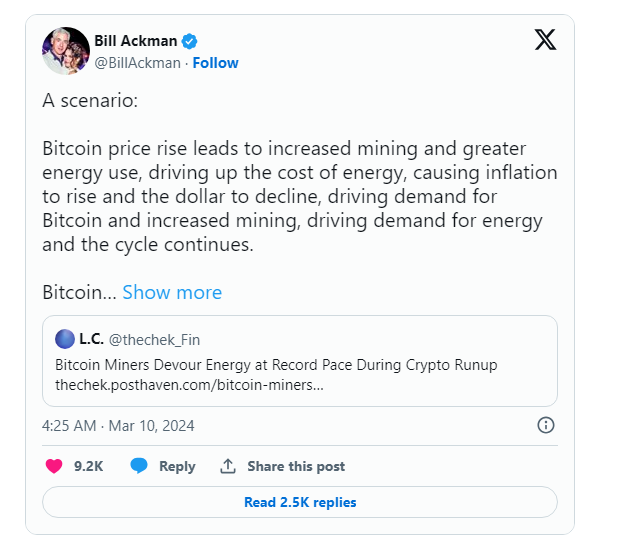

“The surge in Bitcoin prices has led to a more active cryptocurrency mining industry, which in turn consumes more energy. This has resulted in a significant increase in energy costs and an increase in inflation, causing the value of the USD to decline. As a result, the demand for Bitcoin is further stimulated, creating a loop,” Ackman shared on social media platform X.

“If the price of Bitcoin continues to rise, energy costs will also skyrocket, and the economy will collapse. Maybe I should buy some Bitcoin,” he continued. “Of course, it is also possible that everything will happen in the opposite direction.”

Bill Ackman’s post quickly received many responses from experts within the Bitcoin community, including Michael Saylor, the founder and CEO of MicroStrategy – a major player in the market.

“You should buy some Bitcoin, but not for the reasons mentioned above,” Saylor replied to Ackman’s post. “Most Bitcoin miners will reduce energy consumption costs rather than increase them. If you want to have a direct exchange, let me know.”

Prior to this, Ackman had largely avoided Bitcoin and the cryptocurrency market, although in 2022, he stated that he was a small investor in some cryptocurrency projects and speculative investment funds. “I invest more like someone with a thirst for knowledge rather than a cautious investor,” he shared at the time.

Last week, the largest cryptocurrency in the world briefly reached $70,170 USD before retracing to around $68,000 USD. However, the cryptocurrency market is extremely volatile.

After setting a new all-time high in over 2 years on March 5th, Bitcoin immediately plummeted 10%, dragging other cryptocurrencies and related stocks into the red. But the currency recovered the following day. Currently, the volatility index of Bitcoin is at its highest level in nearly a year, according to TradingView.

With the introduction of Bitcoin ETFs in the United States, major developments in the Bitcoin market now occur during regular trading hours, similar to the stock market.