In the past decade, Vietnam has always been seen as an attractive market for foreign investors, not only because of its low labor costs but also due to its simple supply chain integration, good access to free trade, and political stability.

With a population of over 100 million people, indicating a strong consumer demand and abundant labor force, Vietnam has a greater appeal to foreign investors, including real estate giants from the Land of the Golden Pagoda.

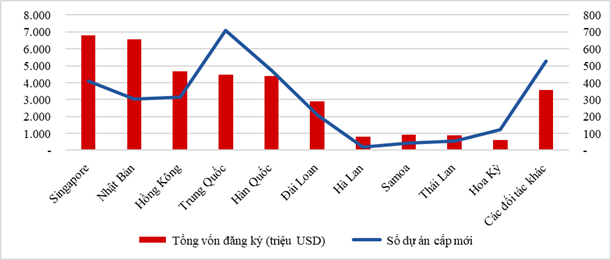

According to the Ministry of Planning and Investment, as of December 20, 2023, the total registered capital, adjusted capital, and capital contribution to buy shares or capital contribution (FDI) of foreign investors reached nearly 36.6 billion USD, a 32.1% increase compared to the same period.

Foreign investors have invested in 18 out of 21 national economic sectors. Among them, the real estate business stands second with a total investment capital of nearly 4.67 billion USD, accounting for over 12.7% of the total registered investment capital, a 4.8% increase compared to the same period.

In 2023, there were investments from 111 countries and territories in Vietnam; among them, Thailand ranked 9th out of 111 (nearly 1 billion USD) with a total registered investment capital of about 14 billion USD.

|

Structure of foreign investment in 2023 by partner

Source: Ministry of Planning and Investment

|

Recently, in early February 2024, Central Pattana Group – a member of Thailand’s leading retail group Central Group – announced its plan to establish a legal entity in Vietnam called CPN Global Vietnam Co., Ltd.

This new company primarily operates in the real estate consulting and management sector, with a registered capital of 20 billion VND, owned by CPN Global Company Limited (based in Thailand). The General Director cum Legal Representative of the company in Vietnam is Mr. Pandit Mongkolkul. The corporate headquarters, along with Central Retail’s headquarters in Vietnam, are located at Satra Building, 163 Phan Dang Luu, Ward 1, Phu Nhuan District, Ho Chi Minh City.

Central Pattana was established in 1980, with an initial registered capital of 300 million Baht (approximately 8.3 million USD). In 1982, Central Pattana opened Central Ladprao, the first fully integrated shopping center in Thailand. Central Pattana was listed on the Stock Exchange of Thailand (SET) in 1995 with the CPN code and an initial registered capital of 1 billion Baht (nearly 28 million USD).

Source: Central Pattana

|

Central Pattana is known as the largest retail real estate development group in Thailand and currently owns and manages nearly 40 luxury shopping centers, 10 office buildings, 5 hotels, and nearly 30 apartment buildings.

As of September 30, 2023, Central Pattana had total assets of over 279.2 billion Baht (approximately 7.8 billion USD), including debts of over 182.5 billion Baht (5 billion USD) and equity of 96.7 billion Baht (approximately 2.7 billion USD). Central Holding Co., Ltd is currently the largest shareholder in Central Pattana, holding over 1.17 billion shares, accounting for a 26.21% stake.

In the first 9 months of 2023, Central Pattana achieved a net profit of over 11 billion Baht (equivalent to 306 million USD), a 40% increase compared to the same period.

* Thai real estate tycoon Central Pattana steps into Vietnam

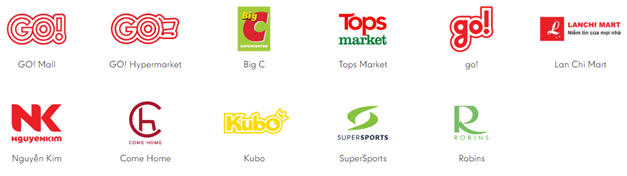

Meanwhile, Central Group has invested in Vietnam through its subsidiary, Central Retail (which began retail operations in Vietnam since 2011). Central Retail’s activities include 4 segments: food, fashion, electronics-appliances, and real estate.

In the retail real estate sector, Central Retail manages retail entities in Vietnam such as GO! supermarkets (formerly Big C), Nguyen Kim Electronics stores, Lan Chi supermarkets, and Tops Market.

|

Brands currently managed by Central Retail

Source: Central Retail

|

The Industrial Zone real estate tycoon – Amata

Amata Corporation PCL (Amata Group) was established in 1989 (headquartered in Thailand) and is one of the leading industrial zone development groups with many industrial zones in Vietnam. The group is currently chaired by Mr. Vikrom Kromadit.

Mr. Vikrom Kromadit – Chairman of Amata Group

|

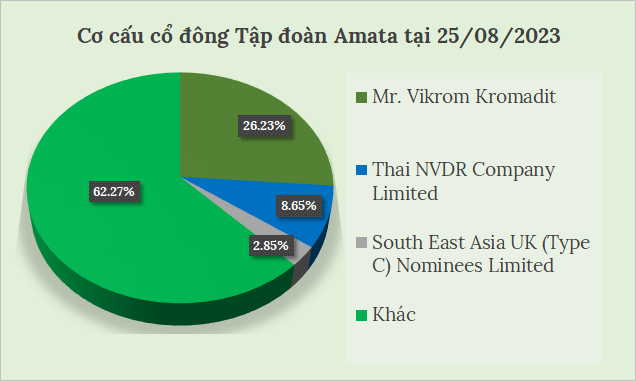

In Amata’s shareholder structure as of May 28, 2023, Mr. Vikrom Kromadit is the largest shareholder, holding 26.23%, and Thai NVDR owns 8.65%.

Source: Amata

|

In Vietnam, Amata Public Company Limited (Amata Vietnam) was established in 2012, operating in the development and operation of industrial zones, commercial areas, and residential areas in Vietnam. Dr. Apichart Chinwanno holds the position of Chairman of the company.

The major shareholders of Amata Vietnam as of May 2023 are Amata Corporation, owning 36.64%, Amata Asia Limited with 36.21%, and Mr. Vikrom Kromadit with 5.23%.

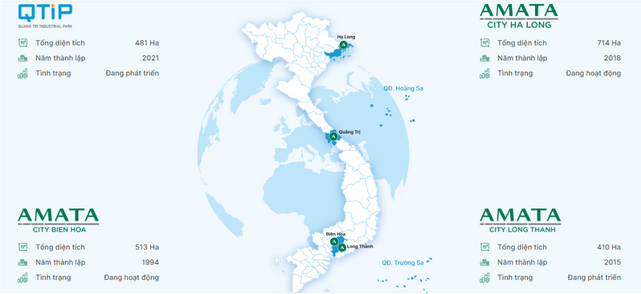

Amata Vietnam has developed 3,000 hectares of land, currently owns 7 industrial and urban projects, 7 subsidiary companies, and 1 joint-venture project, including Amata Bien Hoa Urban Development Joint Stock Company (ACBH) – formerly Amata Vietnam Joint Stock Company of which Amata Vietnam owns 89.99% of the charter capital, Amata Long Thanh Urban Development Joint Stock Company (ACLT) owned by ACBH and Amata Vietnam with ownership ratios of 65% and 35%, respectively, An Dien Thao Dien Urban Development Service Limited Company (ASCLT 1), An Dien Thao Dien Urban Development Service Limited Company 2 (ASCLT 2) with 51% ownership by ACLT, Amata Long Thanh City Joint Stock Company (ATLT) which is a joint venture between ACBH and Amata Vietnam with contribution ratios of 66% and 34% respectively, and Amata Ha Long Urban Development Joint Stock Company (ACHL) with 99.99% ownership by Amata Vietnam. Amata Vietnam is also involved in the Quang Tri Industrial Zone joint venture with partners VSIP and Sumitomo.

Amata’s representative projects in Vietnam include the Amata Bien Hoa Industrial Zone in Dong Nai established in 1994 (513 hectares), Amata Long Thanh (410 hectares), Amata Ha Long (714 hectares), Quang Tri Industrial Zone (481 hectares), etc.

Source: Amata Vietnam

|

As of September 30, 2023, Amata Vietnam had total assets of over 13.8 billion Baht (approximately 385 million USD), an 11% increase compared to the beginning of the year; including debts of over 7.6 billion Baht (212 million USD) and equity of 6.2 billion Baht (approximately 173 million USD). In the first 9 months of 2023, Amata Vietnam achieved a net profit of nearly 102 million Baht (2.8 million USD), a 80% decrease compared to the same period.

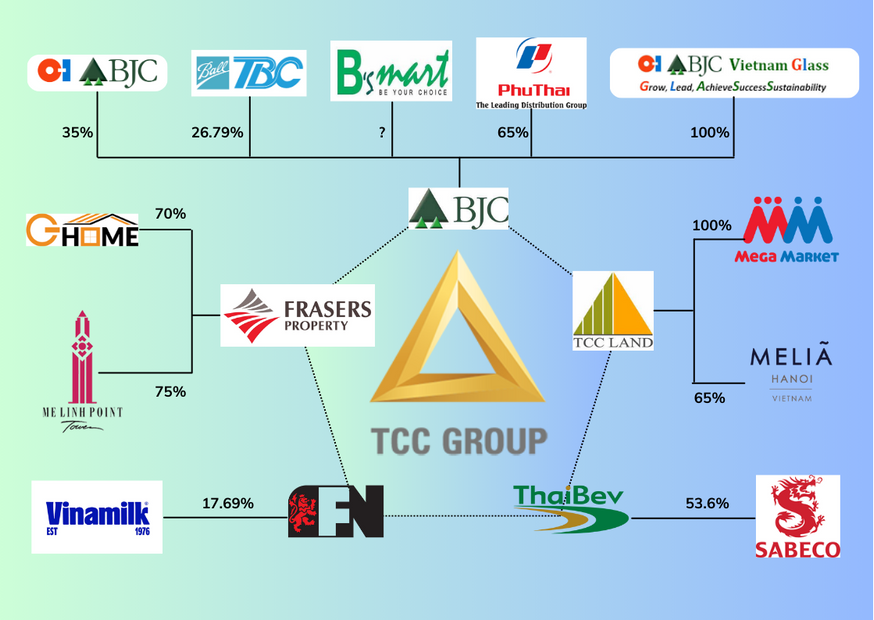

Thai entrepreneur with the largest investments in Vietnam

Mr. Charoen Sirivadhanabhakdi is the founder of the Thai Charoen Corporation Group (TCC Group) established in 1960 – one of Thailand’s leading conglomerates. TCC Group currently has large and small-scale investments in Vietnam in various sectors such as distribution, retail, packaging, beverages, and of course, real estate.

Mr. Charoen Sirivadhanabhakdi and his wife

|

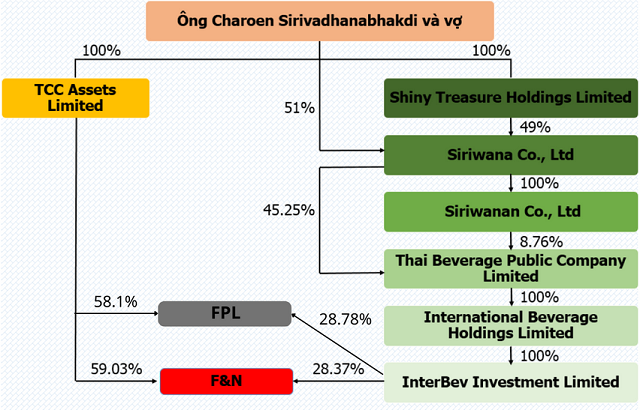

Famous brands that he owns or has an affiliation with through the TCC Group include Fraser and Neave Ltd (F&N) in the food and beverage sector, Thai Beverage PLC (beverages), Berli Jucker PLC (trade, packaging), and of course, real estate through TCC Land and Fraser Centrepoint Limited (FCL).

In the real estate sector, TCC Group owns commercial projects such as the Melia Hanoi Hotel (TCC Land owns 65%) and the Me Linh Point Tower office building (FCL owns 75%) in District 1, Ho Chi Minh City.

|

Frasers Centrepoint Limited (FCL) is now Frasers Property Limited (FPL) – a company owned by Mr. Charoen through TCC Assets Limited (58.1% stake) and InterBev Investment Limited (IIL) with a 28.78% stake.

|

In 2016, through FCL, Mr. Charoen acquired a 70% stake of G Homes Development JSC – a subsidiary of An Duong Thao Dien Real Estate Investment and Trading JSC (HOSE: HAR). This company was granted permission by Ho Chi Minh City to invest in the Thao Dien residential-commercial-service-office complex with a total investment capital of over 1,000 billion VND.

In the same year, he also acquired Metro Cash & Carry Vietnam (now renamed MM Mega Market) through TCC Land for over 700 million USD. Metro Vietnam itself also owns valuable real estate.

Prior to this deal, through Berli Jucker PLC (BJC) – a company under the TCC Group, he acquired a 65% stake of Phu Thai Group since 2013. Besides specializing in distribution, BJC and Phu Thai also own the convenience store chain B’s Mart (formerly Family Mart).

In the packaging sector, BJC invested about 60 million USD in a series of companies specialized in producing aluminum cans and glass bottles for the beverage industry such as BJC Glass Vietnam, Malaya Vietnam Glass, TBC-Ball Vietnam, etc.

At the end of 2017, Thai Beverage – a member of the TTC Group – acquired Sabeco, through Vietnam Beverage Co., Ltd. (a wholly-owned subsidiary of Thai Beverage) with a stake of nearly 53.6% of the charter capital. The value of this deal reached nearly 110 trillion VND (about 5 billion USD).

In addition, indirectly through Fraser and Neave (Singapore) – of which Mr. Charoen owns over 87%, this tycoon currently owns more than 15% of Vinamilk’s capital.

With the aforementioned investments, it is estimated that Mr. Charoen’s enterprises have poured in Vietnam no less than 7 billion USD.

According to Forbes statistics as of February 28, 2024, Mr. Charoen Sirivadhanabhakdi’s total assets amount to nearly 11 billion USD. In 2018, his assets (after acquiring Sabeco) reached 18 billion USD.

|

The TTC Group ecosystem operating in Vietnam

Source: VietstockFinance

|