Today (11/3), the State Bank of Vietnam announced the central exchange rate of the VND/USD pair at 23,972 VND/USD, a decrease of 24 dong compared to the previous listing. With a fluctuation range of +/-5% as regulated, the floor exchange rate is 22,773 VND/USD, and the ceiling exchange rate is 25,171 VND/USD.

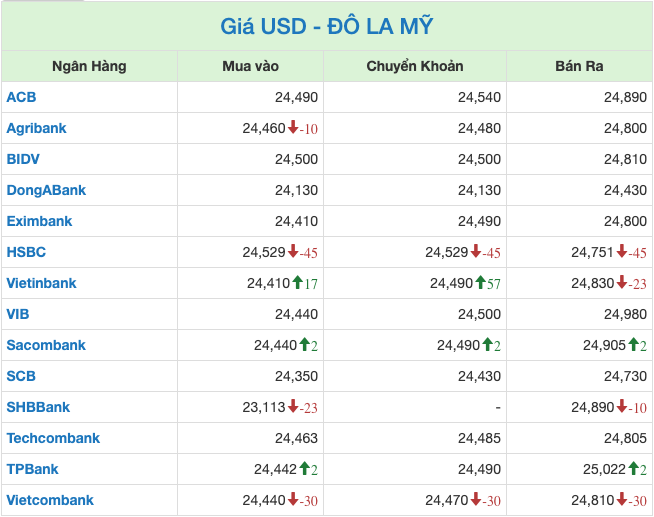

At 1:00 PM on March 11th, at Vietcombank, the buying and selling exchange rates were listed at 24,440 – 24,810 VND/USD, a decrease of 30 dong for both buying and selling compared to the closing rate of the previous week.

At BIDV, the buying and selling exchange rates were listed at 24,500 – 24,810 VND/USD, unchanged in both buying and selling compared to the closing rate of the session on March 8th.

At Techcombank, the buying and selling exchange rates were listed at 24,480 – 24,824 VND/USD, an increase of 17 dong for buying and 5 dong for selling compared to the previous session’s closing rate.

At VietinBank, the buying and selling exchange rates were listed at 24,410 – 24,830 VND/USD, an increase of 17 dong for both buying and selling compared to the closing rate of the previous week.

At Eximbank, the buying and selling exchange rates were listed at 24,410 – 24,800 VND/USD, unchanged compared to the previous session’s closing rate.

At Maritimebank, the buying and selling exchange rates were listed at 24,513 – 24,919 VND/USD, with an increase of 30 dong for buying and 8 dong for selling compared to the closing rate of the previous week.

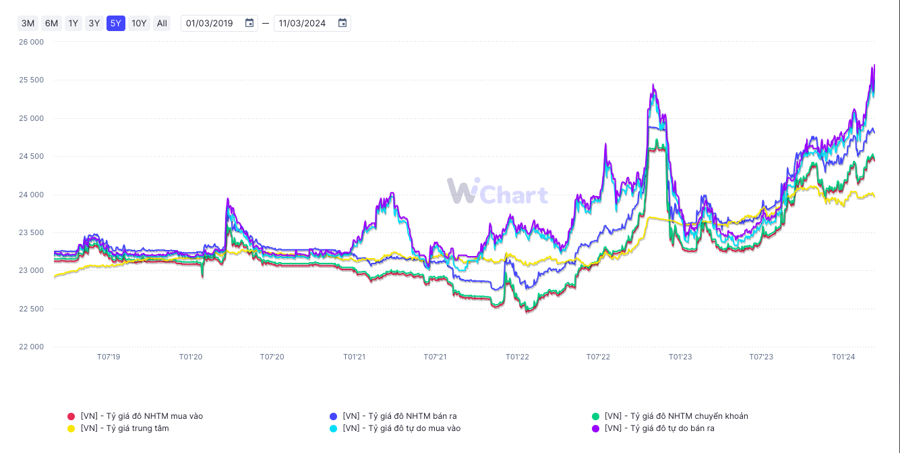

In the free market, as of the closing session on March 8th, the trading exchange rates were at 25,300 – 25,380 (buying – selling), with the upward trend continuing to expand during the last two days of the week.

However, the update from the market at 1:00 PM on March 11th showed that the free market USD rates had risen to 25,500 – 25,700 dong (buying – selling), corresponding to an increase of 200 dong for buying and 320 dong for selling. According to data from WiGroup, the selling rate of the free market USD is the highest in the past 5 years.

In this context, the State Bank of Vietnam has reactivated the bond issuance tool to regulate dong liquidity and cool down the exchange rate. Accordingly, the auctioning house will issue bonds with a term of 28 days.

Experts predict that interbank exchange rates will hover around 24,650 – 24,700 this week and may decrease to below 24,600 if the bond issuance tool is utilized.

In the global market, the USD has decreased by nearly -1.1% in the week from 4th to 8th of March, and also recorded the strongest weekly decline against the EUR (-0.9%) since the beginning of the year.

Stable labor recruitment activities and slower wage growth in the previous month provide the latest signal that the US economy is on track to achieve a “soft landing” to help cool down inflation without causing a recession.

According to the US Department of Labor’s announcement last Friday, businesses in the country created 275,000 jobs in February, surpassing the forecasted figure of 198,000 by economic experts. However, the unemployment rate increased to +3.9%, higher than expected with a slower wage growth (+0.1%). This is what the FED has been waiting for, signs that the economy is better controlled, after concerns about the return of price pressures in January.

This week, data on consumer price index and retail sales in February in the US will help clarify the prospects for interest rate cuts by the Federal Reserve. The forecast shows that the February CPI may increase by +0.4% after a faster than expected increase of +0.3% in January. Last week, Fed Chairman Jerome Powell said that interest rate cuts would occur “at some point later this year” could be appropriate, but made it clear that he and other Fed members still need to monitor more economic data.