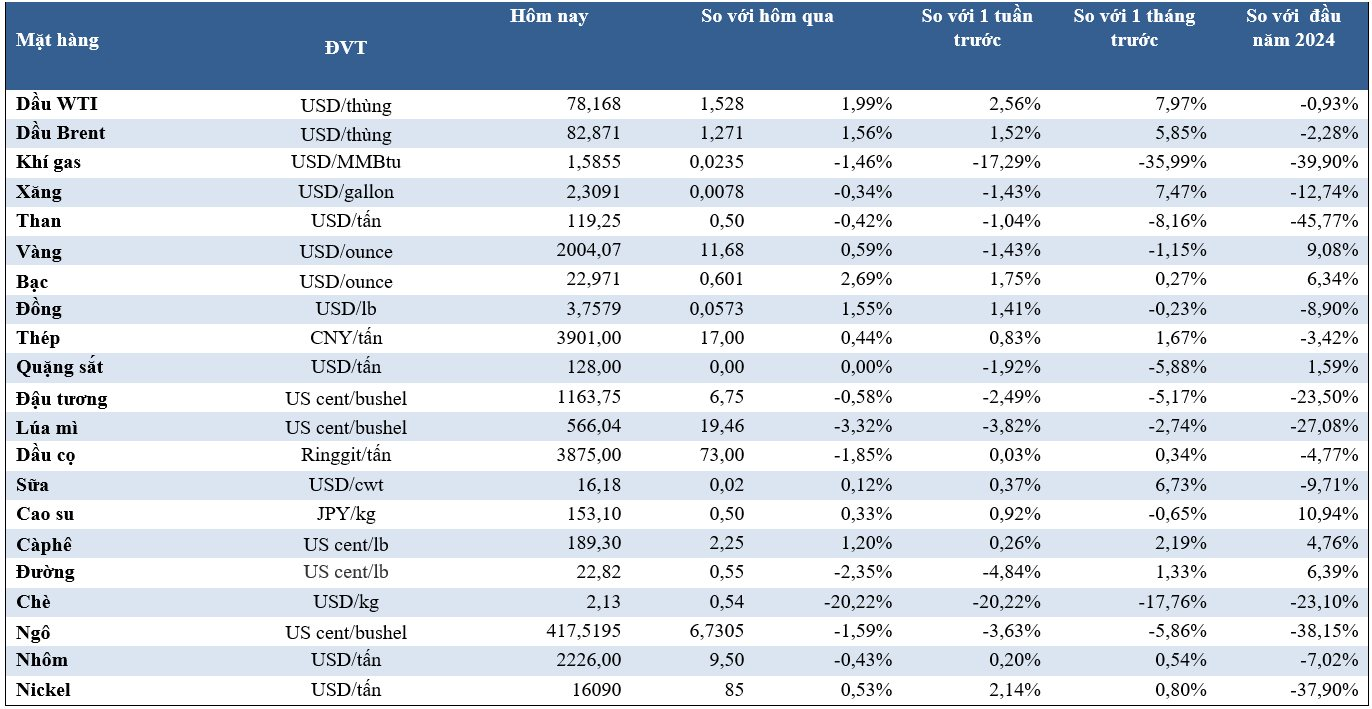

Key commodity prices as of morning 16/2: