Despite operating under restricted trading on HoSE, Vietnam Airlines’ stock (HVN) has taken flight. Upon entering the afternoon trading session on May 3rd, the stock hit the ceiling price of VND18,500 per share, its highest point in 23 months since early June 2022. Notably, the stock had no sell orders with a pending ceiling price buy order of nearly 4.5 million shares.

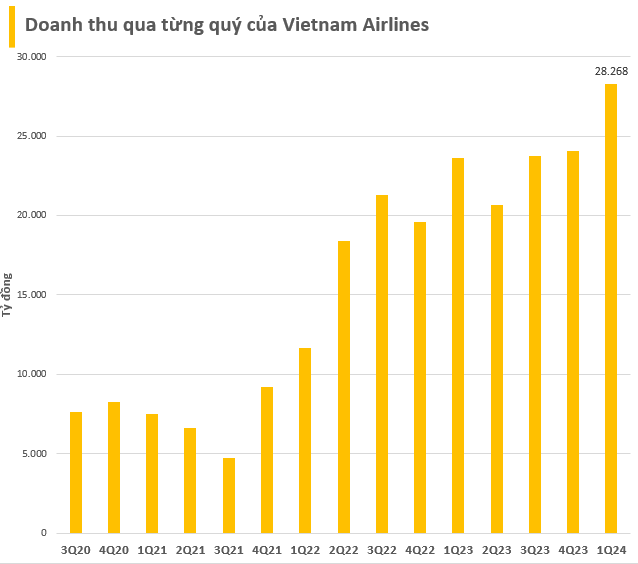

HVN’s rise comes amidst positive developments in Vietnam Airlines’ business operations. In Q1 2024, the airline reported revenue of nearly VND28,270 billion, a 25% increase year-over-year and the highest quarterly revenue since Vietnam Airlines’ transformation into a joint-stock company in 2015.

Vietnam Airlines’ revenue surged amid an aviation market facing aircraft shortages and high domestic airfares during the peak Tet travel season. Bamboo Airways, Vietnam Airlines’ direct competitor in the domestic market segment, has recently cut several routes and reduced its fleet, giving Vietnam Airlines a larger market share.

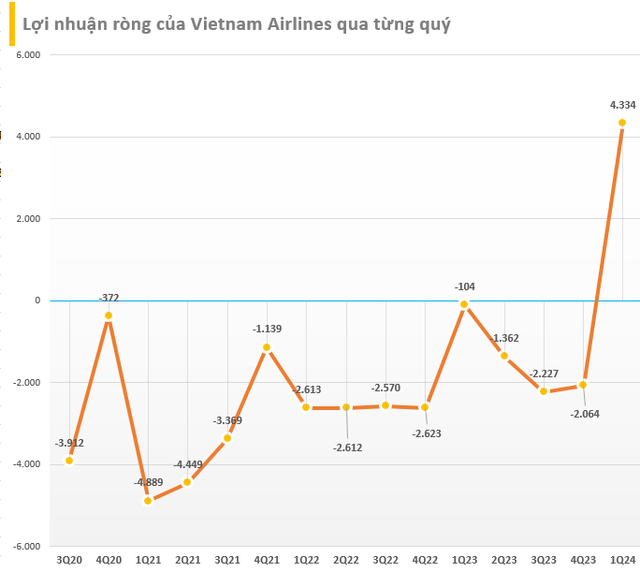

In the first quarter, cost of goods sold rose less than revenue, resulting in Vietnam Airlines’ gross profit of VND4,048 billion, double that of the same period in 2023. Additionally, the company recorded a net income of VND3,672 billion. After deducting expenses, the airline achieved a record net profit of VND4,334 billion, compared to a loss of VND103 billion in the same period of 2023.

According to the company’s explanation, the significant increase in profit compared to the previous year is primarily due to improved performance by the parent company, Pacific Airlines, and its subsidiaries. Furthermore, the airline recorded exceptional other income as Pacific Airlines recognized income from debt cancellation related to aircraft repayments (this is the first quarter since the COVID-19 pandemic that Pacific Airlines has reported a profit).

Despite the positive business performance, some challenges remain. As of March 31st, Vietnam Airlines had an accumulated loss of VND36,742 billion and negative equity of VND12,556 billion. This has led to HVN’s listing on HoSE being under control, with trading restrictions (only allowed to trade in the afternoon sessions), and the stock faces the risk of compulsory delisting.

Regarding the plan to address the reasons for the stock’s restricted status, Vietnam Airlines announced the completion of the Restructuring Plan for the Corporation for the period 2021-2025, which has been submitted to shareholders and relevant authorities for review and approval. Accordingly, the Corporation will implement synchronous solutions to rectify the consolidated loss and negative consolidated equity, including implementing comprehensive measures to enhance adaptability and improve business performance; and restructuring assets and financial investment portfolios to increase revenue and cash flow.

As for the risk of compulsory delisting, Vietnam Airlines may have to rely on a “Special Case” provision. According to the draft amendment to the Law on Securities, which was circulated for feedback by the State Securities Commission earlier this year, Article 120 on compulsory delisting will be supplemented with Clause 7: “Special cases requiring continued listing as considered and decided by the Government.” Many believe that this provision could pave the way for Vietnam Airlines’ stock HVN to remain listed on HoSE.

In other developments, Vietnam Airlines has issued a resolution of the Board of Directors to extend the time for holding the 2024 Annual General Meeting of Shareholders beyond April 30th, 2024, but not later than June 30th, 2024. The record date for participation in the meeting is expected to be May 23rd, and the meeting is scheduled to take place on June 21st, 2024.