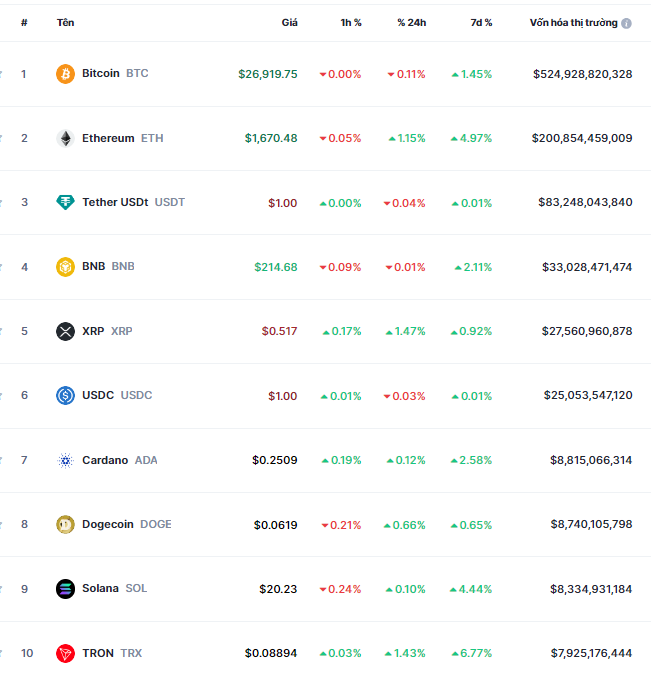

As of September 30, the price of Bitcoin fluctuated around the $26,900 mark, an increase of over 1% compared to the previous week. Meanwhile, Ethereum – the second largest cryptocurrency – rose nearly 5% to $1,670.

Other cryptocurrencies in the top 10 also saw slight increases in the past week, with BNB rising 2%, Cardano advancing 2.5%, Solana surging 4%, and Tron adding 7%.

Performance of the top 10 cryptocurrencies

Source: CoinMarketCap

|

The majority of short-term Bitcoin traders are at a loss

According to cryptocurrency analytics company Glassnode, 97.5% of short-term Bitcoin traders are at a loss, and a pessimistic sentiment has engulfed the cryptocurrency market.

The price decline of Bitcoin in recent months has tested the determination of investors. In fact, not many people have confidence in Bitcoin at this stage. In the cryptocurrency market, there is a term called “STH” referring to those who hold tokens in the short term, i.e., less than 155 days. As of September 17, a staggering 97.5% of short-term Bitcoin traders are at a loss.

According to Glassnode, there have been sudden changes in the sentiment of cryptocurrency traders when the price of Bitcoin dropped from $29,000 to $26,000 in August, triggering a selling frenzy.

Meanwhile, Week On-Chain suggests that the indicators point to further panic and negative sentiment in the near future. According to data from Alternative on September 12, the extreme sentiment of the market dropped to 30 points before returning to the neutral zone with a score of 47, and then remained in the fear zone with 44 points on September 24.

This reflects the overall cautious sentiment of Bitcoin investors. Many believe that a deeper price decline will continue to occur in the near future. However, there are certain debates in the market, as some optimists believe that the good fortune with Bitcoin will come in the beginning of the fourth quarter of 2023.

Huobi exchange hacked

Last week, the cryptocurrency market also received another bad news that the Huobi cryptocurrency exchange was hacked for 5,000 ETH, equivalent to $7.9 million, but the identity of the thief was not disclosed.

“HTX (Huobi exchange) suffered 5,000 ETH in damages due to a hacker attack. The exchange has fully compensated for the losses incurred from the hack and resolved the related issues. All user assets are safe,” Justin Sun, Senior Advisor of Huobi, shared on X (formerly known as Twitter) on September 25.

Earlier on September 24, blockchain analysis platform Cyvers discovered a suspicious transaction when 5,000 ETH from Huobi’s hot wallet was transferred to an unknown address. Subsequently, this wallet continued to transfer 1,000 ETH to a third address to distribute the assets.

A day later, Huobi sent a message to the recipient wallet of the 5,000 ETH in Chinese language, stating: “We have confirmed your true identity. Please return the money. We will reward the white hat hacker with 5%. You have 7 days to think about it. If not returned by October 2, we will seek legal intervention. If returned, we will hire you as a security advisor for the exchange.”

According to Medium, the hacker has not yet laundered the stolen ETH through mixers or other anonymous tools, meaning they are willing to take the risk and wait for the day they can convert it to cash.

On X, Justin Sun also continuously reassured the community. However, he did not publicly disclose the identity of the suspect. He said: “5,000 ETH, equivalent to $8 million, is a relatively small amount compared to the $3 billion in assets we hold for users. The damage from the hack is only equivalent to the exchange’s two weeks of revenue.”

Huobi used to be one of the top three cryptocurrency exchanges in the world after Binance and Coinbase in late 2022. As of September 26, the daily trading volume on the exchange reached $673 million, ranking 10th according to Coinmarketcap statistics. The exchange is of Chinese origin and changed ownership at the end of last year. The new owner of the exchange is Justin Sun, who is also the owner of Poloniex exchange and the founder of the TRON cryptocurrency project.