Oil prices reach highest point in 4 months

Oil prices rose about 3% to their highest level in 4 months on Wednesday as US crude inventories unexpectedly fell, US gasoline inventories declined more than expected, and supply disruption possibilities increased amid escalating tensions between Russia and Ukraine.

The Brent crude futures contract for May delivery ended the session up $ 2.11, or 2.6%, at $ 84.03 a barrel, while US Texas crude (WTI) rose $ 2.16, or 2.8%, to $ 79.72.

That was the highest closing price for Brent since November 6th.

US Energy Information Administration (EIA) said energy companies unexpectedly pulled 1.5 million barrels of crude oil out of storage in the week ending March 8.

Meanwhile, energy companies withdrew 5.7 million barrels of gasoline from storage last week, much higher than expected.

In Russia, an oil refinery in the Ryazan region was attacked for 2 consecutive days by unmanned aircraft.

Gold rebounds

Gold prices rose on Wednesday, supported by a weaker dollar, as investors hope the Federal Reserve will cut interest rates in June despite high inflation in the United States, while escalating political tensions also maintain demand for gold as a safe haven.

The Dollar index fell 0.2%, making gold cheaper for foreign buyers.

Copper hits 11-month high

Copper prices surged on Wednesday to their highest level in 11 months as China’s smelters, the processing site for half of the world’s mined copper, agreed to cut production together.

Three-month futures on the London Metal Exchange (LME) Wednesday session touched $ 8,950 per tonne, the highest level since April 20th, 2023. The price rose 3.2% to $ 8,931 at the close.

China’s largest copper smelters met in Beijing on Wednesday and agreed to cut production in a symbolic gesture without specifying the volume and timing.

Rubber continues to rise

Rubber futures prices in Japan continued to rise for the 7th consecutive session amid high oil prices and unfavorable weather conditions in Thailand.

The August rubber contract on the Osaka Exchange (OSE) closed up 1.4 yen, or 0.43%, at 328.4 yen ($ 2.23) / kg, the highest closing price since February 1st, 2017.

The May rubber contract on the Shanghai Futures Exchange (SHFE) rose 85 yuan, ending at 14,200 yuan ($ 1,974.64) / ton.

Cocoa sets new record before easing

Futures cocoa prices traded in both London and New York reached record highs and have yet to show signs of decline as supplies from West Africa are shrinking.

The May cocoa futures price on the London exchange closed at 5,760 pounds, or 1.2%, down £69 after reaching a record high of £5,873.

The May cocoa futures traded in New York fell 0.2% to $ 7,035 per tonne after also reaching a record high of $ 7,221.

Ivory Coast and the world’s second largest cocoa producer – Ghana – are facing the worst harvest season in years, with estimated harvests in Ivory Coast 28% lower than last season.

Some cocoa plants in Ivory Coast and Ghana have stopped or cut processing due to a lack of funds to buy raw cocoa.

Meanwhile, rain is forecast to continue throughout Ivory Coast and Ghana until Saturday, which will slow the harvesting process, although it improves prospects for the upcoming season.

Iron ore lowest in 6 months

Iron ore prices fell amid concerns about reduced demand in China as steelmakers increase maintenance and the northern region of the country imposes production restrictions for environmental reasons.

The May iron ore futures contract on China’s Dalian Commodity Exchange (DCE) ended the session down 2.53% at 807.5 yuan ($ 112.29) / tonne, the lowest level since August 2023.

The April iron ore futures price on the Singapore Exchange fell 4.42% to $ 103.45 per tonne, the lowest level since August 2023.

Data from the China Iron and Steel Association (CISA) showed that daily crude steel output from member mills in the first 10 days of March fell 3.38% from the previous period to about 2.06 million tonnes.

Corn and soybeans fall, wheat rises

Corn prices fell as technical selling activity took place on Wednesday as market participants sought profit-taking and evaluated US spring prospects.

Meanwhile, wheat prices also fell due to abundant global supply and the impact of falling prices in the corn market. Soybeans, on the other hand, increased after a report showed that the main agricultural area of Argentina could experience significant rainfall, in addition to recent significant rainfall, which could make fields too wet for harvesting in some areas.

At the close, on the Chicago exchange, corn prices fell 1/2 cent to $ 4.41-1/4 per bushel, wheat fell 3-1/4 cents to $ 5.44-1/4 per bushel, after reaching a one-week high on Tuesday; soybeans rose 3/4 cent to $ 11.96-3/4 per bushel.

Coffee falls

Robusta coffee prices for May fell $ 47, or 1.4%, to $ 3,260 per tonne.

Arabica coffee for May fell 1.7% to $ 1.8265 per lb.

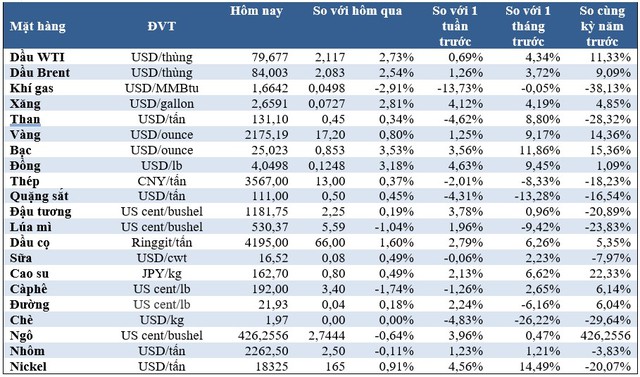

Some key commodity prices morning of March 14th: