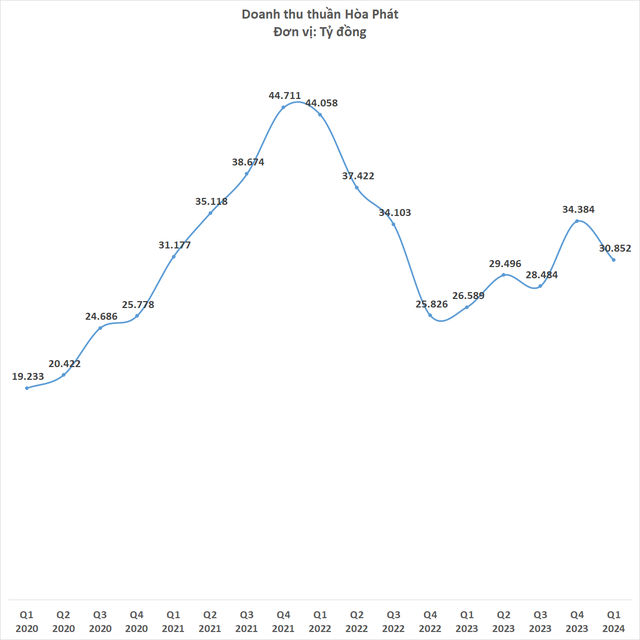

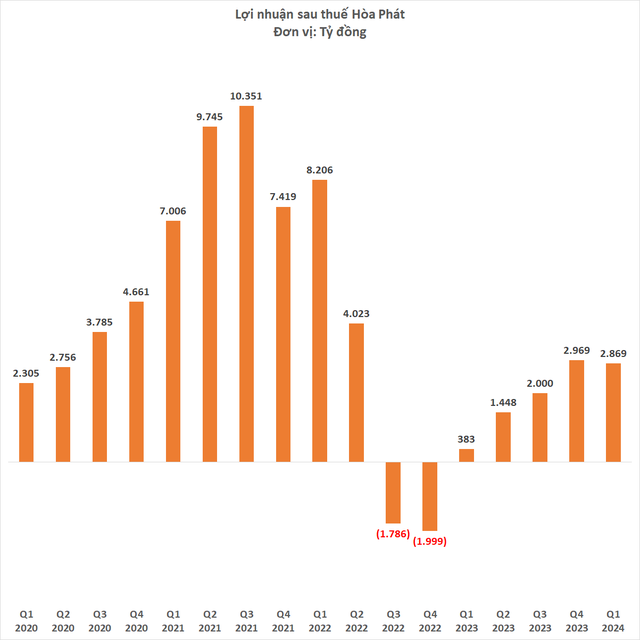

Hoa Phat Group has just announced its financial report for the first quarter of 2024, with net revenue reaching 30,852 billion VND, an increase of 16% compared to the first quarter of 2023. Consolidated profit after tax was 2,869 billion VND, 7.5 times higher than the same period last year.

The Steel Group accounted for the largest proportion, contributing 93% and 85% to the Group’s consolidated revenue and profit after tax, respectively. Agriculture ranked second in terms of revenue with a 5% share. With profit after tax, this position belongs to the Real Estate sector with 9% of consolidated profit after tax.

Blast furnaces operate at full capacity, but consumption decreased compared to the previous quarter

In the first quarter, Hoa Phat produced 2.1 million tons of crude steel, an increase of 70% compared to the same period last year. All blast furnaces of Hai Duong and Dung Quat complexes are currently running at nearly full capacity. The total output of construction steel, steel billets, and HRC supplied to the market this quarter reached 1.85 million tons, slightly decreased compared to the fourth quarter of 2023 but increased by 34% compared to the first quarter of 2023.

The output of construction steel and high-quality steel of Hoa Phat reached 956,000 tons, an increase of 10%, hot rolled coil steel reached 805,000 tons, an increase of 67% compared to the first 3 months of last year. The market share of construction steel still maintains a leading position with 37%. In addition, Hoa Phat also supplied over 87,000 tons of steel billets to other steel rolling mills in Vietnam and for export.

Hoa Phat steel pipes supplied 131,000 tons to the market in the first quarter of 2024, a decrease of 18% compared to the first 3 months of 2023. Coated steel of all kinds reached an output of 98,000 tons, an increase of 40% compared to the same period in 2023, in which the export volume of coated steel increased sharply over the past 3 months, contributing to over 61,000 tons.

Although public investment activities, especially in the field of transport infrastructure, have been boosted since the end of 2023 to the present, the Vietnamese construction steel market in the first quarter of 2024 still witnessed a 20% decrease in consumption output compared to the fourth quarter of 2023 due to the lack of a driving force from the real estate market with weak demand for civil steel as well as real estate development projects, combined with seasonal factors due to the Tet holiday. Hoa Phat’s construction steel consumption also decreased this quarter compared to the previous quarter.

Unlike construction steel, hot rolled coil steel, the second mainstay product of Hoa Phat, is characterized as a semi-finished product, which is an input for various manufacturing industries. This helps hot rolled coil steel products have a lower market risk level because they are not too dependent on a few specific consumer markets. This product is still being consumed very well in many markets, both domestically and exported to nearly 40 countries and territories around the world, increasing the Group’s export revenue to 40% of total consolidated revenue. Hoa Phat is currently running at full capacity of its QSP rolling mill – producing hot rolled coil steel.

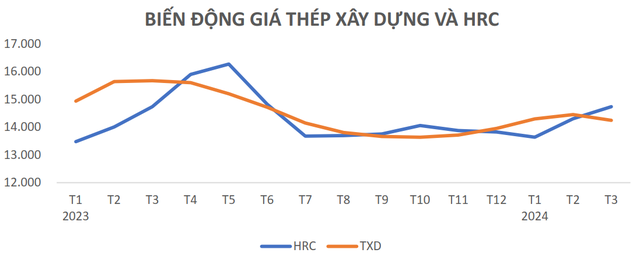

Construction steel prices in the Vietnamese market have increased since November 2023, lasting until January 2024, and have started to have some downward adjustment at the end of the first quarter of 2024. Hot rolled coil steel prices have increased significantly compared to the beginning of the year, along with the stability in the consumption output of this product, which is the growth driver of the Group’s revenue in this quarter, partially offsetting the decline in revenue from construction steel products.

Raw material prices did not fluctuate much in the first quarter of 2024. The full operation of blast furnaces in this quarter also helped reduce the burden of depreciation costs in the unit price of products compared to the previous period. In particular, since the fourth quarter of 2023, Hoa Phat’s Dung Quat complex has achieved complete self-sufficiency in electricity, significantly reducing energy costs in the production cost of various types of steel products.

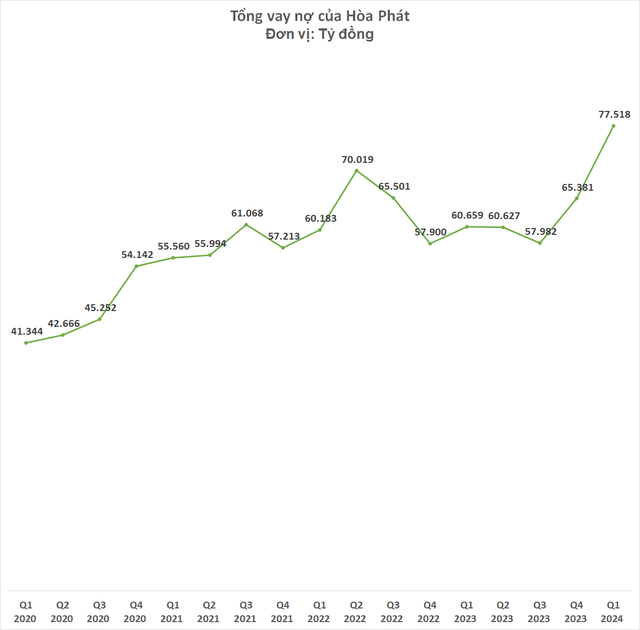

Debt skyrockets but financial costs decrease

The VND interest rate is being maintained at a competitive level while, conversely, the USD borrowing rate remains very high because the FED maintains a cautious view for the goal of curbing inflation and prolongs the waiting time for the next interest rate cut, ignoring the market’s expectations. Good management of the limit structure allows Hoa Phat to flexibly adjust its foreign currency borrowing structure and reduce its dependence on foreign capital at a time when USD capital costs are high and exchange rate risks are high, taking advantage of domestic capital sources with more competitive prices.

Therefore, although Hoa Phat’s outstanding debt increased significantly compared to the end of the year due to material procurement activities and disbursement for the Dung Quat 2 Iron and Steel Complex project, interest expense has decreased to the lowest level in the past 2 years. In the first quarter of 2024, Hoa Phat recorded total financial expenses of 1,061 billion VND, a decrease of 6% or 66 billion VND compared to the fourth quarter of 2023. After offsetting with the exchange rate differential gain, the remaining financial expenses were about 737 billion VND, down from 795 billion VND in the previous quarter, most of which was explained by a 11% decrease in interest expense, or 77 billion VND, from 711 billion VND to 636 billion VND.

Inventory also increased sharply

Hoa Phat’s inventory as of March 31, 2024 increased by more than 8,200 billion VND compared to the end of 2023, which was explained by two main factors, including an increase in finished goods inventory, and the rest coming from a large amount of materials purchased for the basic construction activities of the new project that are currently being reflected in the general account of raw materials and tools and equipment.