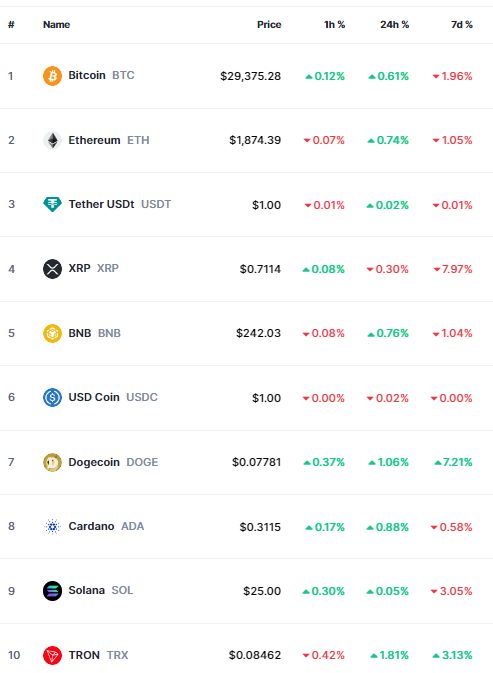

As of the morning of July 29th, Bitcoin is fluctuating at $29,400, a 2% decrease compared to the previous week. Ethereum – the second-largest cryptocurrency – is down 1% below $1,900. Ripple (XRP) has also lost its momentum, dropping 8% in the past week.

Other coins in the top 10 cryptocurrencies are also turning red, with BNB, Solana, and Cardano experiencing slight declines. Meanwhile, Dogecoin has surged 7%.

|

Top 10 cryptocurrencies

Source: CoinMarketCap

|

Fed raises interest rates to the highest level in 22 years

Last week, news that had an impact on the cryptocurrency market in particular and risk assets in general was the Fed’s interest rate hike.

In a previously anticipated decision, the Fed raised interest rates by another 25 basis points to 5.25%-5.5%, the highest level since the beginning of 2001.

This is the Fed’s 11th interest rate hike since March 2022. Prior to this, they decided to keep interest rates unchanged in June to evaluate the impact of tightening monetary policy on the economy.

However, the post-meeting statement by the Fed only provided vague signals about future actions.

“The committee will continue to assess incoming information and the impact of that information on monetary policy,” quoted from the statement by the Federal Open Market Committee (FOMC) – the Fed’s decision-making body. This is perhaps an approach that depends on the data that Fed officials have referred to in recent statements.

In the press conference following the interest rate hike statement, Fed Chairman Jerome Powell said that although inflation had significantly cooled off from its peak, the battle was not over. “Inflation has cooled off somewhat since mid-2022. However, the journey to reduce inflation to 2% is still far,” Powell shared.

He said the Fed will continue to rely on data to make interest rate decisions. “The Fed can raise interest rates if the data shows the need to do so, but it can also pause. We will exercise caution in each meeting,” Chairman Powell commented.

It is the expectation that the Fed is about to stop raising interest rates that serves as a driving force for the risk asset market, including the cryptocurrency market.

Cryptocurrencies score some wins in the US Congress

According to CNBC, before the August recess of legislators, the US Congress has taken important steps by passing some legal regulations to manage digital assets.

Specifically, on July 27, the House Financial Services Committee just passed a resolution to establish a clear legal framework for the issuance of stablecoins used in payments. The law also allows new stablecoin issuers to enter the market under certain conditions.

The stablecoin vote took place just one day after the House Financial Services Committee passed a legal framework for regulating cryptocurrencies, clearly delineating when digital assets are commodities and when they are securities for supervision purposes.

The passage of the laws, after a 14-month-long debate between Republican and Democratic committee members, can be considered a victory for the cryptocurrency industry.

However, the industry also faces challenges from the US Senate. Specifically, on the evening of July 27, the Senate passed a major defense spending bill, including measures to prevent cryptocurrencies from being used for illegal purposes and to combat anonymous cryptocurrency transactions.

Binance withdraws license application in Germany

According to Reuters, Binance has withdrawn its application in Germany. This move shows that the world’s largest cryptocurrency exchange is reassessing its expansion plans as the legal landscape poses difficulties for the industry.

Last month, German regulators said they would not grant Binance a license to conduct cryptocurrency custody activities.

A spokesperson for Binance said: “Binance confirms that the applicant has withdrawn the application to BaFin (the German financial supervisory agency). The situation, both globally and in terms of regulatory requirements, has taken significant changes.”

The spokesperson added: “Binance still intends to submit an application for a license in Germany, but our submission needs to reflect the ongoing changes.”

The company and CEO Changpeng Zhao faced significant pressure last month after a lawsuit by the US Securities and Exchange Commission (SEC) accused Binance of operating a “fraudulent website.” Binance has denied the allegations.

The company is also facing legal battles in other countries. Binance had to leave the Netherlands for not meeting registration requirements. At the same time, the exchange is also being investigated in France.