Technical analyst Gert van Lagen shared his predictions about the future trend of Bitcoin (BTC).

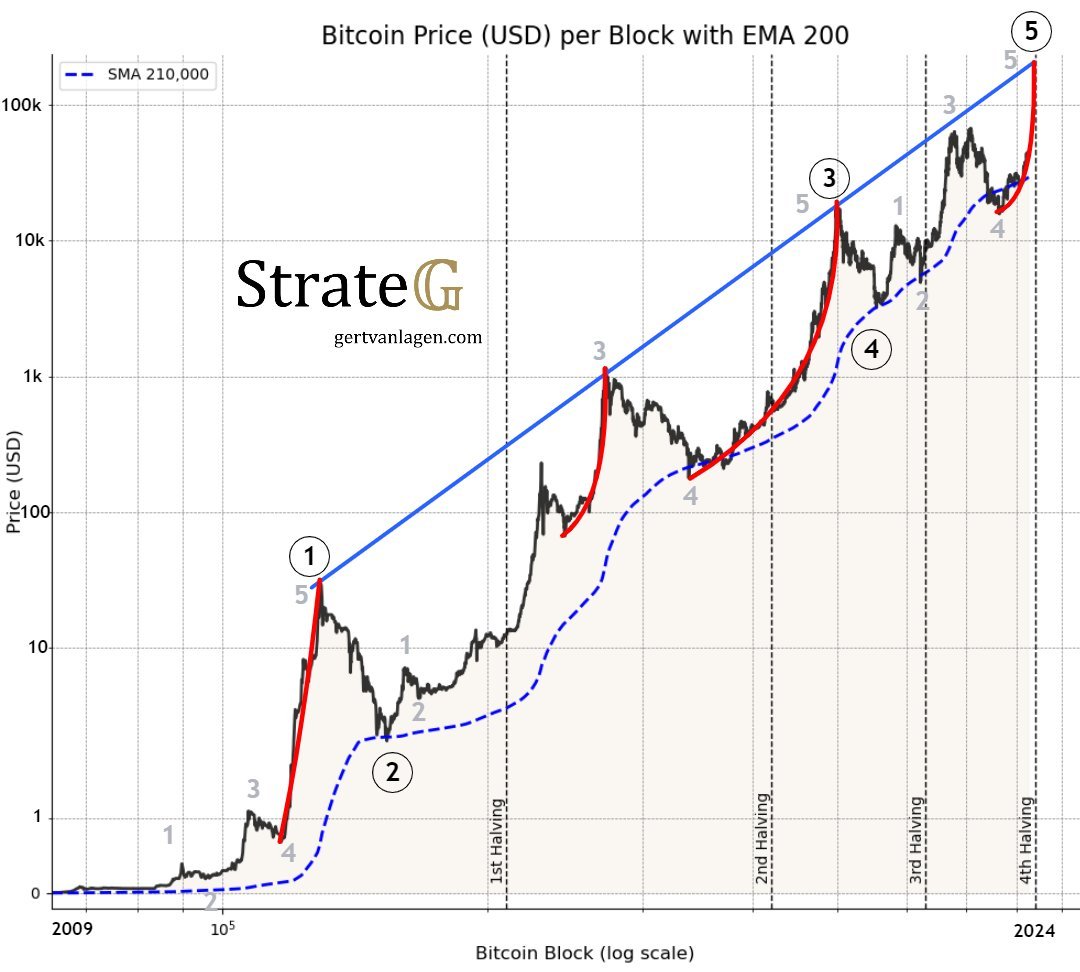

According to Van Lagen, the price of Bitcoin has been following a parabolic trajectory since November 2022 and is on track to reach $200,000 USD in the near future. He sets a invalidation point for this prediction when the price drops below $32,000 USD.

This parabolic rise to $200,000 USD is perfectly in line with the pattern of previous waves, all of which have touched the blue parabolic trend line in historical fashion.

According to Van Lagen, this indicates that the current price movement of Bitcoin is not an anomaly but a continuation of the previously established pattern.

Furthermore, the analyst believes that this prediction aligns with the increasing risk sensitivity in the stock market, which is nearing FOMO levels. In terms of structure, Bitcoin and the S&P 500 have had a tight correlation since late 2021.

The S&P 500 has been trading at all-time highs (ATH) for several consecutive weeks, which could be a positive sign for future performance of Bitcoin.