Haiphat Investment Corporation (Haiphat) has issued document No. 70/CV-HP to correct the 2023 company governance report.

According to this document, on January 26, 2024, Haiphat published the 2023 company governance report No. 38/2024/BC-HPX in the information disclosure document No. 36/CBTT-HPX dated January 26, 2024.

However, due to a typing error, the company has issued a correction to some content in Appendix III – List of insiders and Persons related to insiders as of December 31, 2023, attached to the 2023 company governance report.

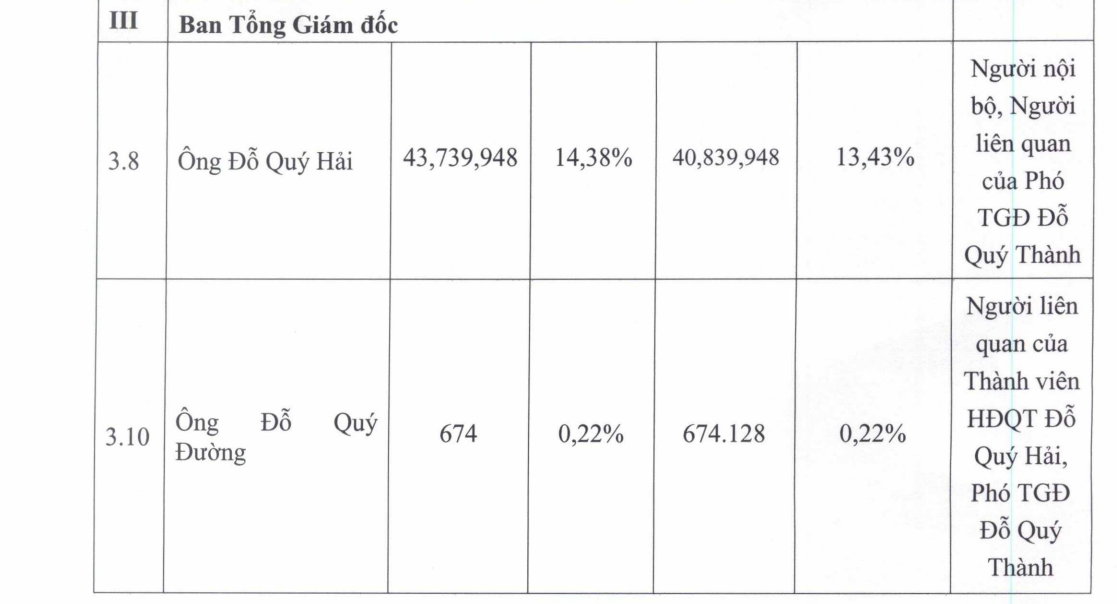

Haiphat corrected the ownership ratio of Mr. Do Quy Hai.

Specifically, Mr. Do Quy Hai – Chairman of the Board of Directors owns 40.8 million shares, equivalent to 13.43% of charter capital (as of the end of 2023), instead of the previously reported 43.74 million shares (equivalent to 14.38% of charter capital).

In addition, Haiphat also corrected the ownership ratio of Ms. La Huyen Trang (related person of Board Member La Quoc Dat), Ms. Pham Thi Ngoc (related person of Board Member Do Manh Quan), however, the ownership amount of Ms. Trang and Ms. Ngoc is insignificant,

The late January 2024 corporate governance report also shows that Mr. Do Quy Duong (related person of Board Member Do Quy Hai, Deputy General Director Do Quy Thanh) owns 674 shares, corresponding to a 0.22% ratio (as of the end of 2023). However, according to the amendment, Mr. Duong’s end-of-period ownership was 674,128 HPX shares, equivalent to 0.22%.

In terms of business performance, according to the consolidated financial statements for the fourth quarter of 2023, Haiphat Invest’s net revenue reached nearly VND 502.6 billion, an increase of 53% compared to the same period last year.

Net profit, after deducting the cost of goods sold, reached VND 42.2 billion, a significant improvement compared to the loss of VND 34.4 billion in the same period in 2022.

In the quarter, financial revenues increased by 73% to VND 250.6 billion, mainly from profits from investments (capital transfer in subsidiaries).

In this quarter, financial costs amounted to VND 63.1 billion, an increase of 26%; sales costs were VND 115 billion, an increase of 64 times; the only cost that decreased was enterprise management costs, down 51.6% to nearly VND 12 billion.

As a result, Haiphat reported a net profit after tax of VND 72.8 billion, an increase of 3.8 times compared to the same period last year.

In 2023, Haiphat’s net revenue reached VND 1,699.6 billion, an increase of 4% compared to the previous year, the highest level in the past 4 years. Gross profit reached VND 288 billion, a decrease of 41%.

As of December 31, 2023, Haiphat’s total assets reached VND 8,298 billion, a decrease of 12% compared to the beginning of the year. Total liabilities stood at VND 4,710 billion, a decrease of 21% compared to the beginning of the year. Borrowings accounted for more than half of the total liabilities, reaching VND 2,465 billion, a decrease of 25%.