Mirae Asset Securities has just released the annual general meeting documents for 2024, scheduled to take place on the morning of March 13th.

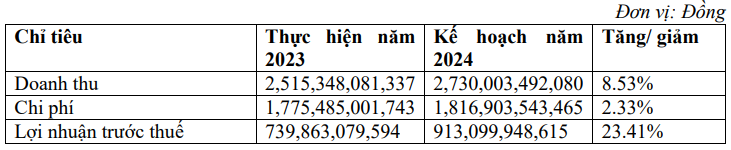

According to the content of the agendas, Mirae Asset plans to achieve revenue and pre-tax profit of VND 2,730 billion (+8.5%) and VND 913 billion (+23%) respectively in 2024. Previously, in 2023, the company’s operating revenue reached VND 2,515 billion, a decrease of 5%. Pre-tax profit is VND 740 billion, a reduction of over 12% compared to the previous year.

Source: Mirae Asset

According to the company, credit growth will accelerate in 2024. Commercial banks have continuously reduced deposit interest rates in 2023, providing a foundation for lowering lending rates. The government has issued short-term policies and solutions to loosen the bottlenecks for bond issuers and the real estate industry. Supportive policies create favorable macro conditions, enabling companies in difficulties to have time to recover.

Mirae Asset expects that investment, production, and consumption will further recover. Thus, the EPS growth in most sectors is expected to increase in 2024, compared to the downward trend of 4% in 2023.

Mirae Asset plans to continue to expand its securities brokerage activities with the goal of increasing its brokerage market share in shares, investment certificates, and warrant certificates with collateral on the HOSE floor to the Top 5. In 2023, the company’s brokerage market share was recorded at 5.06% (top 6) on the HoSE floor, 3.54% (top 6) on the HNX floor, and 2.27% (top 8) in the derivatives market.

In parallel, the company continues to invest in the system and technology team, while making efforts to comply with KRX system testing regulations. In addition, building its own software system with support from the South Korean parent company aims to make Mirae Asset one of the leading securities companies in terms of a superior trading system, meeting the maximum needs of customers. Especially, the company will develop a non-brokerage trading channel to anticipate the wave of investment in the stock market by a large number of new individual investors participating in the market.

During the general meeting, Mirae Asset will also present a resolution to the shareholders regarding the distribution of profits in 2023. The company will pay a 7% dividend per year for 2023 to the shareholders who purchased preferred dividend shares issued at the end of 2021. At that time, Mirae Asset sold 113.5 million preferred shares to existing shareholders at a ratio of 100:20.8, with a fixed dividend rate of 7% per year. As a result, it is projected that in 2023, Mirae Asset will disburse more than VND 79 billion to pay dividends for these preferred shares.