The Vietnamese stock market recorded a “disappointing” April, witnessing a sharp decline from the 1,270-point zone to the 1,180-point zone in the middle of the month, which ended the uptrend. In total, the VN-Index lost nearly 75 points compared to the beginning of the month, closing the last session of the month at 1,209.5 points. There was still pressure from foreign investors as they continued to sell off on the Vietnamese stock market, with the value often reaching around VND 1,000 billion per session. In total, there was an additional net sell-off of VND 5,313 billion in the entire market during April.

According to Mr. Bui Van Huy, Director of DSC Securities Corporation, Ho Chi Minh City Branch, the Vietnamese stock market in April had its own developments and was subject to a lot of negative information, so although it was still in line with the trend, the level of adjustment at some points was deeper than the global market. In May, the world stock market will still be one of the important references to follow, especially the movements surrounding the FED meeting in early May.

VN–Index in the “ambush” position in the first half of May, opportunities arise at the end of the month when the situation becomes clear

Specifically, Mr. Huy assessed that the Vietnamese market will enter the trading week after the May Day holiday with some negative information and investors need to visualize what the market is facing. However, to assess whether this information will really have a too negative impact on the market, it is necessary to look back and see if these factors have a strong enough impact on the three pillars of the increasing market this year, which are (1) monetary easing policy; (2) economic recovery momentum and (3) expectations for market upgrade.

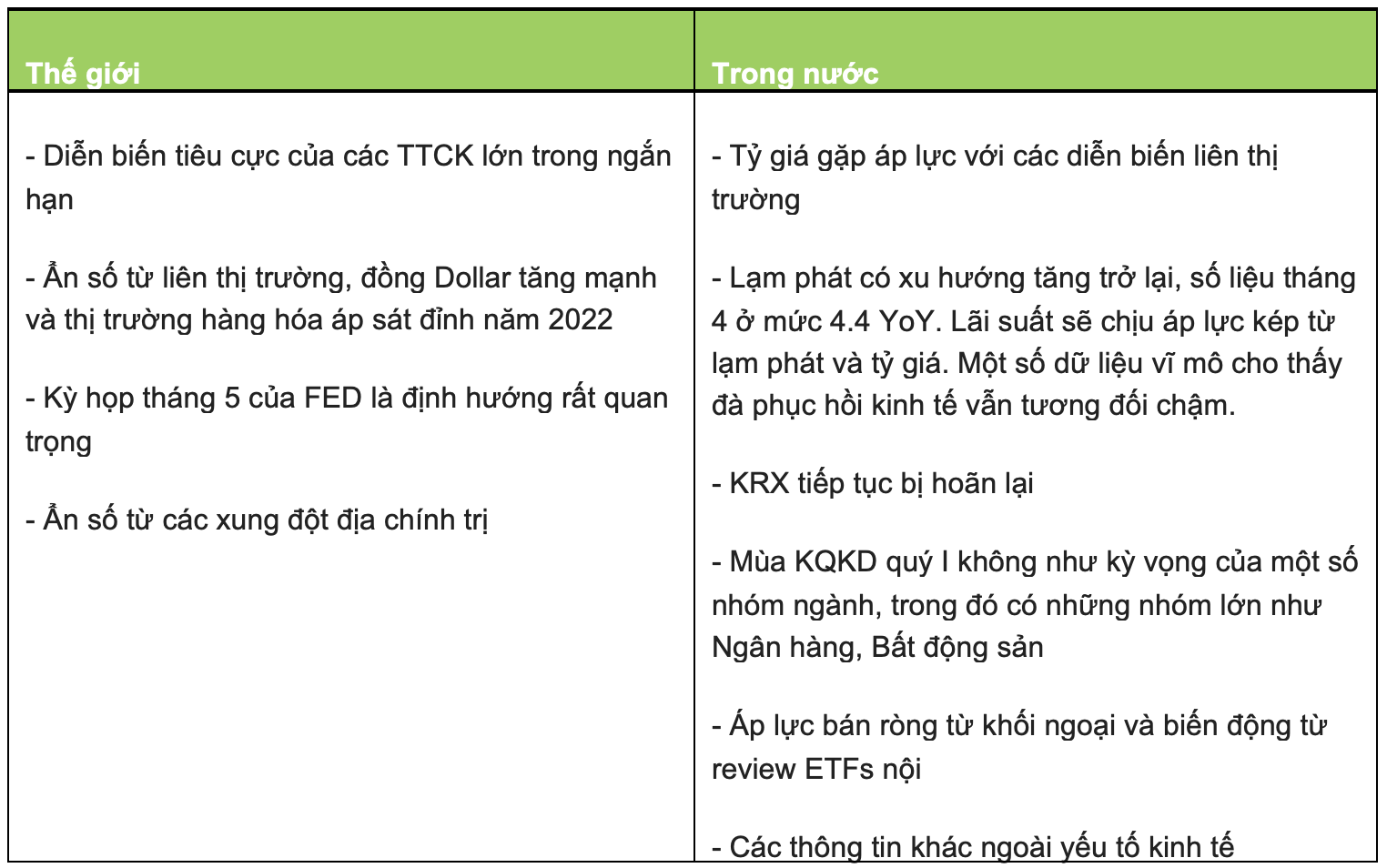

Domestic and international context

Firstly, regarding the monetary easing policy, the expert said that the pressure on the exchange rate is undeniable and there have been the first intervention moves. The pressure on interest rates is real, and if the SBV has to increase interest rates by 0.25%-0.5% from now until the end of the year in a worst-case scenario, it will not be a surprise. The current interest rate is still at a low level in history. Investing in an environment of “economic recovery + appropriate monetary policy” will be more favorable than an environment of “weak economy + excessive easing policy”. Therefore, if interest rates increase slightly but the intrinsic value improves, there will still be many safe opportunities.

Secondly, regarding the economic recovery, Mr. Huy said that the economy is still recovering but not as fast as expected. However, investment is looking to the future rather than the published figures. The economy will recover faster in the next 3-6 months, and one of the important factors of the economy is consumer purchasing power, and purchasing power is gradually improving.

Regarding the lower-than-expected business results of banking and real estate groups, the expert said that the profit potential of some banks has “dimly” peaked, and this is an industry group that will face difficulties later than the economy, so it is not surprising that profit growth is slowing, or even declining if credit growth is low and pressure on bad debt increases. However, the banking group still has a capital increase game after the General Meeting of Shareholders and while the new shares have not been listed, the supply of shares will not be too pressured, so it is difficult to decrease deeply.

Thirdly, expectations for a market upgrade. This has been a story for many years and at times seemed to be very close. The postponement of the KRX may be a big disappointment for investors, but it will not affect the upgrade orientation. The upgrade story is still there.

In summary, Mr. Huy stated that after these pressures, if the global market is not too negative after the FED meeting and holds firm for about 1-2 weeks in early May, creating a higher trough than the previous one, investors can be bolder in looking for opportunities. In the worst-case scenario of breaking the 1,170-1,180 MA200 zone, the next strong support zone will be in the 1,120-1,130 zone. The Director of DSC highly appreciated the view that the market will hold firm and accumulate above the MA200 because the above negative news is not unexpected for those who observe carefully.

“Regardless of the scenario, participating in the market for the first time in early May should be at a probing level, moderate, and more assertive when the situation becomes clear towards the end of the month. Once again, the negative information is not too surprising, and if not for unexpected factors, I still tend to believe that the market will correct to a moderate extent“, Mr. Huy assessed.

Choosing stocks in the “Summer Market”

Instead of the “Sell in May” effect, Mr. Huy said that the stock market in May will be the “Summer Market” – “summer market”. This is the type of market where there is still money but not enough to create consensus, so the differentiation will be fierce. Groups of stocks that attract capital will continue to attract capital, and the rate of increase is not small. However, a large part of the market that does not receive money will go in a gloomy direction.

In the summer market, stocks entering a new phase or stocks that have just set a new peak will be of particular attention, especially those that have set a peak, a high price, and limited supply. Investors can probe in the support zones in the early part of the month and be more assertive at the end of the month when the context is clear.

The market will differentiate strongly, and groups of stocks that have stories and attract capital will continue to attract capital. Therefore, restructuring the portfolio as well as choosing stocks will be more important than predicting the index. The expert from DSC draws attention to some industry groups including Information Technology, Retail, and large stocks that have just bottomed in this cycle and overcome the most difficult period.