Buyers and sellers of VN-Index experienced fluctuations in the stock market during the last trading day of the week. The index closed at a slight decrease of 0.48 points to 1,263 points on March 15th. Money flow continued to be maintained with a trading volume of over 26,000 billion VND on HOSE.

In terms of foreign trading, they unexpectedly sold approximately 1,354 billion VND in the overall market during the portfolio restructuring session of VNM ETF, FTSE Vietnam ETF, and Fubon FTSE Vietnam ETF. This is also the strongest selling session by foreign investors since December 15, 2013.

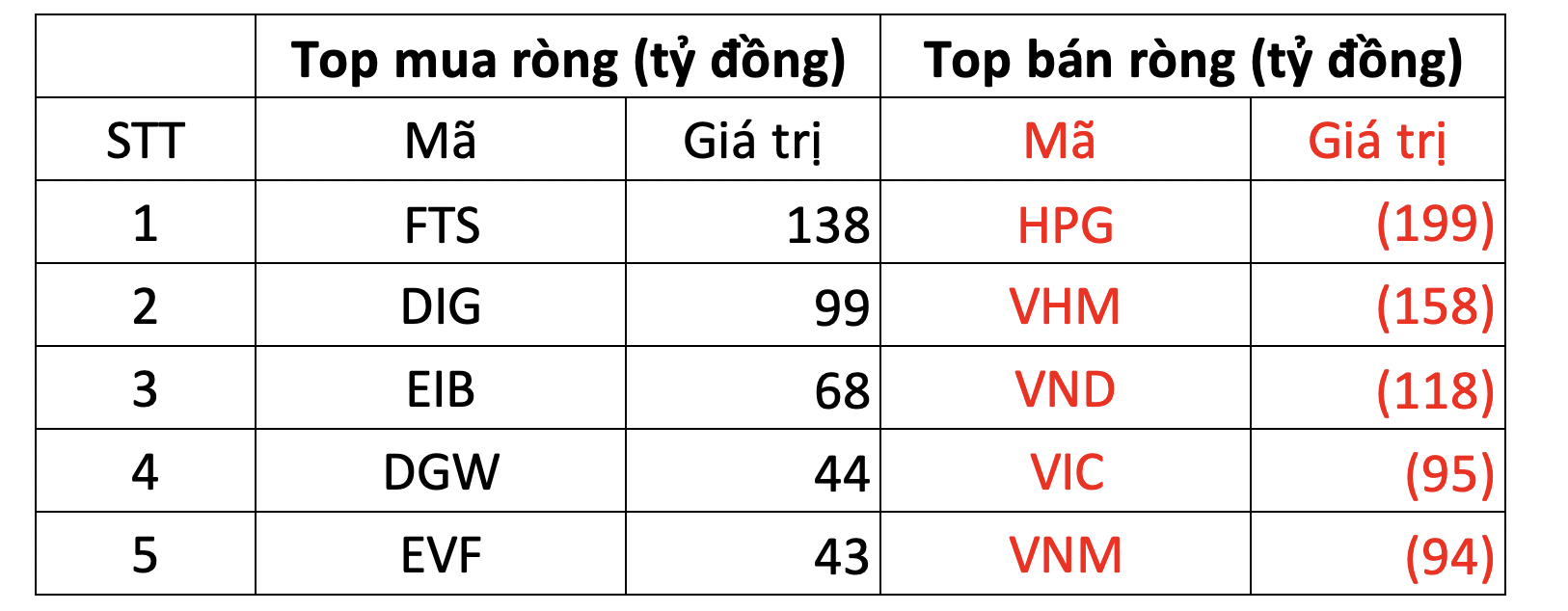

On HOSE, foreign investors were net sellers with an approximate value of 1.312 trillion VND.

In terms of buying, FTS was the most heavily purchased with a value of 138 billion VND. According to the previous announcement, FTS is a newly added stock in the portfolio of the MarketVector Vietnam Local Index – the underlying index of Vaneck Vectors Vietnam ETF (VNM ETF) this term. In addition, DIG ranked next on the list of strong net buys on HOSE with 99 billion VND. Furthermore, foreign investors also net bought EIB and DGW with values of 44 billion VND and 43 billion VND respectively.

On the contrary, HPG faced the strongest selling pressure from foreign investors with a value of 199 billion VND, followed by VHM and VND with net sells of 158 billion VND and 118 billion VND per stock. VIC and VNM were also “dumped” by foreign investors with net sells of 95 billion VND and 94 billion VND respectively.

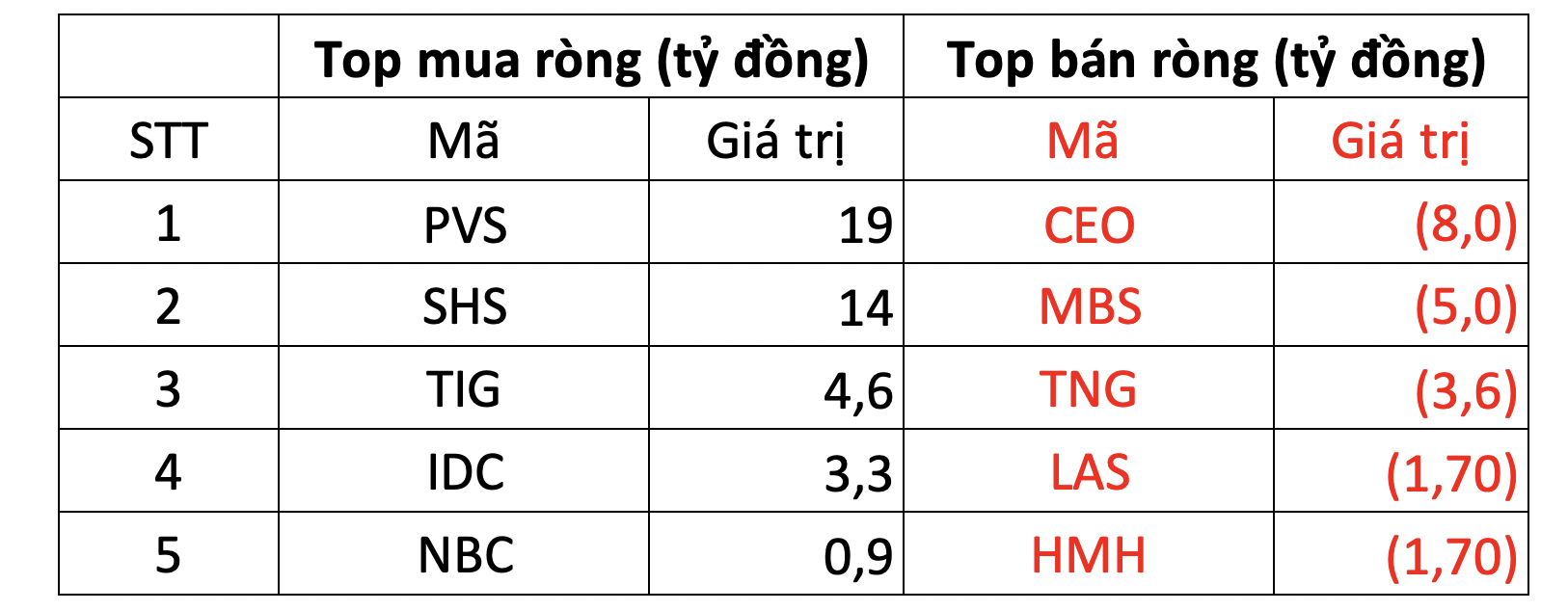

On HNX, foreign investors were net buyers with approximately 18 billion VND.

In terms of buying, PVS was the most heavily purchased with a value of 19 billion VND. Besides, SHS ranked next on the list of strong net buys on HNX with 14 billion VND. Furthermore, foreign investors also net bought TIG, IDC, and NBC with relatively small values.

Conversely, CEO faced the strongest selling pressure from foreign investors with a value of 8 billion VND, followed by MBS with a sell-off of approximately 5 billion VND.

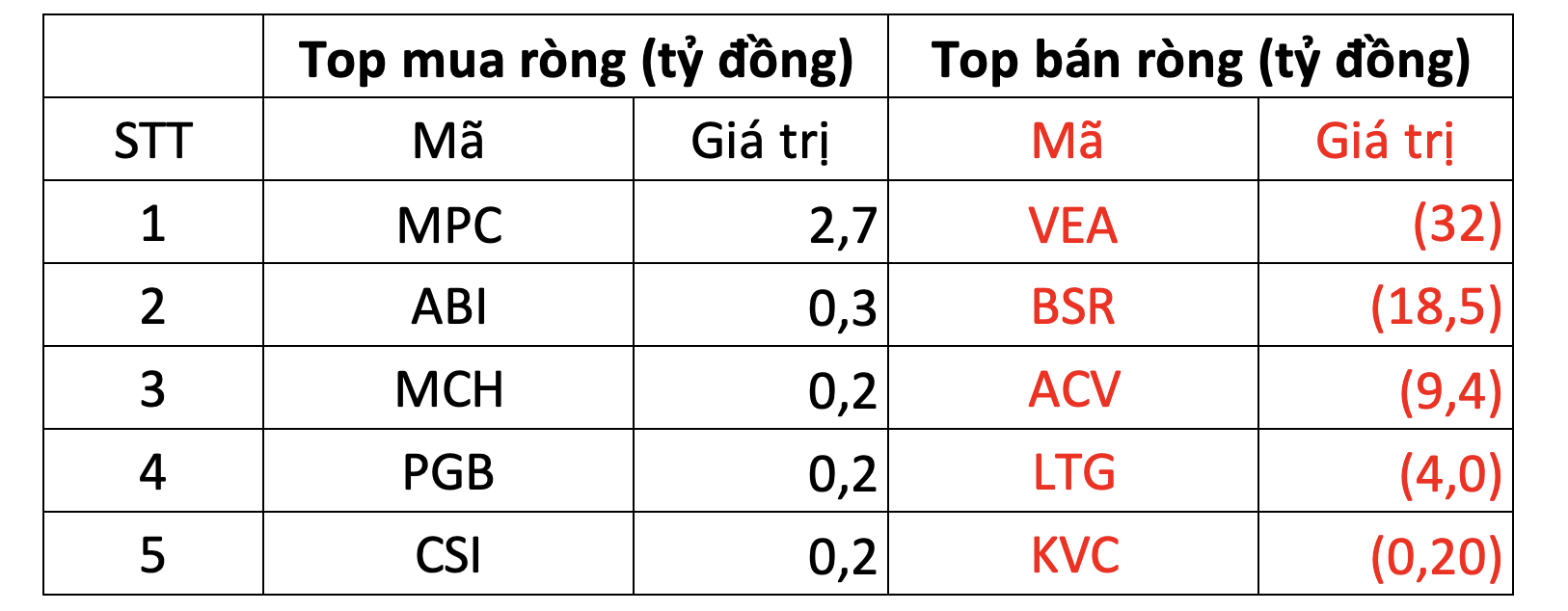

On UPCOM, foreign investors were net sellers with approximately 60 billion VND.

In terms of buying, MPC stocks were purchased by foreign investors with 2.7 billion VND. Afterwards, ABI and MCH were also net bought with a few billion VND each.

Conversely, VEA experienced a net sell-off of approximately 32 billion VND today; in addition, foreign investors also net sold at BSR, ACV, LTG,…