Apartments for sale under 2 billion VND

According to Savills Vietnam, the supply of apartments in Ho Chi Minh City in 2023 is only 10,700 units. It is worth noting that the number of apartment transactions in the past 10 years has been consistently decreasing by 7% annually. In the context of scarce supply and high housing prices, the market only recorded 6,300 transactions in the past year.

According to Savills’ report, new supply accounts for 78% of the market share of transactions and has an absorption rate of 84%. These projects sell well thanks to clear legal frameworks prior to launch, long payment periods, bank loans support, and affordable prices ranging from 2-5 billion VND per unit.

The number of apartment transactions has been consistently decreasing by 7% annually for the past 10 years.

Excluding new supply, the market still has weak sales with only 670 units sold, equivalent to a absorption rate of 14%. The primary selling price returns to the level of 2020 at 69 million VND/sqm, a decrease of 36% quarterly and 45% yearly after many high-priced projects have to temporarily withdraw from the market.

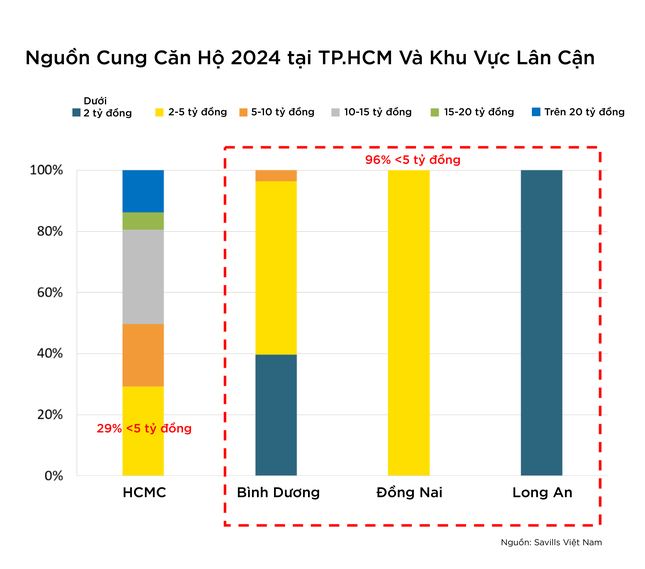

Ms. Giang Huynh, Deputy Director and Head of Market Research Department at S22M, believes that in 2023, Ho Chi Minh City will no longer have products priced under 2 billion VND, with 90% of transactions belonging to the 2-5 billion VND segment.

“In the period from 2024-2026, the supply of apartments priced from 2-5 billion VND will become increasingly scarce, with the main concentration of supply in the 5-10 billion VND segment. Therefore, home buyers in Ho Chi Minh City may switch to buying products in neighboring areas such as Binh Duong, Dong Nai, and Long An with more affordable prices,” analyzed Ms. Giang.

The Change for a Better Option

According to the same expert, in 2024, 96% of future housing supply in Binh Duong, Dong Nai, and Long An will be in the price range below 5 billion VND per unit. Therefore, this is considered a solution to the “thirst” for affordable housing in Ho Chi Minh City area.

< figcaption>

96% of future housing supply in Binh Duong, Dong Nai, and Long An are in the price range below 5 billion VND per unit.

Ms. Giang analyzed that apartments in Binh Duong, Dong Nai still maintain competitive prices compared to the Ho Chi Minh City market. This makes these areas attractive destinations for homebuyers. The demand for housing in Binh Duong is increasing rapidly due to industrial development and an increase in immigration rate. This creates stability in market demand and ensures the continuous development of the real estate market in the area.

Grasping this trend, many investors and real estate businesses have come to Binh Duong to develop affordable apartments. Recently, in Binh Duong, businesses have started to launch a series of affordable apartment projects to the market, such as Hung Thinh, Dat Xanh, Phuc Dat Group, Danh Khoi, Le Phong…

For example, Bcons Group is developing the Bons Polaris project at around 37-41 million VND/sqm, the selling price of the Phuc Dat Connect 2 project by Phuc Dat Group is about 40 million VND/sqm, the Picity Sky Park project is expected to be around 40-45 million VND/sqm, Phuc Dong Group is developing the Phuc Dong SkyOne project with a selling price below 1.5 billion VND per unit…

96% of future housing supply in Binh Duong, Dong Nai, and Long An are in the price range below 5 billion VND per unit.

In addition, Binh Duong also receives attention from foreign investors, such as CapitaLand… The selling prices of primary apartments from new projects are expected to increase slightly due to the increasing development costs, while the prices of secondary apartments may decrease slightly in the short term due to the slower market absorption rate.

“However, with the fairly rapid development in recent years, the supply of secondary apartments has been delivered and the future supply expected in Binh Duong will increase significantly, creating great competitive pressure for new projects. This can pose challenges in setting prices for new projects, especially as construction and development costs are increasing,” said the Deputy Director of Savills.